Sectoral Diversification in Equities Does It Truly Reduce Risk?

Sectoral Diversification in Equities: Does It Truly Reduce Risk?

When equity markets fluctuate, one common suggestion is to “diversify across sectors.” But what does that actually mean in practice? And more importantly, does sectoral diversification in equities genuinely reduce risk, or is it just a widely repeated concept?

For Indian retail investors seeking stability without exiting equity markets altogether, understanding sector diversification can play a meaningful role in portfolio construction. This article explores how sector allocation works, whether it helps in managing volatility, and how investors can approach it thoughtfully.

Understanding Sectoral Diversification in Equities

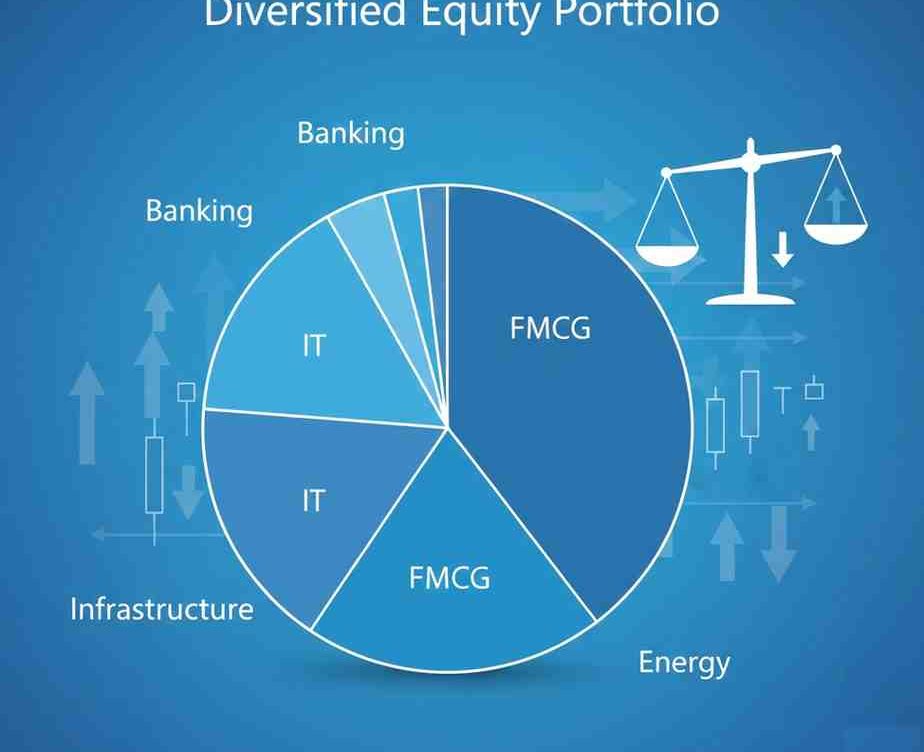

Equity markets are broadly divided into sectors such as banking and financial services, information technology, pharmaceuticals, FMCG, energy, infrastructure, and more. Each sector responds differently to economic cycles, regulatory changes, interest rate movements, and global developments.

Sectoral diversification in equities refers to spreading investments across multiple industries instead of concentrating exposure in just one or two sectors. For instance, an investor heavily invested in banking stocks may face higher portfolio volatility if financial markets experience stress. However, combining exposure to defensive sectors like FMCG or healthcare may potentially moderate the impact.

This approach does not eliminate risk. Instead, it aims to balance sector-specific vulnerabilities.

How Sector Diversification Reduces Portfolio Risk

To understand how sector diversification reduces portfolio risk, it is useful to look at economic cycles.

Different sectors tend to perform differently during various phases of the economy:

- Expansion phase: Capital goods, infrastructure, and banking often see stronger earnings growth.

- Slowdown phase: Defensive sectors like pharmaceuticals and FMCG may demonstrate relatively stable demand.

- High inflation environment: Energy or commodity-linked businesses may respond differently than consumer-driven sectors.

When investors allocate capital across sectors with varying sensitivities to economic factors, they reduce dependence on a single growth driver. This helps manage what is known as unsystematic risk—risk specific to a company or industry.

However, it is important to recognise that in severe market corrections, correlations across sectors may increase. During such phases, even diversified portfolios can experience temporary drawdowns. Sector diversification works as a risk-balancing tool, not as a guarantee against losses.

Sector Allocation Strategy in Stock Investing

A disciplined sector allocation strategy in stock investing typically involves three considerations:

- Economic Outlook

Investors may analyse macroeconomic indicators such as GDP growth, inflation, interest rates, and government spending patterns. Certain sectors tend to respond more directly to policy reforms and fiscal initiatives in India.

- Portfolio Objectives

A long-term investor focused on capital appreciation may allocate differently compared to someone nearing financial goals and prioritising capital preservation.

- Risk Tolerance

An investor comfortable with cyclical volatility may hold higher exposure to sectors like metals or infrastructure. A conservative investor may maintain exposure to relatively stable consumption-oriented businesses.

Retail investors often search for “how to diversify equity portfolio in India” or “sector allocation for long-term investing.” These long-tail queries reflect informational intent. They are not necessarily looking for stock tips, but for structured guidance on portfolio design.

A balanced allocation does not imply equal weighting across all sectors. Instead, it requires periodic review and alignment with evolving market conditions and financial goals.

Diversifying Across Sectors in Stock Market: Practical Considerations

When diversifying across sectors in the stock market, investors can consider different routes:

- Direct stock selection across industries

- Sectoral mutual funds or ETFs

- Broad-based index funds that already incorporate multi-sector exposure

Each route has distinct implications. Direct stock investing requires deeper research and monitoring. Sectoral funds offer targeted exposure but may increase concentration risk if used excessively. Broad-market index funds inherently provide sector diversification based on index composition.

Indian investors should also consider sector concentration in benchmark indices. For example, financial services often carry significant weight in major indices. Even passive investors may indirectly hold high sector concentration unless complemented by additional allocation strategies.

Sector Risk Management in Equity Portfolio

Sector risk management in equity portfolio involves ongoing assessment rather than one-time allocation. Markets evolve, industries transform, and regulatory frameworks change.

Consider these monitoring aspects:

- Sector weight relative to overall portfolio

- Earnings trends within each industry

- Regulatory developments affecting specific sectors

- Global linkages, particularly for export-driven industries like IT or pharmaceuticals

Overexposure to a single high-growth theme can amplify volatility. For instance, technology stocks may outperform for extended periods but may also correct sharply due to global demand concerns.

Periodic rebalancing—adjusting allocations back to intended levels—helps maintain risk discipline. Rebalancing does not aim to predict market movements but ensures portfolio structure remains aligned with initial strategy.

Limitations of Sectoral Diversification

While sectoral diversification contributes to risk moderation, it has limitations:

- It does not protect against systemic market-wide downturns.

- Correlations between sectors can rise during global crises.

- Over-diversification may dilute meaningful returns if allocation becomes excessively fragmented.

Additionally, focusing only on sectors without considering asset class diversification (such as debt, gold, or international exposure) may leave portfolios exposed to broader equity market volatility.

For investors evaluating “sector diversification vs asset allocation,” it is important to understand that sectoral diversification operates within equities, while asset allocation spans across different asset classes.

Is Sectoral Diversification Enough for Retail Investors?

For many retail investors in India, broad-based mutual funds or diversified equity funds already incorporate sector diversification. Investors managing direct equity portfolios, however, may need to consciously evaluate concentration levels.

Sector diversification is not about predicting which industry will outperform next. It is about reducing dependency on a single economic driver.

A structured approach may include:

- Avoiding excessive allocation to a single sector

- Aligning sector exposure with financial goals

- Reviewing allocation periodically

- Seeking professional advice where appropriate

As per regulatory guidelines, investors should assess scheme-related documents, understand risk factors, and evaluate suitability before making investment decisions.

Conclusion

Sectoral diversification in equities plays a meaningful role in managing industry-specific risks. By spreading exposure across sectors with different economic sensitivities, investors may moderate volatility within their equity portfolios.

However, it should be viewed as one component of broader portfolio construction. Effective risk management often involves combining sector diversification with asset allocation, periodic review, and disciplined rebalancing.

Equity investing inherently involves market risk. Sector diversification does not eliminate uncertainty, but it can contribute to a more balanced investment structure when implemented thoughtfully.

Investors are encouraged to evaluate their financial objectives, risk appetite, and investment horizon before making allocation decisions, and consult a SEBI-registered investment adviser where necessary.

Download the app today to start your trading journey on your Android device: (Download GigaPro Mobile App) or on your Apple device: (Download GigaPro Mobile App).

Related Blogs:

How Sector Rotation Enhances Traditional Value Investing Strategies

Growth Investing vs. Value Investing: Which Strategy Is Right for You?

Risk Management in Equity Investing: Protecting Your Portfolio

Value Investing as a Stock Market Investing Strategy in 2025

Long-Term Equity Investing: Beat the Market and Achieve Financial Freedom

Swing Trading: A Comprehensive Guide to Make Short-Term Gains

A Guide to Value Investing in 2025

Combining Sector Rotation with Other Investing Strategies

Beyond Buy and Hold: Elevating Returns with Sector Rotation

Common Pitfalls of Sector Rotation and How to Avoid Them

What is Sector Rotation and How Does it Work?

Sector rotation and the economic cycle: what is the connection?

How to Implement Diversification for a Profitable Portfolio

Build a Stronger Investment Portfolio Through Diversification

Diversification Strategies: Combining Commodities and Equities

Diversification Strategies: Why Spreading Your Risk Matters

How to Use Sector Rotation to Diversify Your Portfolio

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Does sectoral diversification eliminate risk in equities?

No. It reduces industry-specific risk but cannot eliminate overall market risk.

How many sectors should be included in an equity portfolio?

There is no fixed number. The allocation depends on portfolio size, investment goals, and monitoring capacity.

Is investing in sectoral mutual funds sufficient for diversification?

Sectoral funds provide focused exposure. However, relying solely on one sector fund may increase concentration risk.