How to Analyze ROCE & ROE Like a Pro

How to Analyze ROCE & ROE Like a Pro

Ever compared two Indian stocks and wondered which one is truly better at generating returns?

Thank you for reading this post, don't forget to subscribe!That’s where ROCE (Return on Capital Employed) and ROE (Return on Equity) come in. These two financial ratios reveal how efficiently a company converts capital into profits—making them must-know metrics for every serious investor.

In Indian markets, where capital allocation can make or break a company, understanding ROCE and ROE is a game-changer.

Let’s break it down—clear, practical, and India-specific.

What is ROCE?

Formula:

ROCE = EBIT / Capital Employed

- EBIT = Earnings Before Interest and Taxes (i.e., Operating Profit)

- Capital Employed = Total Assets – Current Liabilities (or Equity + Debt)

🧠 Why ROCE Matters:

- Measures total capital efficiency—both debt and equity

- Ideal for capital-heavy sectors like manufacturing, cement, steel, power, or infrastructure

- Offers a holistic view of how efficiently the business generates returns

✅ Good Benchmark:

>15% is considered strong in most sectors.

But in capex-heavy sectors, consistency matters more than a one-off spike.

What is ROE?

Formula:

ROE = Net Profit / Shareholders’ Equity

ROE measures how much net profit is generated from shareholders’ money.

🧠 Why ROE Matters:

- Reflects return purely to equity holders

- Ideal for asset-light, high-margin sectors like FMCG, IT, banking, or fintech

- Can be inflated by high leverage—so always analyze debt levels alongside

✅ Good Benchmark:

15–20% ROE is considered strong in India, especially if consistent over multiple years.

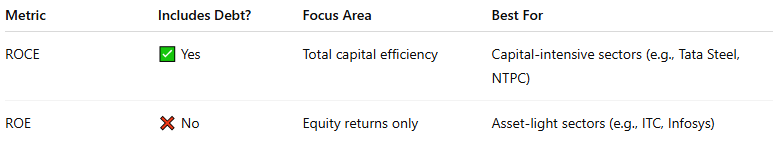

ROCE vs ROE: What’s the Difference?

💡 Tip:

- Use ROCE when you want the full picture (debt + equity).

- Use ROE to see how efficiently shareholder money is working.

Real-World Indian Examples

🏭 Tata Steel

- ROE: 10%

- ROCE: 13%

➡ Capital-heavy business.

Here, ROCE is more relevant—it shows modest efficiency, and the gap indicates debt load is a factor.

🛍️ Avenue Supermarts (DMart)

- ROE: 17%

- ROCE: 21%

➡ Lean balance sheet, strong execution.

High and consistent ROCE signals excellent operational efficiency.

🚨 3 Red Flags to Watch For

- High ROE but low ROCE

→ Likely using excessive debt to boost equity returns artificially. - Declining ROCE over time

→ Signals capital inefficiency, poor reinvestment, or bloated asset base. - Negative ROCE or ROE

→ Company is destroying capital. Proceed with extreme caution.

Where to Check These Ratios?

- Screener.in → Look under “Ratios”

- Tickertape

- Morningstar India

- Company Annual Reports → Look at 5-year summary or financial highlights section

Conclusion: ROCE & ROE Are Your Investing Compass

In a world full of hype, ROCE and ROE help you cut through the noise. They don’t just tell you if a company is growing—but whether it’s doing so efficiently.

🔑 Key Takeaways:

- Always compare both ratios together for a complete view

- Don’t rely on one year—track 5–10 years for consistency

- Tailor your metric based on the sector type (capital-heavy vs asset-light)

Pro Tip for Indian Investors:

Use ROCE >15% with low debt as a powerful filter to spot compounders.

Combine it with other moat signals like pricing power or customer stickiness to build long-term conviction.

Related Blogs:

Stock Market Investment: Top 4 Equity Investment Tips for “Beginners”

What Is Fundamental Analysis? A Beginner’s Guide with Indian Context

How to Read a Company’s Balance Sheet: Step-by-Step with Indian Examples

Profit & Loss Statement: What Matters for Retail Investors in India

Cash Flow Statement: Why It’s More Important Than Net Profit

How to Analyze Management Quality Using Publicly Available Data

Key Financial Ratios Explained Simply (ROE, ROCE, D/E & More)

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.