How Momentum Funds Manage Drawdowns and Portfolio Turnover

How Momentum Funds Manage Drawdowns and Portfolio Turnover

Momentum funds have gained attention among Indian investors who are interested in rule-based equity strategies rather than discretionary stock picking. These funds follow a systematic approach: they invest in stocks that have shown relatively stronger price performance over a defined period and exit those that lose momentum. While the concept appears straightforward, investors often want clarity on two critical aspects—how momentum funds manage drawdowns and how portfolio turnover in momentum mutual funds affects risk and returns. Understanding these elements is essential before considering momentum as part of an equity allocation.

Understanding the Momentum Investing Strategy in India

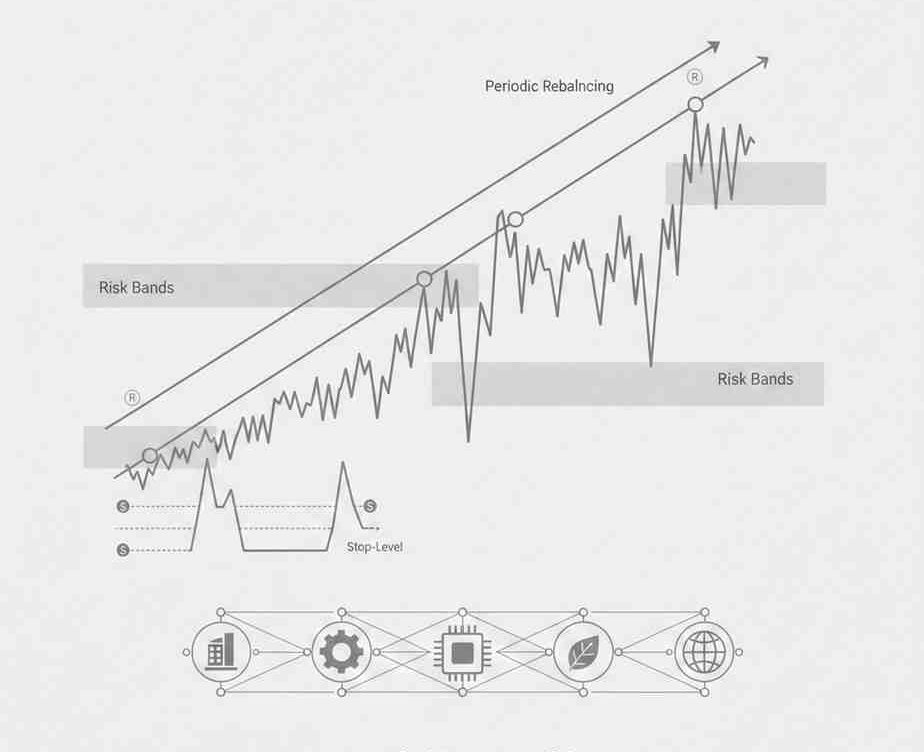

The momentum investing strategy in India is typically implemented through quantitative models. These models rank stocks based on recent price performance, sometimes adjusted for volatility or liquidity. Periodic rebalancing—monthly, quarterly, or semi-annually—is used to realign the portfolio with the updated rankings.

Unlike value or growth strategies that rely heavily on fundamentals, momentum investing is driven primarily by market behaviour. This makes momentum funds more responsive to trends, but also more exposed to market reversals. As a result, drawdown management and portfolio turnover become central to how these funds operate.

How Momentum Funds Manage Drawdowns

Drawdowns refer to the decline in a portfolio’s value from its previous peak. In momentum strategies, drawdowns often occur during sharp market reversals or when leadership shifts abruptly from one set of stocks or sectors to another.

To understand how momentum funds manage drawdowns, it is important to look at the built-in risk controls within their models:

- Rule-based exits

Momentum funds typically exit stocks that fall below certain ranking thresholds. When a stock’s relative performance weakens, it is removed during the next rebalance cycle. This disciplined exit process aims to limit prolonged exposure to declining stocks. - Diversification across sectors and market capitalisation

Most momentum funds in India maintain diversification limits to avoid concentration in a single sector or theme. This helps reduce drawdowns caused by sector-specific corrections, although it does not eliminate market-wide risks. - Volatility filters and score adjustments

Some strategies incorporate volatility measures to avoid excessively unstable stocks. By moderating exposure to high-volatility names, momentum fund volatility and drawdown control can be somewhat improved, especially during uncertain market phases. - Regular rebalancing discipline

Frequent rebalancing ensures that the portfolio adapts to changing trends. While this does not prevent short-term losses, it helps align the portfolio with prevailing market strength over time.

It is important to note that momentum funds do not aim to avoid drawdowns entirely. Instead, they seek to respond systematically to changing price trends rather than relying on discretionary judgment.

Portfolio Turnover in Momentum Mutual Funds

Portfolio turnover in momentum mutual funds is generally higher than in traditional diversified equity funds. This is a direct result of the strategy’s reliance on periodic re-evaluation of stock momentum.

Higher turnover occurs because:

- Stocks that lose momentum are replaced.

- New stocks with improving relative performance are added.

- Rebalancing is carried out at predefined intervals.

From an investor’s perspective, higher turnover has both implications and trade-offs.

On the operational side, higher turnover can increase transaction costs. Fund managers attempt to manage this through liquidity filters and staggered rebalancing, but turnover remains an inherent feature of momentum strategies.

From a taxation standpoint, frequent buying and selling within the fund may lead to higher short-term capital gains at the portfolio level. However, since these transactions occur within the mutual fund, the tax impact is reflected in the net asset value rather than triggering individual tax liabilities for the investor until redemption.

Risks of Momentum Investing in Mutual Funds

Understanding the risks of momentum investing in mutual funds is critical, particularly for investors new to factor-based strategies.

- Trend reversals

Momentum strategies tend to underperform when markets shift direction suddenly. Stocks that performed well in the recent past may correct sharply, leading to short-term drawdowns. - Market-phase sensitivity

Momentum funds often behave differently across market cycles. They may perform relatively better during trending markets and face challenges during range-bound or highly volatile phases. - Higher volatility compared to broad indices

Due to concentration in recent outperformers, momentum fund volatility and drawdown control may differ from that of diversified index funds. Investors should be prepared for performance deviations over shorter periods. - Behavioural discomfort

Since momentum strategies may exit fundamentally strong stocks due to price weakness, the approach may feel counterintuitive to investors accustomed to long-term buy-and-hold investing.

Role of Drawdown and Turnover Management for Indian Investors

For Indian investors, momentum funds are often positioned as a satellite allocation rather than a core holding. Their rules-based structure provides transparency, but it also requires patience and an understanding of factor cycles.

Drawdown management in momentum funds relies more on systematic exits and diversification than on defensive positioning. Similarly, portfolio turnover in momentum mutual funds is a structural feature rather than a short-term tactical decision.

Investors evaluating momentum funds should focus on:

- Consistency of the underlying model

- Rebalancing frequency and methodology

- Historical behaviour across different market phases

- Alignment with their own risk tolerance and investment horizon

Conclusion

Momentum funds offer a structured way to participate in prevailing market trends, supported by quantitative decision-making. How momentum funds manage drawdowns depends largely on predefined rules, diversification limits, and periodic rebalancing rather than discretionary intervention. At the same time, portfolio turnover in momentum mutual funds reflects the adaptive nature of the strategy, bringing both responsiveness and additional costs.

The momentum investing strategy in India can play a role in a diversified equity portfolio, provided investors understand the associated volatility, drawdown patterns, and risks of momentum investing in mutual funds. A clear grasp of these factors helps set realistic expectations and supports more informed investment decisions.

About GigaPro: Beyond basic trading, GigaPro mobile trading app equips users with a suite of advanced features to enhance their trading strategies. Download the app today to start your trading journey on your Android device: (Download GigaPro Mobile App) or on your Apple device: (Download GigaPro Mobile App).

Related Blogs:

Momentum Funds for Beginners: Factors to Consider Before You Start

Role of Open-Ended Funds in Goal-Based Financial Planning

Is Momentum Investing Suitable for Conservative Investors?

How to Evaluate Momentum Funds: Metrics and Factors to Analyse

What is Quoted Price in Commodity Trading?

What are Momentum Funds?

Momentum Funds vs Index Funds: Which One Aligns With Your Strategy?

Top Mistakes Investors Make While Investing in Momentum Funds

ETF Investing in India: A Beginner’s Guide to Passive Wealth

Understanding Index Funds in the Indian Market

Index Funds vs Mutual Funds: Which One Should You Pick?

Understanding Commodity Markets for Investment Opportunities

What is Sector Rotation and How Does it Work?

How to Implement Diversification for a Profitable Portfolio

Build a Stronger Investment Portfolio Through Diversification

Diversification Strategies: Combining Commodities and Equities

Diversification Strategies: Why Spreading Your Risk Matters

How to Use Sector Rotation to Diversify Your Portfolio

Different Types of Commodities and Their Trading Characteristics

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.