How Basket Orders Reduce Execution Risk in Multi-Stock Portfolios

How Basket Orders Reduce Execution Risk in Multi-Stock Portfolios Building and managing a diversified equity portfolio often involves executing multiple trades within a short time

How Basket Orders Reduce Execution Risk in Multi-Stock Portfolios Building and managing a diversified equity portfolio often involves executing multiple trades within a short time

How Exit Loads Work in Open-Ended Mutual Funds When you invest in mutual funds, liquidity is one of the key advantages—especially with open-ended schemes. You can invest and rede

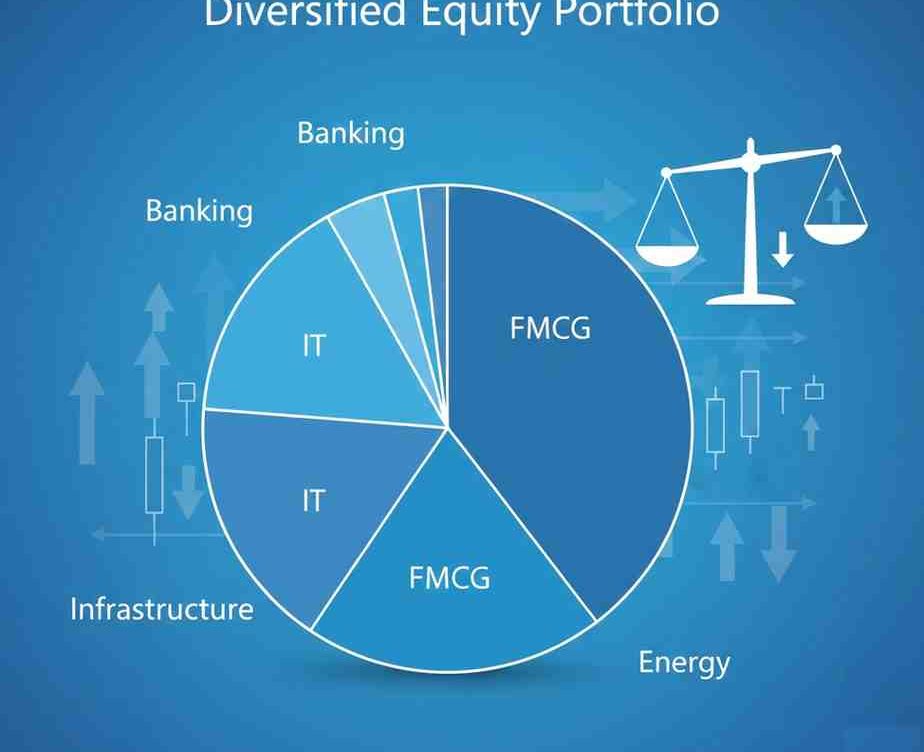

Sectoral Diversification in Equities: Does It Truly Reduce Risk? When equity markets fluctuate, one common suggestion is to “diversify across sectors.” But what does that actua

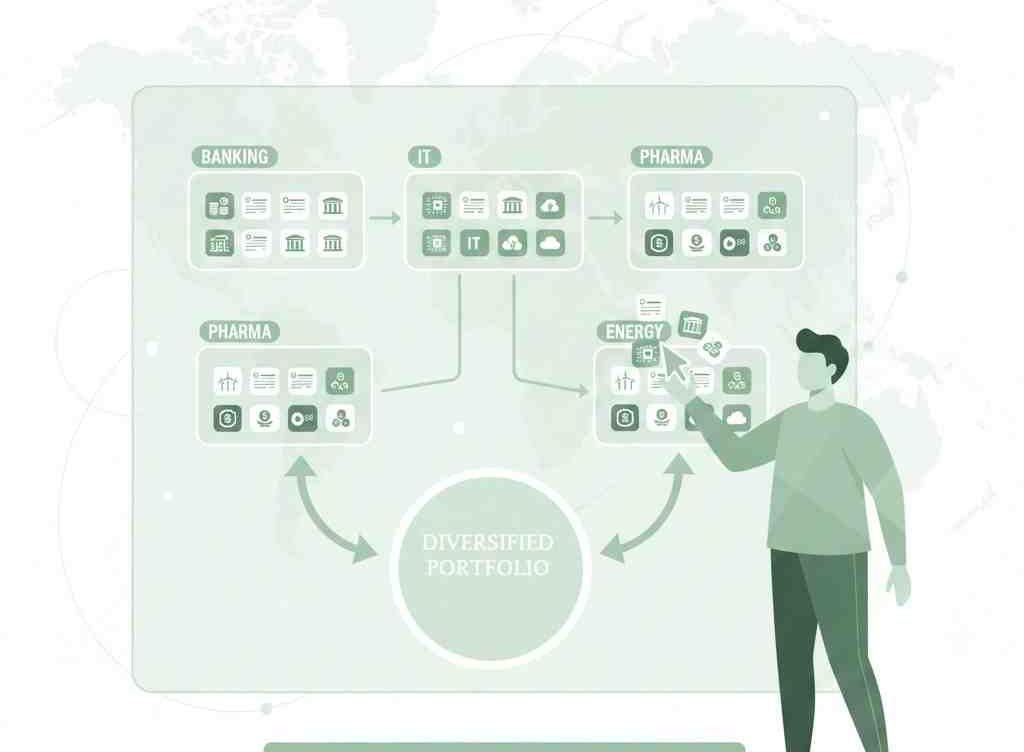

Why Basket Orders Are Powerful Tools for Portfolio Diversification Simultaneous Execution Across Multiple Stocks When you place individual orders, market prices can move between ea

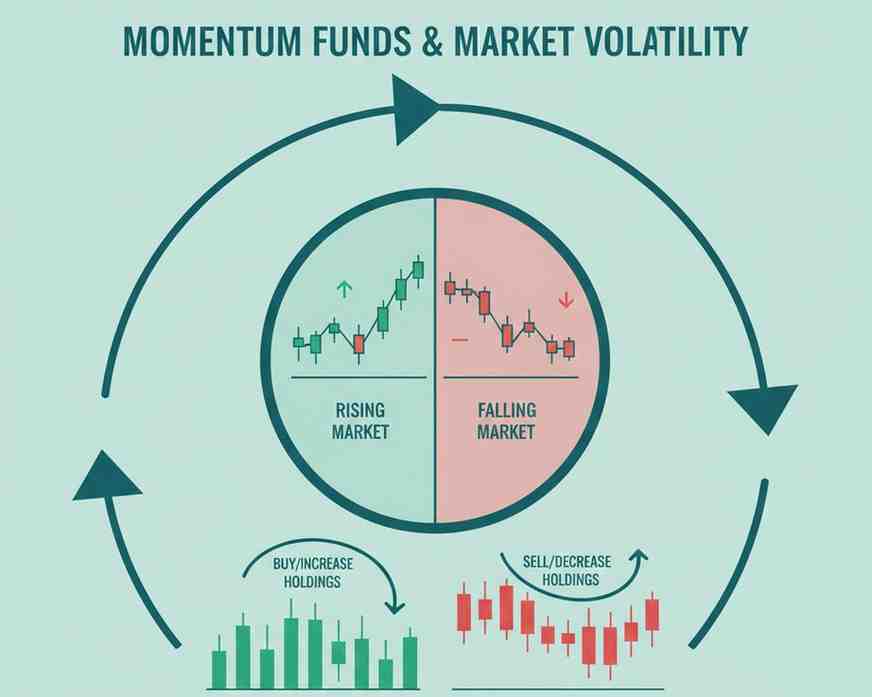

How Momentum Funds React to Market Volatility Market volatility is an inevitable part of equity investing. Prices move sharply in response to economic data, global events, policy d