How Momentum Funds React to Market Volatility

How Momentum Funds React to Market Volatility

Market volatility is an inevitable part of equity investing. Prices move sharply in response to economic data, global events, policy decisions, and investor sentiment. During such phases, investors often question how different investment strategies behave—and whether certain approaches are more sensitive to sudden market swings.

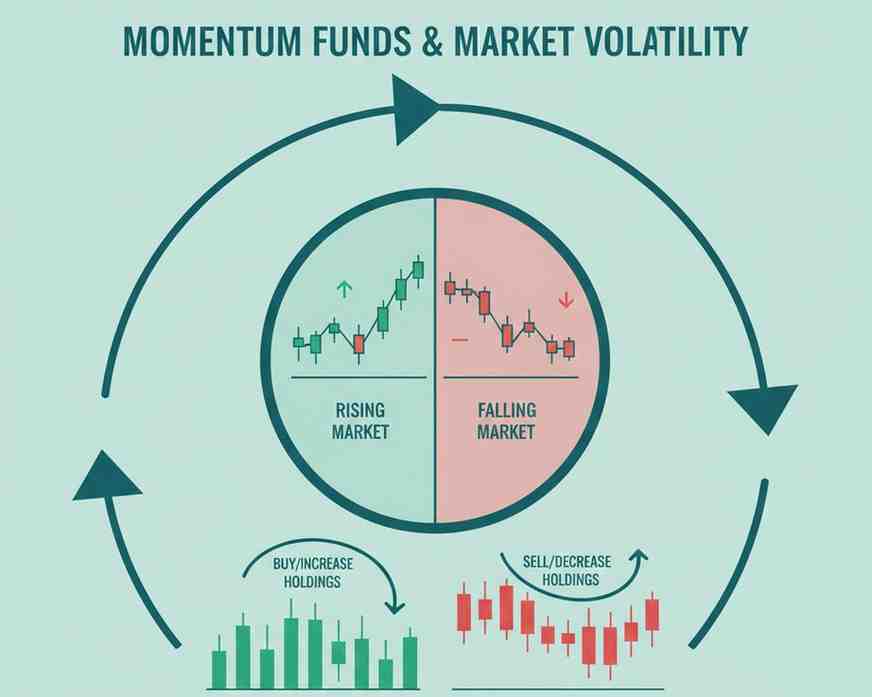

Momentum funds, which follow a rules-based strategy of investing in stocks showing strong recent performance, tend to attract particular attention during volatile periods. Understanding how momentum funds react to market volatility requires clarity on how these funds are constructed, how they rebalance, and how they respond to changing trends rather than short-term noise.

What Are Momentum Funds?

Momentum funds are a type of factor-based mutual fund that select stocks based on their recent price performance relative to peers. Instead of relying on forecasts or discretionary judgement, these funds follow predefined quantitative rules to identify stocks exhibiting upward momentum.

In India, factor-based momentum funds typically rebalance periodically—such as semi-annually or annually—based on index methodologies or internal models. This systematic approach helps remove emotional bias but also means the strategy reacts with a certain lag.

Momentum Funds and Market Volatility: The Core Relationship

The relationship between momentum funds and market volatility is nuanced. Momentum strategies do not attempt to predict volatility; instead, they respond to established price trends. This distinction is important.

- In trending markets, even if volatility is elevated, momentum funds may continue to hold stocks that maintain relative strength.

- In choppy or range-bound markets, frequent reversals can challenge momentum signals.

As a result, volatility alone does not determine performance—its interaction with market direction matters more.

How Momentum Funds Perform in Volatile Markets

Understanding how momentum funds perform in volatile markets requires separating different volatility scenarios:

- Volatility With a Clear Trend

When markets experience sharp movements but maintain a directional bias—upward or downward—momentum strategies often adapt reasonably well. Stocks that continue to outperform the broader market remain in the portfolio until the next rebalance.

- Volatility Without Direction

Sideways markets with frequent reversals can be more challenging. Momentum signals may change rapidly, increasing portfolio churn and potentially affecting returns.

- Sharp Market Corrections

During sudden market corrections, momentum funds may initially hold stocks that were leaders in the previous phase. Adjustments occur gradually during scheduled rebalancing, rather than immediately.

This explains why momentum funds are not designed as defensive strategies, but as trend-following ones.

Momentum Investing During Market Fluctuations

Momentum investing during market fluctuations works best when investors understand its time horizon. The strategy is not meant to react to daily price movements but to capture sustained trends over months.

For retail investors, this means:

- Short-term volatility may not be fully reflected in portfolio changes

- Performance dispersion can widen during unstable phases

- Patience becomes a key requirement

Momentum investing rewards consistency in process rather than attempts to time volatility.

Impact of Market Volatility on Momentum Funds

The impact of market volatility on momentum funds shows up in a few structural ways:

Portfolio Turnover

Higher volatility can increase the frequency of ranking changes among stocks, leading to higher turnover at rebalancing points.

Tracking Error

During volatile phases, momentum funds may diverge more noticeably from broad market indices, both positively and negatively.

Sector Concentration

Momentum strategies may become temporarily concentrated in sectors showing strong trends, which can amplify volatility at the portfolio level.

These characteristics make momentum funds distinct from diversified market-cap-weighted strategies.

Factor-Based Momentum Funds in India

In India, factor-based momentum funds typically follow transparent index methodologies. These indices define:

- Look-back periods for momentum calculation

- Rebalancing frequency

- Stock inclusion and exclusion rules

- Liquidity and market-cap filters

Because of this structure, Indian momentum funds are better viewed as long-term allocation tools rather than tactical instruments for volatile markets.

Regulatory frameworks also ensure disclosures around risks, methodology, and rebalancing, helping investors understand expected behaviour during market stress.

Key Considerations for Investors

Momentum funds are not designed to smooth volatility or protect capital during sharp corrections. Instead, they aim to capture persistent trends over time. Investors evaluating these funds should consider:

- Their ability to stay invested through cycles

- Portfolio diversification across other factors or asset classes

- Alignment with long-term financial goals

Volatility is part of the process, not a flaw of the strategy.

Conclusion

Momentum funds respond to market volatility through a structured, rules-based approach rather than discretionary judgement. While market volatility can influence momentum fund performance in the short term, the strategy’s effectiveness depends on capturing sustained trends across market cycles.

For investors exploring how momentum funds perform in volatile markets, the key takeaway is to view momentum investing as a long-term factor exposure—one that behaves differently from traditional equity funds, especially during periods of heightened market uncertainty.

About GigaPro: Beyond basic trading, GigaPro mobile trading app equips users with a suite of advanced features to enhance their trading strategies. Download the app today to start your trading journey on your Android device: (Download GigaPro Mobile App) or on your Apple device: (Download GigaPro Mobile App).

Related Blogs:

Momentum Funds for Beginners: Factors to Consider Before You Start

What are Closed-Ended Mutual Funds?

Lump Sum Investments – How Is It Different from an SIP?

What Are Open Ended Mutual Funds?

What is Reversal Trading?

What Is an Auction Market and How Does It Work?

Understanding Mutual Fund SIP Returns: How to Calculate and Maximize Your Earnings

SIP Calculator and Inflation: Understanding How Inflation Impacts Your Mutual Fund Returns

SIP vs. Lumpsum: What’s the Best Way to Invest in Mutual Funds for Retirement?

How to Evaluate Momentum Funds: Metrics and Factors to Analyse

What is Quoted Price in Commodity Trading?

What are Momentum Funds?

Momentum Funds vs Index Funds: Which One Aligns With Your Strategy?

Top Mistakes Investors Make While Investing in Momentum Funds

ETF Investing in India: A Beginner’s Guide to Passive Wealth

Understanding Index Funds in the Indian Market

Index Funds vs Mutual Funds: Which One Should You Pick?

Understanding Commodity Markets for Investment Opportunities

What is Sector Rotation and How Does it Work?

How to Implement Diversification for a Profitable Portfolio

Build a Stronger Investment Portfolio Through Diversification

Diversification Strategies: Combining Commodities and Equities

Diversification Strategies: Why Spreading Your Risk Matters

How to Use Sector Rotation to Diversify Your Portfolio

Different Types of Commodities and Their Trading Characteristics

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

What are momentum funds?

Momentum funds are factor-based mutual funds that invest in stocks showing strong recent price performance, following a predefined, rules-based strategy.

How do momentum funds react to market volatility?

Momentum funds respond to volatility by gradually adjusting their portfolios during scheduled rebalancing, rather than reacting to short-term market movements.

Do momentum funds perform well in highly volatile markets?

Momentum fund performance during volatile markets depends on whether clear price trends exist. Frequent market reversals can challenge momentum signals.

Are momentum funds riskier than traditional equity funds?

Momentum funds can experience higher short-term fluctuations due to concentration in trending stocks, making them more sensitive during volatile phases.

Are factor-based momentum funds suitable for long-term investors?

Factor-based momentum funds may suit investors with a long-term horizon who understand factor cycles and can remain invested through periods of volatility.