How Global Commodity Prices Influence Quoted Prices in India

How Global Commodity Prices Influence Quoted Prices in India

Commodity prices quoted in India often appear to change overnight—fuel prices rise, metal prices fluctuate, and input costs for companies shift with little warning. While these movements may seem domestic on the surface, they are deeply influenced by developments far beyond India’s borders. Understanding how global commodity prices influence quoted prices in India is essential for investors, businesses, and anyone tracking inflation or corporate profitability.

This article explains the mechanics behind global-to-local price transmission, why international markets matter for Indian prices, and how these changes affect Indian stocks and sectors.

The Global Nature of Commodity Markets

Commodities such as crude oil, metals, natural gas, and agricultural products are traded in global markets. Their benchmark prices—like Brent crude, LME metal prices, or international agricultural indices—are discovered through international demand-supply dynamics.

Because India imports a significant portion of its commodity requirements, especially energy and industrial metals, global commodity prices and Indian markets are closely interconnected. Even domestically produced commodities are not fully insulated, as exporters, importers, and traders align prices with global benchmarks.

As a result, quoted prices in India often reflect international trends rather than purely local conditions.

How Global Commodity Prices Affect India

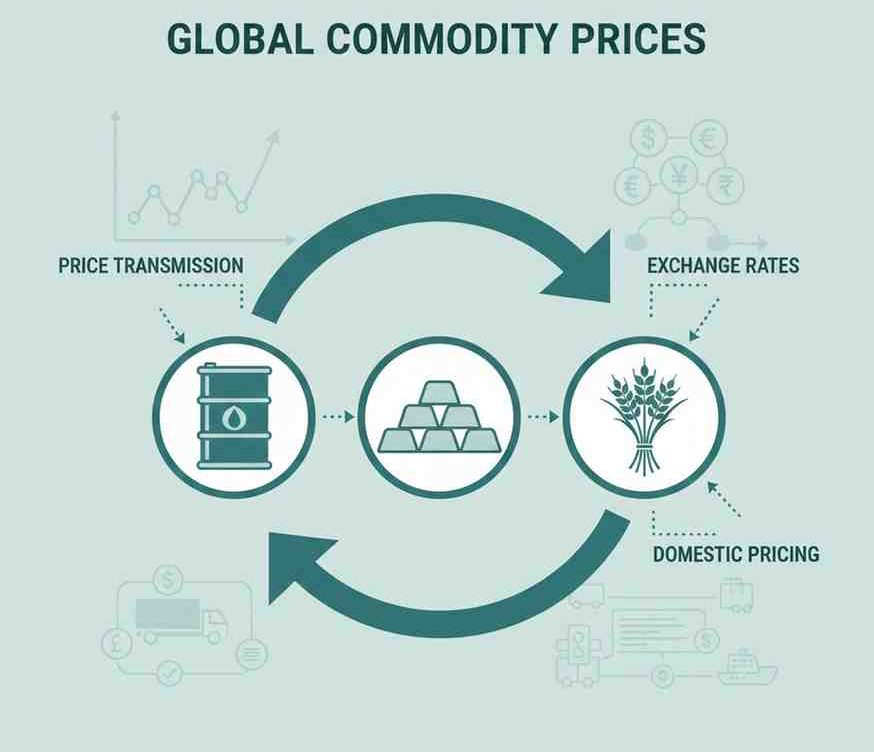

To understand how global commodity prices affect India, it helps to look at three broad transmission channels:

- Import Dependency

India relies heavily on imports for crude oil, natural gas, fertilisers, and certain metals. When global prices rise, import costs increase, leading to higher landed prices for refiners, manufacturers, and distributors.

These higher costs are gradually passed on through the supply chain, influencing retail prices, wholesale price indices, and corporate margins.

- Currency Exchange Rates

Commodity prices are typically denominated in US dollars. Movements in the rupee-dollar exchange rate can amplify or soften the impact of global price changes.

For instance, even if global prices remain stable, a weakening rupee can push up quoted commodity prices in India, while a stronger rupee can provide partial relief.

- Trade and Policy Adjustments

Customs duties, export restrictions, subsidies, and price controls also play a role in determining how much of the global price movement is reflected domestically. However, over time, global trends tend to influence domestic prices despite policy buffers.

Commodity Price Transmission in India

Commodity price transmission in India refers to the process by which global price changes filter into domestic markets. This transmission is rarely immediate or uniform across commodities.

- Energy commodities such as crude oil tend to show faster transmission due to frequent price revisions and high import dependence.

- Metals experience moderate transmission, influenced by inventory levels, demand cycles, and long-term supply contracts.

- Agricultural commodities may see delayed or partial transmission due to government interventions and seasonal factors.

Understanding this transmission mechanism helps investors interpret why domestic prices sometimes lag global movements—or react with a time delay.

Impact of Global Commodity Prices on Indian Stocks

The impact of global commodity prices on Indian stocks varies by sector and business model.

Commodity Producers

Companies involved in metals, oil and gas, and mining often benefit from rising global prices, provided costs remain controlled. Higher realisations can support revenues and operating margins.

Commodity Consumers

Sectors such as automobiles, infrastructure, FMCG, aviation, and chemicals may face margin pressure when input costs rise faster than their ability to pass them on.

Financial Markets and Sentiment

Sharp changes in global commodity prices can influence inflation expectations, interest rate outlooks, and currency movements—all of which affect broader equity market sentiment.

This is why commodity price trends are closely tracked by equity investors, even if they are not directly investing in commodity-linked stocks.

Why Quoted Commodity Prices in India May Differ from Global Prices

Retail investors often notice that quoted commodity prices in India do not always move in exact proportion to global benchmarks. This divergence can be attributed to:

- Local taxes and duties

- Transportation and logistics costs

- Inventory levels and procurement contracts

- Regulatory interventions

- Demand-supply imbalances within India

These factors explain why domestic prices sometimes adjust gradually rather than instantly.

Conclusion

Global commodity prices play a meaningful role in shaping domestic price movements, corporate profitability, and market sentiment in India. While policy measures and local factors influence short-term outcomes, global commodity prices and Indian markets remain structurally linked.

For retail investors, understanding how global commodity prices affect India provides valuable macro context—helping interpret price volatility, sector performance, and inflation trends with greater clarity. As always, informed analysis and awareness of broader economic linkages are essential when evaluating market developments.

About GigaPro: Beyond basic trading, GigaPro mobile trading app equips users with a suite of advanced features to enhance their trading strategies. Download the app today to start your trading journey on your Android device: (Download GigaPro Mobile App) or on your Apple device: (Download GigaPro Mobile App).

Related Blogs:

How Quoted Prices Are Determined in Commodity Exchanges

What is Quoted Price in Commodity Trading?

What is Commodity Trading?

How to Diversify Your Portfolio with Commodities: A Strategic Approach

The Rising Appeal of Commodities for Indian Investors

Top Strategies and Tips for Maximizing Profits in Commodity Trading

Different Types of Commodities and Their Trading Characteristics

Beyond Stocks: Exploring the World of Commodities

Diversification Strategies: Combining Commodities and Equities

Commodity vs Equity Market: A Beginner’s Guide to Understanding the Differences

What are Commodities? Understanding the Basics

Why Energy Commodities Deserve a Spot in Your Indian Investments

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Why do global commodity prices matter for India?

Global commodity prices matter for India because many key commodities—such as crude oil, metals, and fertilisers—are imported or priced using international benchmarks.

How are quoted commodity prices in India determined?

Quoted commodity prices in India are influenced by global prices, exchange rates, import duties, transportation costs, and domestic demand-supply conditions.

Does a rise in global commodity prices always increase Indian prices?

Not always. Government policies, subsidies, inventory levels, and currency movements can delay or moderate the transmission of global price changes.

How do global commodity prices affect Indian stock markets?

Changes in global commodity prices can impact company margins, inflation expectations, and sector performance, thereby influencing Indian stock market sentiment.

Which sectors are most sensitive to global commodity price movements?

Energy, metals, infrastructure, automobiles, aviation, and FMCG sectors tend to be more sensitive due to their direct or indirect reliance on commodity inputs.