Understanding Moats: What Makes a Company Defensible

Understanding Moats: What Makes a Company Defensible

In the world of investing, numbers can be misleading without context. Two companies may look similar on paper, but only one will outperform over a decade—and often, that difference lies in one word: moat.

Thank you for reading this post, don't forget to subscribe!Coined by Warren Buffett, a moat represents a company’s sustainable competitive advantage—its ability to protect market share and profits from competition.

Let’s explore:

- What economic moats are

- Types of moats with Indian stock examples

- How to identify them using public data

- And why they matter for long-term investing

What Is an Economic Moat?

An economic moat is a durable structural advantage that shields a company from competitors. It leads to:

- Pricing power

- Sticky customers

- High entry barriers

- Superior margins & returns

Companies with moats enjoy consistent free cash flows and high ROCE, even in hyper-competitive sectors.

Why Moats Matter to Investors

✅ Stable Margins: They protect against pricing pressure

✅ Long-Term Compounding: Higher reinvestment returns

✅ Downside Protection: Better resilience in downturns

✅ Valuation Premium: Quality gets rewarded with higher P/E multiples

6 Types of Moats (With Examples)

1. Brand Moat

“People don’t just buy a product—they buy trust.”

Examples: Asian Paints, Titan, HUL

- Consumers choose them even if cheaper options exist

- Strong brand = repeat purchases + premium pricing

- Decades of consistent advertising and trust

2.Cost Advantage Moat

“Lowest cost operator wins in the long run.”

Example: DMart (Avenue Supermarts)

- Efficient inventory management

- Own-store model = high margins

- Passes savings to consumers, builds loyalty

3.Network Effect Moat

“The more who use it, the better it gets.”

Examples: Zomato, CRED, NSE

- More users attract more vendors = self-reinforcing loop

- Winner-takes-most dynamic in digital platforms

4.Switching Cost Moat

“It’s too painful to leave.”

Examples: Infosys, TCS

- Deep client integrations in IT services

- Switching = high risk, cost, and operational disruption

- Ensures long-term contracts and repeat revenues

5.Regulatory Moat

“Licenses and government support act as walls.”

Examples: IRCTC, IEX, Coal India

- Monopolies or duopolies protected by regulation

- High compliance barriers deter new players

6.Capital Requirement Moat

“Not everyone can write that cheque.”

Examples: Reliance Jio, Power Grid

- Massive upfront investments needed

- Only deep-pocketed firms can survive

- Years of gestation before profitability

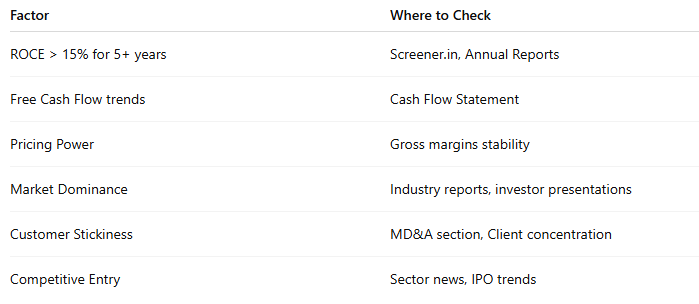

How to Identify a Moat Using Public Data

What Happens Without a Moat?

- Price wars destroy margins (e.g., airlines, telecom pre-Jio)

- Low brand loyalty = high customer churn

- New disruptors can quickly erode market share

- No pricing power leads to flat or declining earnings

📌 Example: Many e-commerce startups burn cash endlessly due to the absence of durable moats.

Case Study: Asian Paints – The Textbook Brand Moat

- 50%+ market share in decorative paints

- Legendary dealer network = distribution moat

- Superior brand recall & innovation

- ROCE consistently above 25%

- Minimal credible competition despite decades of growth

🧠 Lesson: It’s not just paint—it’s dominance through brand, distribution, and pricing power.

Moats Aren’t Permanent

A strong moat today doesn’t mean it’s strong forever. Watch out for:

- 🛠️ Tech Disruption: Kodak, Nokia

- 💸 Bad Capital Allocation: Jet Airways

- 🏛️ Regulatory Changes: Ban on single-use plastics affecting packaging companies

- ⚙️ Leadership Missteps: Yes Bank

📌 Always reassess moat durability—don’t assume it’s eternal.

Conclusion

Moats don’t just protect profits—they enable sustainable compounding. For retail investors in India, focusing on moat-rich companies is one of the best ways to:

- Minimize downside

- Maximize long-term returns

- Sleep peacefully through market cycles

🛡️ “In the long run, it’s the moat—not the momentum—that builds real wealth.”

Related Blogs:

Stock Market Investment: Top 4 Equity Investment Tips for “Beginners”

What Is Fundamental Analysis? A Beginner’s Guide with Indian Context

How to Read a Company’s Balance Sheet: Step-by-Step with Indian Examples

Profit & Loss Statement: What Matters for Retail Investors in India

Cash Flow Statement: Why It’s More Important Than Net Profit

How to Analyze Management Quality Using Publicly Available Data

Key Financial Ratios Explained Simply (ROE, ROCE, D/E & More)

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.