Index Funds vs Mutual Funds: Which One Should You Pick?

Index Funds vs Mutual Funds: Which One Should You Pick?

If you’ve started your investment journey, you’ve likely come across index funds and actively managed mutual funds. Both aim to help you grow wealth—but their strategies, costs, and performance can differ significantly.

Thank you for reading this post, don't forget to subscribe!So how do you decide which one is right for you?

Let’s break down the difference between index funds and mutual funds, their pros and cons, and when you should pick one over the other.

What Are Index Funds?

Index Funds are mutual funds that replicate the performance of a market index like the Nifty 50 or Sensex.

- Passive investing: No fund manager actively picking stocks

- Invests in the same stocks, in the same proportion as the index

- Returns mirror index performance (minus a small cost)

✅ Example: A Nifty 50 Index Fund holds all 50 stocks in the Nifty 50 in the same weightage.

What Are Actively Managed Mutual Funds?

These are funds where fund managers actively select stocks to beat the market returns (called alpha).

- Portfolio changes based on research, analysis, and market view

- Includes large-cap, mid-cap, multi-cap, sectoral funds, etc.

- Returns can outperform or underperform the benchmark depending on manager skill and market conditions

✅ Example: A Large Cap Fund may invest only in top 100 companies but weightings and picks vary by fund manager.

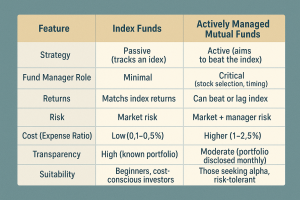

Key Differences: Index Funds vs Mutual Funds

Why Choose Index Funds?

✅ Low Cost

With minimal expense ratios, more of your returns are retained.

✅ Simplicity & Transparency

You always know what the fund holds—it mirrors the index.

✅ Market-Matching Returns

While they won’t beat the market, they usually perform better than many underperforming active funds.

✅ Ideal for Beginners

No need to analyze fund manager performance or market timing.

Why Choose Actively Managed Funds?

✅ Potential for Outperformance

Good fund managers can beat the index, especially in mid/small-cap segments.

✅ Flexibility

Managers can change holdings based on economic or sector trends.

✅ Goal-Based Diversification

Available in many types—sectoral, thematic, hybrid—aligned with your goals and risk levels.

Real-Life Example: Ramesh’s Dilemma

Ramesh, a 30-year-old professional, has ₹10 lakh to invest:

- He chooses ₹6 lakh in index funds (Nifty 50 & Sensex) for low-cost, long-term exposure

- Allocates ₹4 lakh in actively managed mid-cap and flexi-cap funds to try and capture higher growth

This blend gives him cost-efficiency + growth potential while managing risk.

Which One Should You Pick?

💡 Pick Index Funds If:

- You’re a beginner or passive investor

- You want low-cost, market-linked returns

- You prefer minimal monitoring

💡 Pick Actively Managed Funds If:

- You’re comfortable with slightly higher risk

- You believe in the fund manager’s ability to generate alpha

- You want exposure to mid/small caps or specific themes

📌 Pro Tip: Many experienced investors now follow a core-satellite approach:

- Core: Index funds (stability, low cost)

- Satellite: Actively managed funds (growth)

The Expense Ratio Effect Over 10 Years

| Investment | Average Return | Expense Ratio | Net Return | Value of ₹1 lakh (10 yrs) |

|

Index Fund |

11% | 0.3% | 10.7% | ₹2.76 lakh |

|

Active Fund |

12% | 2.0% | 10.0% | ₹2.59 lakh |

Even if an active fund earns a bit more, high expenses can eat into returns.

Conclusion

Both index funds and actively managed mutual funds have their place in a smart investor’s portfolio. It’s not about choosing one over the other—but choosing what suits your goals, risk appetite, and investment style.

For most investors, a balanced combination of both can offer cost-efficiency, diversification, and potential outperformance.

Need Help Choosing the Right Mix?

At Goodwill Wealth Management, we help you create a portfolio that blends the best of both worlds—low-cost passive funds and high-quality active funds tailored to your risk profile and goals.

Talk to our experts today to make investing simple, smart, and strategic.