How to Analyze Management Quality Using Publicly Available Data

How to Analyze Management Quality Using Publicly Available Data

When investing in stocks, numbers don’t always reveal the full story.

Thank you for reading this post, don't forget to subscribe!A company can have solid financials—but if the management lacks vision, integrity, or execution ability, shareholder returns will suffer.

As Warren Buffett said:

“When a management team with a reputation for brilliance tackles a business with a reputation for bad economics, it’s the reputation of the business that remains intact.”

This makes evaluating management quality a critical part of fundamental analysis of Indian stocks. The best part? You don’t need paid tools or insider access—publicly available data is more than enough.

Let’s break it down step-by-step.

Why Management Quality Matters in Investing

✅ Capital Allocation: Good management invests profits wisely. Bad ones destroy value.

✅ Corporate Governance: Honest, transparent practices build long-term trust.

✅ Crisis Handling: True leadership shines during market or business disruptions.

✅ Vision & Execution: A great strategy means nothing without solid execution.

1. Check Promoter Holding & Pledging

📍 Where to Find:

- BSE/NSE websites → Shareholding Pattern

- Company filings → “Shareholding” tab

📊 What to Look For:

- Promoter holding >50% = high skin in the game

- Stable/increasing holding = promoter confidence

- Pledging of shares = 🚩 potential liquidity stress

📌 Example: A rise in pledging ahead of a capex plan without explanation? Be cautious.

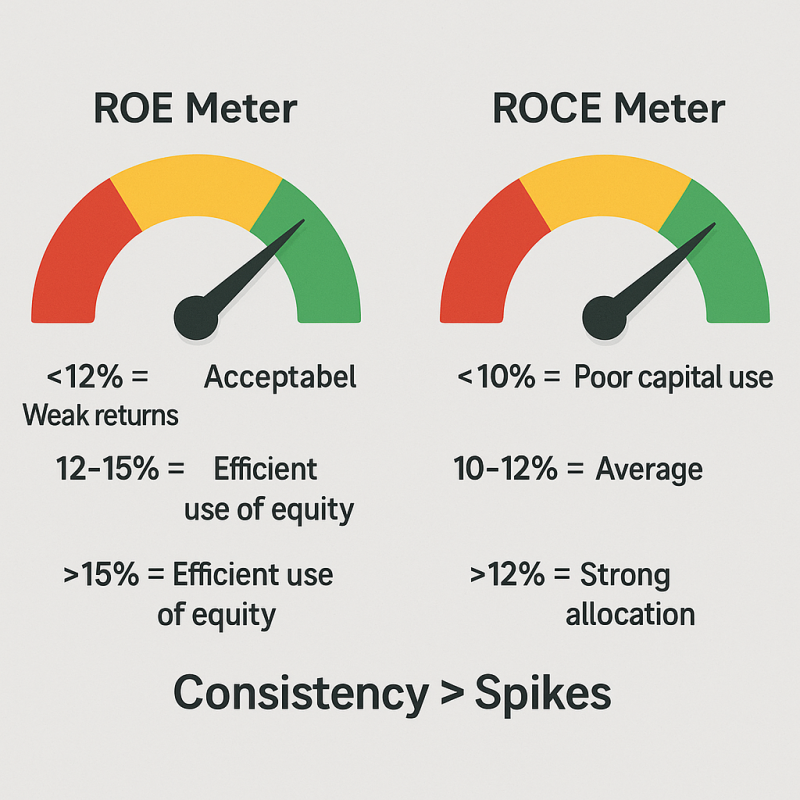

2. Analyze Return Ratios (ROE & ROCE)

📍 Where to Find:

- Screener.in

- Moneycontrol

- Annual Reports

📊 What to Look For:

- ROE >15% → effective use of shareholder equity

- ROCE >12% consistently → strong operational efficiency

📌 A consistently high ROCE over 5–10 years shows disciplined capital use, a hallmark of quality management.

3. Review Leadership Background & Track Record

📍 Where to Find:

- Company Website → Leadership / Investor Relations

- LinkedIn, Economic Times, Mint articles

- Old interviews & management bios

🔍 What to Check:

- Education, industry experience, and past achievements

- Any controversies or regulatory issues

- Past crisis management or turnaround stories

📌 Example: Infosys saw investor confidence return when Narayana Murthy rejoined during leadership uncertainty.

4. Read the MD&A Section of the Annual Report

📍 Where to Find:

- Annual Report → “Management Discussion & Analysis (MD&A)”

🔍 What to Look For:

- Does the strategy sound clear and actionable?

- Is there consistency between past guidance and actual results?

- Are they honest during bad years or just sugarcoating?

📌 Good management communicates plans transparently and owns mistakes.

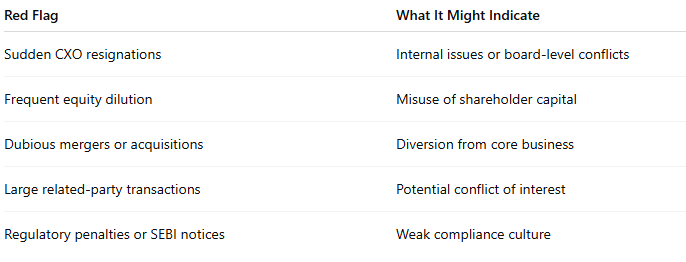

5. Check Related Party Transactions

📍 Where to Find:

- Annual Report → Notes to Financial Statements

🚨 What to Flag:

- Large or unexplained transactions with promoter-linked entities

- Excessive remuneration to directors

- Unusual loans, asset transfers, or contracts with related parties

📌 These may indicate misuse of shareholder funds—a classic red flag in stock analysis.

6. Listen to Earnings Calls & Interviews

📍 Where to Find:

- Company website → Investor Relations section

- YouTube, Trendlyne, TIKR, BloombergQuint interviews

🎧 What to Observe:

- Are they clear and confident when answering analysts?

- Do they acknowledge problems or dodge them?

- Is guidance realistic or overly optimistic?

📌 Great leaders communicate clearly and calmly—even under pressure.

7. Evaluate Capital Allocation Decisions

🔍 Ask Yourself:

- Are they focused on core business or diversifying blindly?

- Are they issuing equity or raising debt unnecessarily?

- Are buybacks timed smartly or just to inflate EPS?

- Is capex productive or ego-driven?

📌 Example: TCS maintains a strong ROCE by staying focused on core strengths—no unnecessary acquisitions.

Bonus: Red Flags That Signal Poor Management

Conclusion: Look Beyond the Numbers

“In the long run, management integrity and execution matter as much as the balance sheet.”

Strong management is like a ship captain—they can’t control the storm, but they decide how the ship survives it.

Using public data—annual reports, shareholding trends, interviews, and earnings calls—you can evaluate management quality without guesswork.

Related Blogs:

Stock Market Investment: Top 4 Equity Investment Tips for “Beginners”

Why Indicators Fail in Range-Bound Markets (and What to Do)

Why Indicators Fail in Range-Bound Markets (and What to Do)

What Is Fundamental Analysis? A Beginner’s Guide with Indian Context

How to Read a Company’s Balance Sheet: Step-by-Step with Indian Examples

Profit & Loss Statement: What Matters for Retail Investors in India

Cash Flow Statement: Why It’s More Important Than Net Profit

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.