Top 5 Indian Companies with Durable Moats (2025)

Top 5 Indian Companies with Durable Moats (2025)

In investing, a “moat” refers to a company’s sustainable competitive advantage that protects it from the competition—just like a moat around a castle. These moats allow businesses to maintain high profitability, pricing power, and market share over the long term.

Thank you for reading this post, don't forget to subscribe!Identifying companies with strong moats is a key part of long-term investing. Let’s look at five Indian companies in 2025 that have durable moats and continue to deliver consistent value to shareholders.

If you’re new to the concept, start with our explainer on What Makes a Company Defensible in India to understand the different types of moats and how to spot them.

1. Asian Paints – Distribution & Brand Dominance

- Moat Type: Brand, Distribution Network, High Entry Barriers

Why It Stands Out:

- Over 55% market share in decorative paints

- Deep network of 70,000+ dealers across India

- Consistently delivers industry-leading margins

- Heavy investment in technology, logistics, and automation

2025 Update:

Asian Paints continues to fend off competition from Grasim and Berger through its powerful brand recall, dealer stickiness, and rapid supply chain turnaround.

✅ Not just a paint company—it’s a consumer brand with an FMCG-like moat.

📌 Related: Learn how Brand Moats create durable advantage in this guide on moat types.

2. HDFC Bank – Low-Cost Capital & Trust

- Moat Type: CASA Franchise, Underwriting Skills, Scale

Why It Stands Out:

- CASA (Current & Savings) deposits drive low-cost funding

- Among India’s most trusted retail lenders

- Superior credit underwriting with consistently low NPAs

- 7,000+ branch network and a top-tier digital ecosystem

2025 Update:

Even after merging with HDFC Ltd., the bank has maintained stable margins, strong capital adequacy, and sector leadership.

✅ Its moat lies in execution, trust, and distribution strength—the same metrics that matter most in sector-specific banking analysis.

3. DMart (Avenue Supermarts) – Cost Efficiency & Scale

- Moat Type: Cost Leadership, Execution, Ownership Model

Why It Stands Out:

- Operates on an ownership model = more control, better margins

- EDLP (Everyday Low Price) strategy builds customer loyalty

- Extremely lean supply chain and tight cost discipline

2025 Update:

DMart continues expanding cautiously, focusing on unit economics rather than burning cash like competitors.

✅ While others chase GMV, DMart compounds profits—a classic case of a cost advantage moat.

📌 Read: Types of Moats & Indian Examples for more on cost-driven moats.

4. Infosys – Client Stickiness & Talent Depth

- Moat Type: Switching Costs, Brand Trust, Talent Pool

Why It Stands Out:

- 1000+ active clients with multi-year contracts

- Leading in cloud, AI, and automation services

- In-house training & reskilling programs keep talent future-ready

2025 Update:

Infosys’ global reputation and consulting strength continue to drive large deals, despite margin pressures in the broader IT sector.

✅ When clients stick for a decade, that’s a moat driven by switching costs and delivery depth.

📌 Also read: Sector Analysis: What to Track in IT Services to dive into metrics like attrition, margins, and deal wins.

5. Nestlé India – Strong Brands & Pricing Power

- Moat Type: Brand Equity, Habit Products, R&D

Why It Stands Out:

- Maggi, Nescafé, KitKat—products consumed daily and emotionally

- Premium pricing even in inflationary periods

- R&D-backed new product pipeline in health, kids, and beverages

2025 Update:

Nestlé expands deeper into Tier 2–3 towns, launches health-centric innovations, and maintains leadership in core SKUs.

✅ When customers say Maggi, they don’t want noodles—they want Maggi. That’s habitual brand dominance at work.

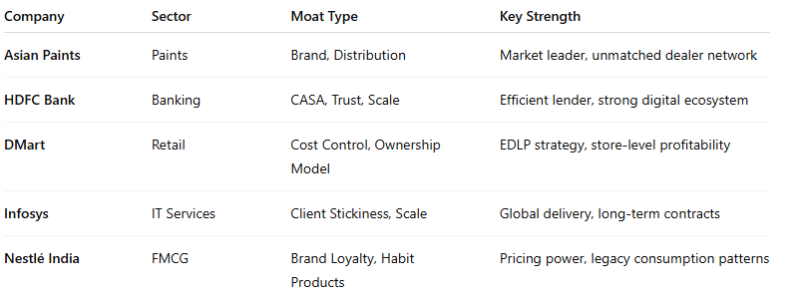

Moat Snapshot Table

Conclusion

Durable moats are what separate great companies from good ones. They help firms survive through market cycles, inflation shocks, new entrants, and regulatory changes—while still compounding shareholder wealth.

In 2025, the Indian stock market continues to reward companies with structural advantages, not just short-term trends. The five businesses above show how moats in execution, trust, and innovation still lead the charge.

📌 Want to build your own moat filter? Combine this with:

- How to Analyze Management Quality Using Public Data

- Sector-Specific Framework for Banking, FMCG, and IT

Related Blogs:

Stock Market Investment: Top 4 Equity Investment Tips for “Beginners”

What Is Fundamental Analysis? A Beginner’s Guide with Indian Context

How to Read a Company’s Balance Sheet: Step-by-Step with Indian Examples

Profit & Loss Statement: What Matters for Retail Investors in India

Cash Flow Statement: Why It’s More Important Than Net Profit

How to Analyze Management Quality Using Publicly Available Data

Key Financial Ratios Explained Simply (ROE, ROCE, D/E & More)

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.