Technology and Automation in Basket Trading: The Role of Online Trading Platforms

Technology and Automation in Basket Trading: The Role of Online Trading Platforms

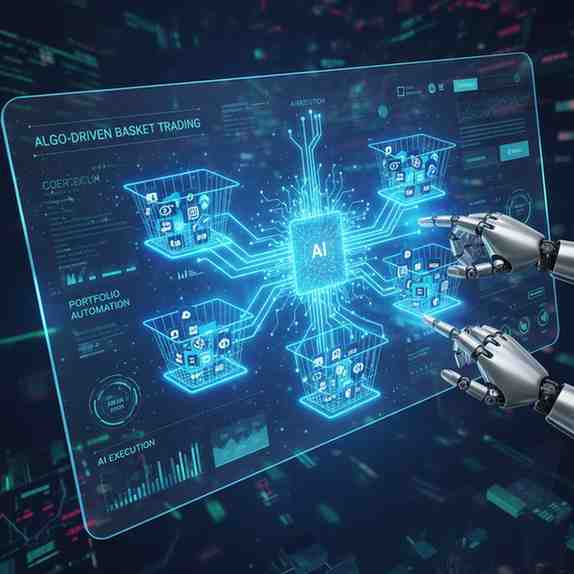

Technology has transformed almost every aspect of financial markets, and trading in India is no exception. Among the many developments shaping the modern trading environment, basket trading has benefited significantly from digital innovation. Earlier, traders had to execute multiple orders manually—an approach that required time, effort, and constant monitoring. Today, with the rise of efficient online platforms, basket trading automation has made this process faster, more consistent, and easier to manage.

As online trading platforms evolve, they are increasingly integrating advanced tools, algorithmic capabilities, and process automation to enhance order execution. This blog discusses the role of technology in online trading platforms, how automated basket orders work, and why automation has become an important part of trading strategies for Indian investors.

Understanding Basket Trading and Its Evolution

Basket trading allows investors to place multiple trades simultaneously across a group of securities. These securities may belong to a single sector, track a specific index, or follow a customised strategy defined by the trader. In India, basket trading is widely used by retail traders, portfolio managers, and institutions looking to execute structured trades without having to place each order individually.

Traditionally, traders had to calculate allocations, monitor market prices, and enter orders one by one. This manual process created delays and increased the risk of inaccurate entries. The integration of automation tools into trading platforms has helped reduce these challenges and opened the path for more sophisticated trading strategies.

Basket Trading Automation and Its Impact

The shift toward basket trading automation has created notable changes in how market participants execute trades. Automation ensures that multiple orders are placed accurately and efficiently, reducing manual intervention.

- Consistent Execution

Automation allows traders to define rules for order placement, such as weights, quantities, and price conditions. Once set, the system executes the entire basket based on predefined parameters.

- Reduced Execution Time

Executing multiple trades one by one can lead to delays, especially during periods of high volatility. Automated basket orders minimise time gaps, helping traders avoid significant price deviations between individual orders.

- Reduced Manual Errors

Typing errors, incorrect quantities, and wrong price inputs are common when placing large sets of orders manually. Automation reduces the potential for such mistakes by executing rules-based instructions.

- Alignment With Trading Strategies

Professional traders and institutions often use baskets to follow index-tracking strategies, hedging techniques, or sector rotations. Automation helps maintain consistency in these strategies by placing trades according to defined criteria.

The Role of Technology in Online Trading Platforms

Modern trading tools have made it easier for investors to adopt structured and disciplined trading methods. The growing role of technology in trading lies in its ability to make processes more transparent, accurate, and accessible.

- Advanced User Interfaces

Today’s platforms provide clean, intuitive dashboards that allow traders to create, modify, and monitor baskets without technical complexity. This visual clarity helps users keep track of multiple instruments simultaneously.

- Real-Time Data Integration

Execution quality depends heavily on accurate market data. Technology in online trading platforms ensures real-time quote streaming, enabling traders to match execution prices closely with planned strategies.

- Customisation Tools

Platforms offer features like drag-and-drop basket creation, custom weight allocation, rebalancing tools, and scenario analysis. These tools give traders full control over how baskets are constructed and executed.

- API and Algorithmic Integration

Some platforms provide API support, allowing advanced users to create rule-based trading models. This extends automation beyond standard orders and helps traders build personalised strategies with minimal manual involvement.

Automated Basket Orders: How They Improve Execution

Automated basket orders are now commonly used by Indian traders who want to streamline their strategies. These automated instructions cover multiple actions—buying, selling, rebalancing, and even aligning with index movements.

- Systematic Strategy Implementation

A set of predefined rules ensures that baskets are executed in a consistent manner, especially when traders repeat similar strategies regularly.

- Efficient Rebalancing

Portfolio rebalancing can be time-consuming. Automation tools allow traders to adjust weights and rebalance baskets instantly. This can be useful for sector rotation strategies, index replication, or risk management.

- Support for Intraday and Short-Term Trading

High-frequency or short-duration traders benefit from automation because it helps them place multiple trades with minimal delay. Faster execution can be particularly relevant in volatile markets.

- Enhanced Transparency

Most platforms provide detailed execution logs, making it easier for traders to review activity and refine their strategies.

Benefits of Automated Trading Systems in Basket Execution

Investors often look for information on the benefits of automated trading systems to understand whether these tools suit their trading style. Automation brings clarity, consistency, and better alignment with planned strategies.

Key Benefits Include:

- Faster order execution across multiple securities

- Reduced manual workload for traders managing several instruments

- Improved accuracy due to rule-based order placement

- Better risk management through automated allocation and rebalancing

- Structured decision-making, which reduces emotional trading

- Ability to operate complex strategies that would be difficult manually

For Indian traders who follow index-based strategies or sector-focused baskets, automation adds efficiency and helps streamline their daily trading activity.

Why Technology Matters for Indian Investors

India’s financial markets have seen rapid digital transformation. With the growth of online trading platforms, more investors are adopting sophisticated tools that were once limited to institutional traders. Automation in basket trading reflects this shift, enabling retail investors to access tools that support better execution and structured decision-making.

Online platforms continue to introduce advanced charting, data analytics, risk management modules, and automated workflows. These developments support the wider adoption of basket trading automation in India.

Conclusion

Basket trading has evolved significantly with the rise of digital platforms. As investors in India look for efficient ways to execute multiple trades, automation has become an important solution. By understanding how automated basket orders function and recognising the broader role of technology in trading, individuals can make more informed decisions about incorporating these tools into their strategies.

Technology in online trading platforms continues to influence how traders engage with the markets. With improved accessibility, enhanced execution quality, and a clearer workflow, basket trading automation offers practical value for those seeking structured and efficient trading methods.

Download the app today to start your trading journey on your Android device: (Download GigaPro Mobile App) or on your Apple device: (Download GigaPro Mobile App).

Related Blogs:

How Basket Orders Help Reduce Execution Time and Transaction Costs

Key Benefits of Using Basket Orders for Portfolio Diversification

How to Use Basket Orders for Efficient Portfolio Rebalancing in India

What is Sector Rotation and How Does it Work?

How to Implement Diversification for a Profitable Portfolio

Build a Stronger Investment Portfolio Through Diversification

Diversification Strategies: Combining Commodities and Equities

Diversification Strategies: Why Spreading Your Risk Matters

How to Use Sector Rotation to Diversify Your Portfolio

Why Diversification Strategies Matter for Managing Investment Risk

Why Trade Commodities? Harnessing Diversification and Inflation Hedge Potential

How Do Asset Allocation and Diversification Work Together?

How to Diversify Your Portfolio with Commodities: A Strategic Approach

Building an All-Weather Portfolio for the Indian Investor Integrating Equities, Bonds, and Commodities

The Rising Appeal of Commodities for Indian Investors

Commodity Trading: Key Strategies for Risk Management and Informed Decisions

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.