How Quoted Prices Are Determined in Commodity Exchanges

How Quoted Prices Are Determined in Commodity Exchanges

Commodity trading often appears complex to new market participants, largely because prices seem to change continuously throughout the trading session. One of the most common questions traders and investors ask is how quoted prices are actually formed on commodity exchanges. Understanding how quoted prices are determined in commodity exchanges helps market participants interpret price movements more accurately and make informed decisions, especially in the Indian context where exchanges like MCX and NCDEX play a central role.

What Is a Quoted Price in Commodity Trading?

A quoted price refers to the price at which a commodity contract is currently available for buying or selling on an exchange. It is not a fixed value but a dynamic figure that reflects ongoing market activity. At any given moment, quoted prices represent the interaction between buyers willing to pay a certain price and sellers willing to accept it.

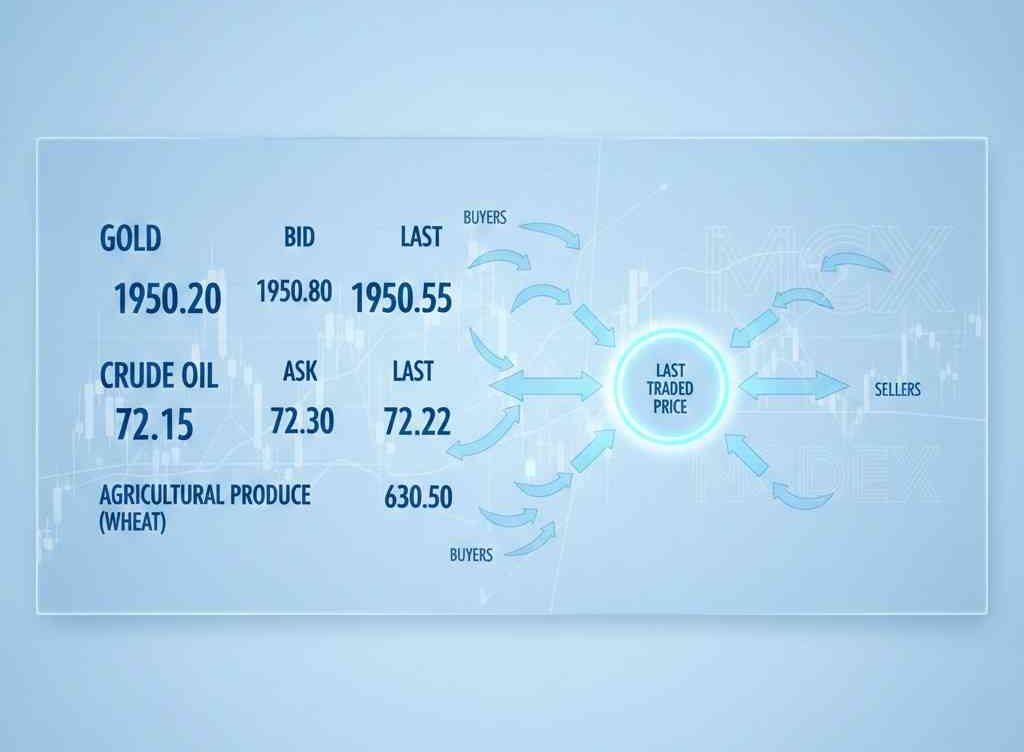

In commodity markets, quoted prices are typically visible as bid and ask prices, along with the last traded price. These collectively help participants assess prevailing market conditions.

What is Quoted Price in Commodity Trading? What is Quoted Price in Commodity Trading?

The Commodity Exchange Price Discovery Process

The foundation of quoted pricing lies in the commodity exchange price discovery process. Price discovery occurs when multiple buyers and sellers submit orders to the exchange, each with their own expectations about value.

Commodity exchanges use electronic trading platforms where orders are matched based on price and time priority. When a buy order matches a sell order, a trade occurs, and that transaction contributes to the current market price. Over time, this continuous matching process leads to a price that reflects collective market sentiment.

In India, exchanges such as MCX (Multi Commodity Exchange) and NCDEX (National Commodity and Derivatives Exchange) follow transparent, order-driven mechanisms to facilitate price discovery.

Commodity Quoted Price Calculation: How It Works

The commodity quoted price calculation is not based on a single formula. Instead, it emerges from real-time trading activity. The key components involved include:

- Bid price: The highest price a buyer is willing to pay

- Ask price: The lowest price a seller is willing to accept

- Last traded price: The price at which the most recent trade was executed

The quoted price displayed on trading screens is usually the last traded price, supported by current bid and ask levels. As new orders enter the system, these values update automatically, reflecting the latest market information.

Factors Affecting Quoted Prices in Commodities

Several variables influence quoted prices, making commodity markets highly responsive to both domestic and global developments. Some of the main factors affecting quoted prices in commodities include:

Demand and Supply Dynamics

Changes in production levels, inventory data, and consumption patterns directly impact prices. For example, lower crop output may affect agricultural commodity prices, while changes in industrial demand influence metal prices.

Global Market Trends

Indian commodity prices often take cues from international markets. Movements in global benchmarks, currency fluctuations, and geopolitical developments can influence domestic quoted prices.

Government Policies and Regulations

Import-export duties, minimum support prices, stock limits, and regulatory interventions can affect price expectations and trading behaviour.

Market Liquidity

Highly traded contracts generally have narrower bid-ask spreads and more stable quoted prices. Lower liquidity can result in wider spreads and sharper price movements.

Speculation and Hedging Activity

Participation by hedgers and traders influences order flow, which in turn impacts quoted prices during trading hours.

How Commodity Prices Are Set in MCX and NCDEX

Understanding how commodity prices are set in MCX and NCDEX requires familiarity with their contract structures and trading mechanisms.

MCX primarily focuses on metals and energy commodities such as gold, silver, crude oil, and natural gas. Prices are influenced by international benchmarks, adjusted for factors like currency conversion and local costs.

NCDEX, on the other hand, deals largely in agricultural commodities. Prices here are influenced by domestic supply-demand conditions, crop forecasts, weather patterns, and government policy measures.

In both exchanges, prices are not decided by the exchange itself. Instead, they are discovered through market participation, with the exchange providing the platform, rules, and transparency required for fair trading.

Role of Futures Contracts in Quoted Pricing

Most commodity trading in India happens through futures contracts rather than physical delivery. Futures prices incorporate expectations about future supply and demand, storage costs, interest rates, and other carrying costs.

As a result, quoted prices for futures contracts may differ from spot market prices. This difference, known as the basis, adjusts as contracts approach expiry, aligning futures prices more closely with spot prices.

What Traders and Investors Are Looking For

From a search intent perspective, users exploring this topic are primarily seeking information and understanding, not trading tools or services. They want clarity on how prices appear on trading screens, what influences those prices, and how exchanges function.

A clear grasp of quoted pricing helps traders assess entry and exit points, while investors gain insight into how commodity markets respond to economic and policy changes.

Conclusion

Quoted prices in commodity exchanges are the outcome of a transparent and continuous interaction between buyers and sellers. By understanding the commodity exchange price discovery process, the commodity quoted price calculation, and the factors affecting quoted prices in commodities, market participants can better interpret price movements. For Indian traders and investors, knowing how commodity prices are set in MCX and NCDEX provides essential context for navigating commodity markets with greater awareness and discipline.

About GigaPro: Beyond basic trading, GigaPro mobile trading app equips users with a suite of advanced features to enhance their trading strategies. Download the app today to start your trading journey on your Android device: (Download GigaPro Mobile App) or on your Apple device: (Download GigaPro Mobile App).

Related Blogs:

What is Quoted Price in Commodity Trading?

What is Commodity Trading?

How to Diversify Your Portfolio with Commodities: A Strategic Approach

The Rising Appeal of Commodities for Indian Investors

Top Strategies and Tips for Maximizing Profits in Commodity Trading

Different Types of Commodities and Their Trading Characteristics

Beyond Stocks: Exploring the World of Commodities

Diversification Strategies: Combining Commodities and Equities

Commodity vs Equity Market: A Beginner’s Guide to Understanding the Differences

What are Commodities? Understanding the Basics

Why Energy Commodities Deserve a Spot in Your Indian Investments

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

How are quoted prices determined in commodity exchanges?

Quoted prices are determined through the commodity exchange price discovery process, where buy and sell orders from market participants are matched electronically based on price and time priority.

What does the quoted price represent in commodity trading?

The quoted price usually reflects the last traded price, supported by current bid and ask prices, and changes continuously with market activity.

Is there a fixed formula for commodity quoted price calculation?

No, commodity quoted price calculation is not based on a fixed formula. It emerges from real-time demand and supply interactions on the exchange.

What are the main factors affecting quoted prices in commodities?

Key factors include demand and supply conditions, global price movements, government policies, market liquidity, and hedging or speculative activity.

How are commodity prices set in MCX and NCDEX?

Commodity prices in MCX and NCDEX are set through transparent, order-driven trading systems, where prices are discovered by participants rather than determined by the exchange itself.