Things to Check Before Investing in Momentum Mutual Funds

Things to Check Before Investing in Momentum Mutual Funds

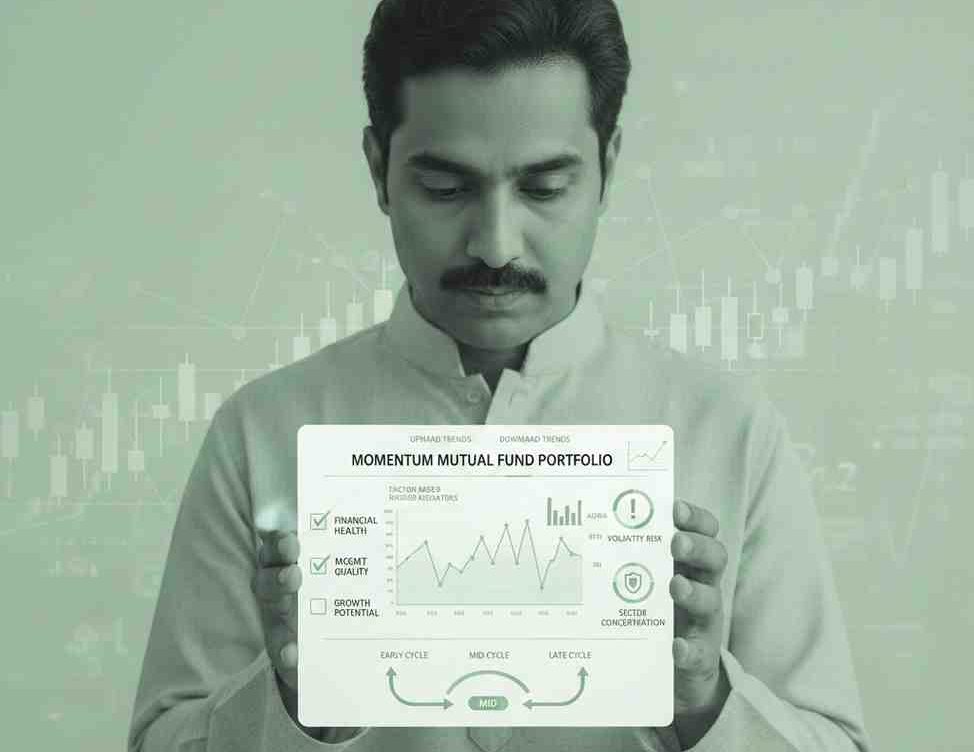

Momentum mutual funds have gained attention among Indian investors who are looking to align their portfolios with prevailing market trends. These funds follow a rule-based approach, investing in stocks that have shown relatively strong recent performance compared to their peers. While the strategy may appear straightforward, momentum investing comes with its own dynamics, risks, and suitability considerations. Before allocating capital, it is important to evaluate several factors carefully.

This article outlines the key things to consider before investing in momentum mutual funds, helping investors make informed decisions aligned with their financial objectives.

Understanding the Momentum Mutual Fund Investment Strategy

At the core of a momentum mutual fund investment strategy lies the principle that stocks which have performed well in the recent past may continue to do so for a certain period. Fund managers typically select securities based on quantitative indicators such as price trends, relative strength, or performance rankings within an index.

In India, momentum funds are often offered as factor-based or smart beta funds, following predefined rules rather than discretionary stock picking. This makes them systematic in nature, but also means their performance is closely tied to market cycles. Investors should understand that momentum strategies work differently in trending markets versus sideways or volatile phases.

Market Cycles and Timing Considerations

One of the most important things to consider before investing in momentum mutual funds is their sensitivity to market cycles. Momentum strategies tend to perform more consistently when markets exhibit clear upward or downward trends. During periods of sharp reversals or prolonged consolidation, these funds may experience fluctuations.

Investors should assess their comfort with timing-related risks. Entering a momentum fund after a strong rally may expose the portfolio to corrections if market leadership changes. Since predicting short-term market movements is challenging, momentum funds are generally better suited as part of a broader allocation rather than a standalone solution.

Risks of Investing in Momentum Mutual Funds

Understanding the risks of investing in momentum mutual funds is essential before committing capital. Some of the key risks include:

- Higher volatility: Momentum portfolios may experience sharper price movements due to frequent rebalancing and concentration in trending stocks.

- Trend reversals: Stocks that were recent outperformers can underperform if market sentiment changes.

- Sector concentration: Momentum strategies may result in higher exposure to specific sectors during certain phases, increasing concentration risk.

- Short-term underperformance: In choppy or range-bound markets, momentum strategies may lag broader indices.

These risks do not make momentum funds unsuitable, but they do highlight the importance of aligning expectations with the strategy’s inherent characteristics.

Investment Horizon and Portfolio Role

Another crucial factor is momentum funds suitability for long-term investors. Momentum investing is often perceived as a short- to medium-term strategy, but in practice, it can be used over longer horizons when approached systematically. Over extended periods, momentum as a factor has shown persistence across market cycles, though returns may not be linear.

Long-term investors should view momentum funds as a tactical or satellite allocation rather than a core holding. Combining them with other investment styles, such as value or quality-oriented funds, may help balance portfolio behaviour across different market conditions.

Who Should Invest in Momentum Funds?

Clarifying who should invest in momentum funds can help avoid mismatched expectations. These funds may be suitable for investors who:

- Have a moderate to high risk tolerance

- Understand factor-based investing and market cycles

- Are comfortable with periodic volatility

- Already have diversified core equity exposure

On the other hand, investors seeking stable return patterns or those new to equity investing may need to approach momentum funds with caution. Adequate awareness of how the strategy behaves in different scenarios is important before investing.

Expense Ratios and Portfolio Turnover

Momentum strategies generally involve periodic rebalancing to capture changing trends. This can lead to higher portfolio turnover compared to traditional index funds. While expense ratios of momentum funds in India are regulated, investors should still compare costs across schemes.

Higher turnover may also have implications for tracking error and post-tax returns. Evaluating how efficiently the fund executes its strategy is an important part of due diligence.

Historical Performance and Index Methodology

While past performance does not indicate future outcomes, analysing historical data can provide insights into how the fund has behaved across market phases. Investors should look beyond headline returns and examine performance consistency, drawdowns, and relative returns versus benchmark indices.

Additionally, understanding the underlying index methodology—such as stock selection criteria, rebalancing frequency, and weight caps—can help investors assess whether the strategy aligns with their expectations.

Conclusion

Momentum mutual funds offer a rules-based approach to capturing market trends, but they are not without complexities. Evaluating market conditions, understanding the momentum mutual fund investment strategy, and being aware of the associated risks are essential steps before investing.

By carefully assessing these factors and considering how momentum funds fit within an overall asset allocation, investors can make more informed decisions aligned with their financial goals and risk profile.

About GigaPro: Beyond basic trading, GigaPro mobile trading app equips users with a suite of advanced features to enhance their trading strategies. Download the app today to start your trading journey on your Android device: (Download GigaPro Mobile App) or on your Apple device: (Download GigaPro Mobile App).

Related Blogs:

Are Momentum Funds Good for Long-Term Wealth Creation?

Role of Open-Ended Funds in Goal-Based Financial Planning

Is Momentum Investing Suitable for Conservative Investors?

How to Evaluate Momentum Funds: Metrics and Factors to Analyse

What is Quoted Price in Commodity Trading?

What are Momentum Funds?

Momentum Funds vs Index Funds: Which One Aligns With Your Strategy?

Top Mistakes Investors Make While Investing in Momentum Funds

ETF Investing in India: A Beginner’s Guide to Passive Wealth

Understanding Index Funds in the Indian Market

Index Funds vs Mutual Funds: Which One Should You Pick?

Understanding Commodity Markets for Investment Opportunities

What is Sector Rotation and How Does it Work?

How to Implement Diversification for a Profitable Portfolio

Build a Stronger Investment Portfolio Through Diversification

Diversification Strategies: Combining Commodities and Equities

Diversification Strategies: Why Spreading Your Risk Matters

How to Use Sector Rotation to Diversify Your Portfolio

Different Types of Commodities and Their Trading Characteristics

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.