Cash Flow Statement: Why It’s More Important Than Net Profit

Cash Flow Statement: Why It’s More Important Than Net Profit

A company may show strong profits on paper, but still struggle to pay salaries, repay loans, or fund growth. Sounds strange? That’s why you can’t rely solely on the Profit & Loss (P&L) Statement.

Thank you for reading this post, don't forget to subscribe!The Cash Flow Statement tells you the real story—where the money is coming from and where it’s going.

If you want to spot financially healthy businesses, especially in India’s volatile markets, learning to read the cash flow statement is a game-changer. It’s a key part of fundamental analysis of stocks for retail investors.

What Is a Cash Flow Statement?

It shows actual cash inflows (money received) and outflows (money spent) over a financial period.

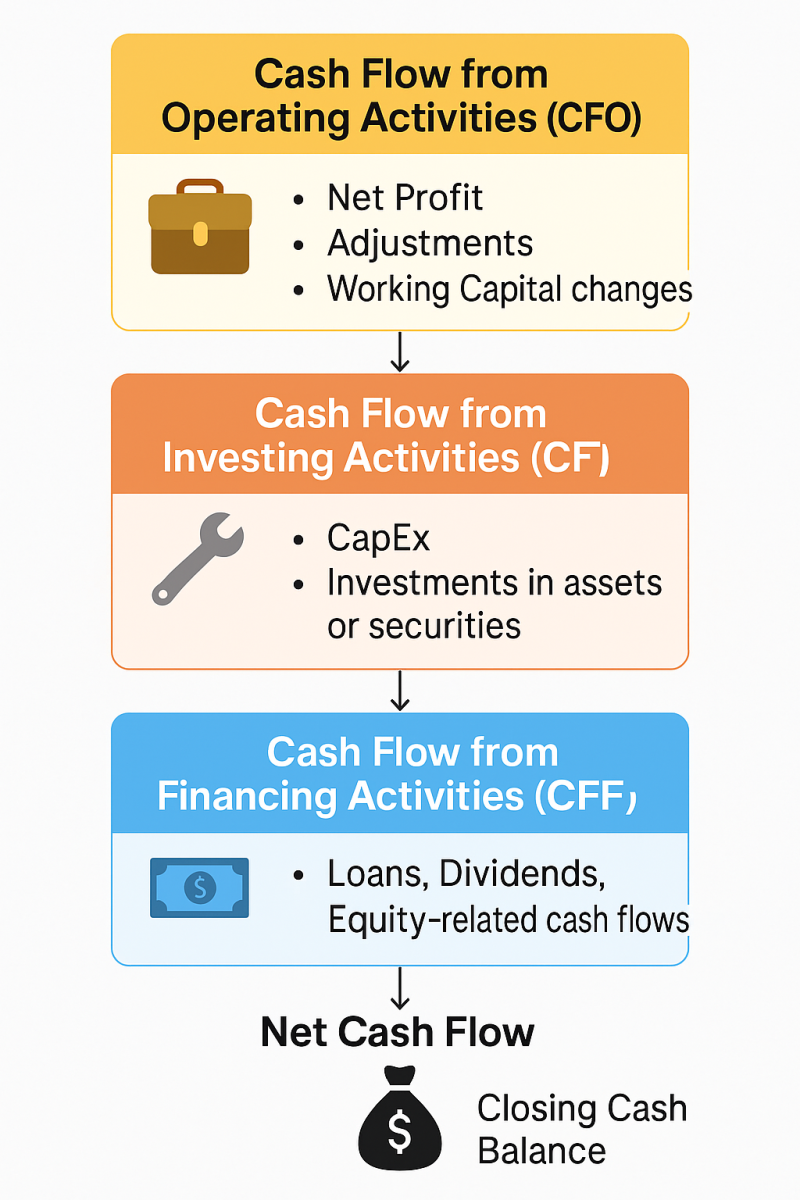

It is divided into three key sections:

- Operating Activities – Cash from core business operations

- Investing Activities – Cash used for or generated from investments

- Financing Activities – Cash raised or paid via loans, dividends, etc.

📅 Published quarterly and annually by listed companies, alongside the balance sheet and P&L.

Understanding all three statements is essential when learning how to analyse stocks in India.

Structure of a Cash Flow Statement

1️⃣ Cash Flow from Operating Activities (CFO)

💼 This is the most important section—it shows whether the business is self-sustaining.

Includes:

- Net profit (from P&L)

- Adjustments for non-cash items (depreciation, interest)

- Changes in working capital (inventory, receivables)

🧾 Example (Asian Paints FY24):

CFO: ₹3,200 Cr → Strong operational cash flow

✅ Positive CFO = the company is generating cash from its core business

This is a top filter in stock analysis for beginners.

2️⃣ Cash Flow from Investing Activities (CFI)

🔧 Reflects investments in assets like:

- Buying/selling property, equipment

- Buying/selling shares of other companies

- Loan repayments received or given

🟥 Usually negative for growing companies (they invest in assets)

🟩 Positive cash flow here could mean asset sales—not always a good sign if frequent

3️⃣ Cash Flow from Financing Activities (CFF)

💸 Includes:

- Borrowings and loan repayments

- Dividend payments

- Issuing or buying back shares

🧾 Example (TCS):

CFF often shows large outflows due to high dividend payouts

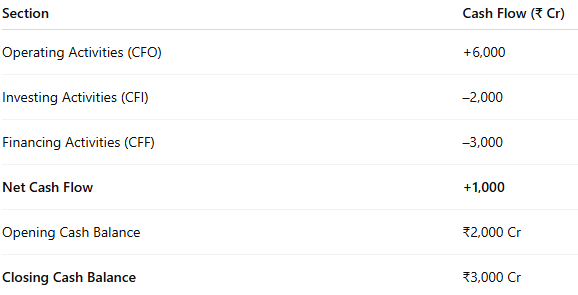

Example: Simplified Cash Flow Statement of HUL (FY24)

✅ Positive net cash flow

✅ Strong cash generation from operations

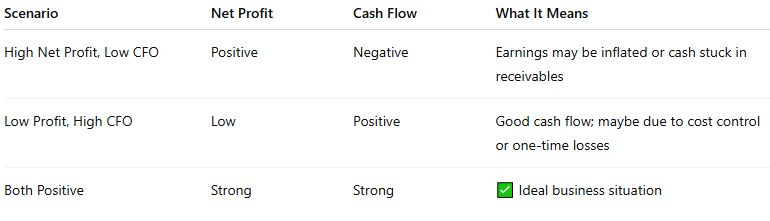

Why Cash Flow > Net Profit

This kind of analysis is essential when searching for the best stocks for long term investment in India.

What Retail Investors Should Focus On

✅ 1. Consistent Positive CFO

Is the company regularly generating cash from its operations?

✅ 2. CFO > Net Profit

It’s a good sign if cash flow exceeds net profit consistently.

✅ 3. Free Cash Flow (FCF)

= CFO – Capital Expenditure

💡 FCF tells you how much cash is truly “free” after investing in growth.

✅ 4. Cash Flow Trends

Look at 3–5 years of data, not just one quarter.

This is critical for anyone learning how to do fundamental analysis.

❗ Red Flags to Watch

🚩 Negative CFO year after year (unsustainable business)

🚩 High receivables, low cash (money stuck with customers)

🚩 Financing operations through debt, not cash

🚩 Frequent equity dilution to raise cash

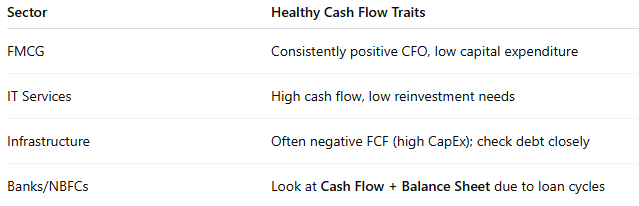

Cash Flow in Different Sectors

Want to know when indicators fail and cash flow saves the day? Don’t miss that piece.

Final Thoughts

“Profit is opinion. Cash is reality.”

The Cash Flow Statement is the most transparent document in company financials. While the P&L can be manipulated through accounting techniques, cash doesn’t lie.

As a retail investor, learning to spot positive, sustainable cash flows can protect you from value traps and help you invest in fundamentally sound companies.

Mastering this is a key part of how to analyse stocks in India—and it gives you an edge in long-term wealth creation.

Related Blogs:

Stock Market Investment: Top 4 Equity Investment Tips for “Beginners”

Why Indicators Fail in Range-Bound Markets (and What to Do)

Why Indicators Fail in Range-Bound Markets (and What to Do)

What Is Fundamental Analysis? A Beginner’s Guide with Indian Context

How to Read a Company’s Balance Sheet: Step-by-Step with Indian Examples

Profit & Loss Statement: What Matters for Retail Investors in India

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.