Why Basket Orders Are Powerful Tools for Portfolio Diversification

Why Basket Orders Are Powerful Tools for Portfolio Diversification

Simultaneous Execution Across Multiple Stocks

When you place individual orders, market prices can move between each execution. This creates price gaps and uneven allocation.

Basket orders reduce this timing risk by executing all trades together (or in rapid sequence), ensuring:

- More consistent entry prices

- Better alignment with your planned allocation

- Reduced exposure to sudden intraday volatility

For example, if you’re allocating ₹5 lakhs across five sectors, simultaneous execution keeps your diversification intact from the start.

Precise Allocation Control

True diversification isn’t random stock selection — it’s planned allocation.

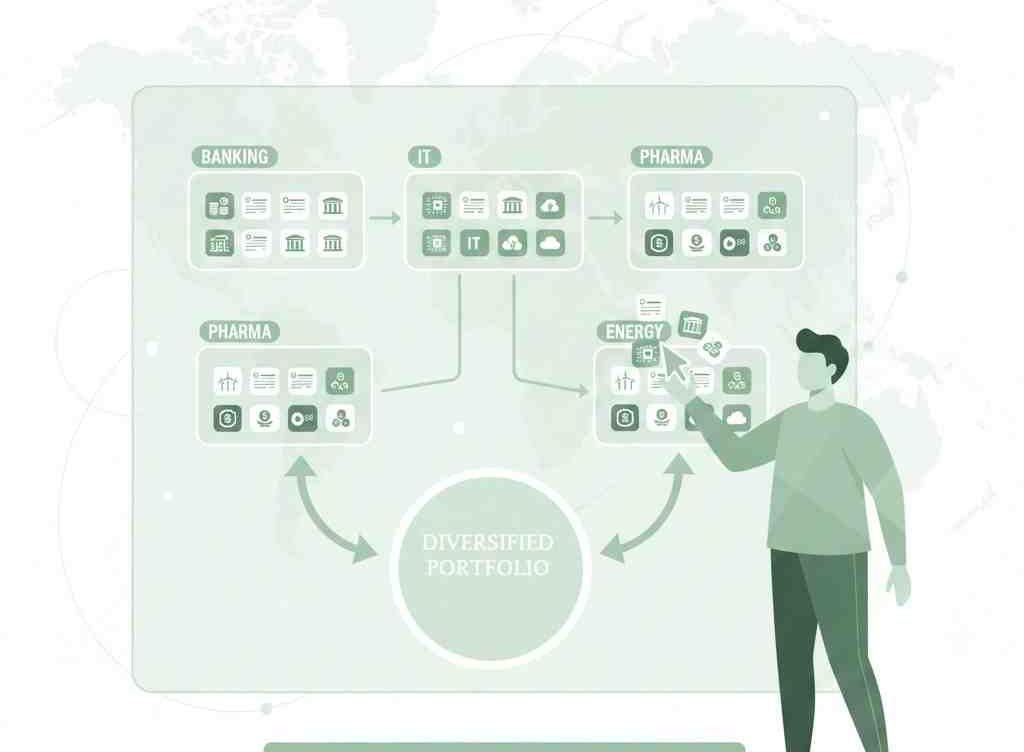

Let’s say you want:

- 30% in banking

- 20% in IT

- 20% in FMCG

- 15% in pharma

- 15% in energy

With basket orders, you can structure quantities exactly as per your allocation model. Instead of adjusting each trade manually, the basket executes your diversification blueprint in one go.

This makes basket orders especially useful for:

- Goal-based investing

- Asset allocation strategies

- Model portfolio replication

Reduced Execution Risk in Volatile Markets

During high volatility, stock prices can swing rapidly within minutes.

If you’re buying 8–10 stocks individually, price changes between orders can distort your intended diversification ratio.

Basket orders:

- Minimise delay between executions

- Reduce allocation mismatch

- Help lock in your strategy before markets shift

For investors building portfolios during earnings season or macro-driven market swings, this can make a noticeable difference.

Efficiency in Portfolio Rebalancing

Diversification is not a one-time event. Portfolios drift.

Suppose IT outperforms and now forms 35% of your portfolio instead of the intended 25%. You’ll need to rebalance by:

- Selling overweight positions

- Buying underweight sectors

Without basket orders, this means multiple manual trades.

With basket orders, you can:

- Sell selected stocks

- Buy others simultaneously

- Restore allocation discipline efficiently

This is particularly valuable for long-term investors who rebalance quarterly or annually.

Better Risk Management Through Structured Investing

Diversification reduces risk — but only when done systematically.

Basket orders encourage a structured approach because:

- You plan before execution

- You allocate intentionally

- You trade as per strategy, not impulse

It removes emotional, reactive decision-making and supports rule-based investing.

For example, if you follow:

- Multi-factor investing strategies

- Thematic diversification

- Sector rotation strategies

- Quant-driven models

Basket orders become a natural execution tool.

Time-Saving and Operational Simplicity

Managing 10–15 stocks individually can be time-consuming. Especially for working professionals or serious retail investors.

Basket orders:

- Save time

- Reduce order-entry errors

- Simplify tracking

- Improve workflow efficiency

Over the long term, operational efficiency plays a bigger role in investment success than most investors realise.

Custom Diversification vs ETFs

Many investors use ETFs for diversification — and rightly so.

But basket orders allow you to:

- Customize stock selection

- Exclude specific companies

- Adjust sector weights

- Build concentrated diversification

For example:

Instead of buying a broad index ETF, you could create your own basket of 15 carefully selected stocks that align with your risk appetite and conviction.

This offers more flexibility while maintaining diversification discipline.

Improved Cost Awareness

Depending on brokerage structure, basket orders can streamline transaction costs and reduce repetitive order placements.

More importantly, they allow you to plan capital deployment more efficiently rather than spreading trades over multiple days (which may increase slippage).

While cost savings may not always be dramatic, execution efficiency often improves.

Who Should Consider Using Basket Orders?

Basket orders are particularly useful for:

- Long-term equity investors building diversified portfolios

- Active traders managing sector-wide positions

- Investors replicating index components

- Portfolio managers following allocation models

- Investors rebalancing periodically

They may be less necessary for someone buying a single stock occasionally. But once your portfolio expands beyond 5–6 stocks, the advantages become more visible.

Are Basket Orders a Replacement for Diversification Strategy?

No.

Basket orders are an execution tool, not a strategy.

Diversification still depends on:

- Asset allocation

- Sector analysis

- Risk profiling

- Time horizon

- Market conditions

Basket orders simply help you implement your diversification strategy efficiently and with greater precision.

Conclusion

Portfolio diversification is one of the most important principles in investing. But how you execute that diversification matters just as much as the idea itself.

Basket orders help investors:

- Execute multiple trades simultaneously

- Maintain allocation discipline

- Reduce timing and execution risk

- Rebalance efficiently

- Save time and effort

In fast-moving markets, efficiency and structure can be a competitive advantage.

If you’re serious about building a disciplined, diversified equity portfolio, basket orders are not just convenient — they can be strategically powerful.

Download the app today to start your trading journey on your Android device: (Download GigaPro Mobile App) or on your Apple device: (Download GigaPro Mobile App).

Related Blogs:

Technology and Automation in Basket Trading: The Role of Online Trading Platforms

How Basket Orders Help Reduce Execution Time and Transaction Costs

Key Benefits of Using Basket Orders for Portfolio Diversification

How to Use Basket Orders for Efficient Portfolio Rebalancing in India

What is Sector Rotation and How Does it Work?

How to Implement Diversification for a Profitable Portfolio

Build a Stronger Investment Portfolio Through Diversification

Diversification Strategies: Combining Commodities and Equities

Diversification Strategies: Why Spreading Your Risk Matters

How to Use Sector Rotation to Diversify Your Portfolio

Why Diversification Strategies Matter for Managing Investment Risk

Why Trade Commodities? Harnessing Diversification and Inflation Hedge Potential

How Do Asset Allocation and Diversification Work Together?

How to Diversify Your Portfolio with Commodities: A Strategic Approach

Building an All-Weather Portfolio for the Indian Investor Integrating Equities, Bonds, and Commodities

The Rising Appeal of Commodities for Indian Investors

Commodity Trading: Key Strategies for Risk Management and Informed Decisions

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Do basket orders guarantee better returns?

No. They improve execution efficiency, not investment performance directly.

Are basket orders suitable for beginners?

Yes, especially if they’re building a diversified portfolio across multiple stocks.

Can basket orders be used for rebalancing?

Absolutely. They are particularly effective for portfolio rebalancing.

Are basket orders better than ETFs for diversification?

Not necessarily better — just more customizable. ETFs offer instant diversification, while basket orders provide flexibility.