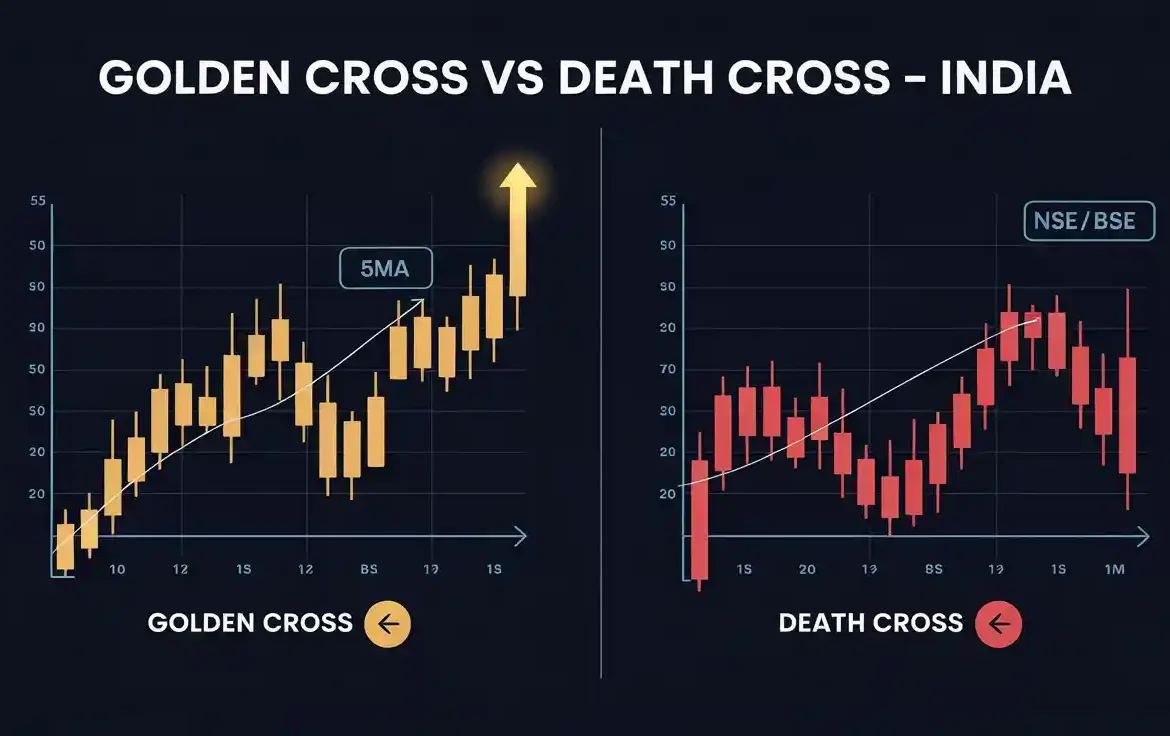

Golden Cross vs Death Cross: How Reliable Are They in Indian Markets?

Golden Cross vs Death Cross: How Reliable Are They in Indian Markets? When it comes to technical analysis of stocks, few patterns are as widely discussed as the Golden Cross and the Death Cross. These simple moving average crossovers often make headlines when they appear on Nifty, Bank Nifty, or popular stocks like Reliance and […]