Breakout Trading Strategies for NSE Stocks: Entry, Exit, and Stop-Loss Rules

Breakout Trading Strategies for NSE Stocks: Entry, Exit, and Stop-Loss Rules

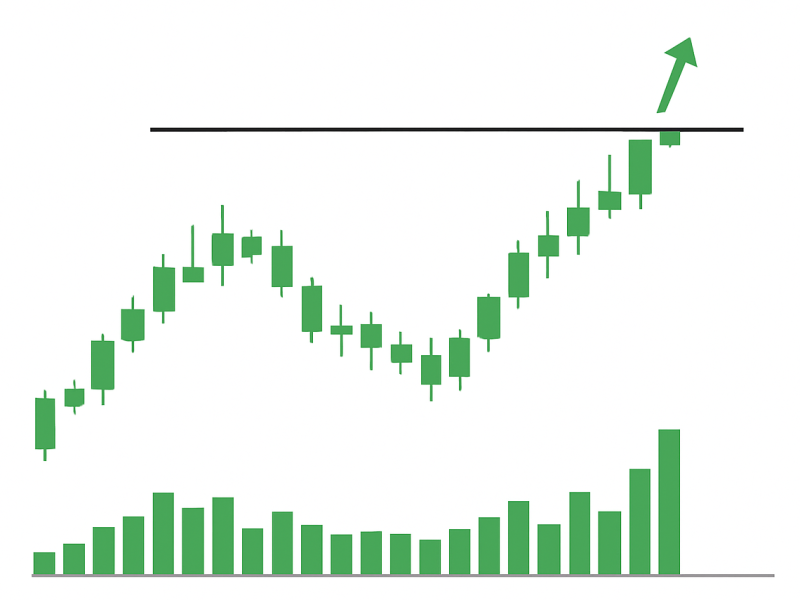

In the Indian stock market, breakouts are among the most powerful trading setups. A breakout happens when a stock’s price moves beyond a defined support or resistance level with strong volume, signaling the possibility of a new trend.

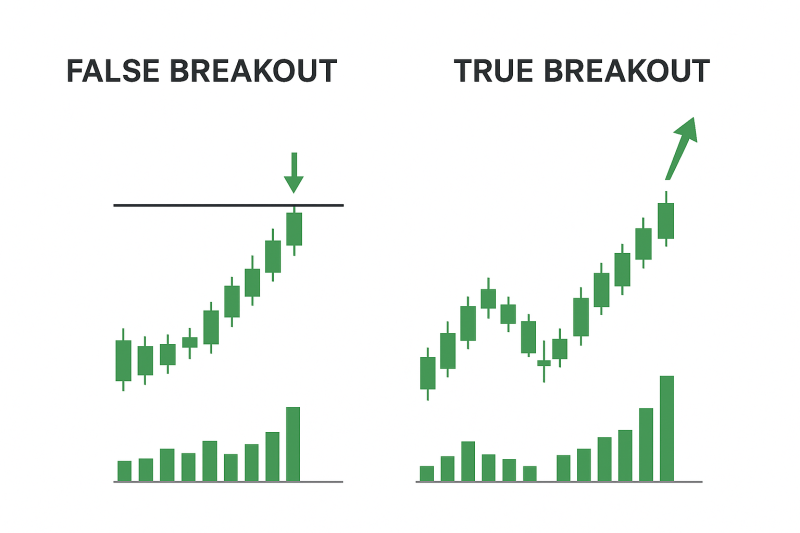

Thank you for reading this post, don't forget to subscribe!But here’s the challenge: not every breakout is real — many turn out to be fakeouts that trap traders. To succeed, you need clear entry, exit, and stop-loss rules.

What is Breakout Trading?

Breakout trading involves entering a trade when the price crosses a key resistance (upside breakout) or breaks a key support (downside breakout), often with increased volume.

- Upside breakout: Signals the start of a bullish rally.

- Downside breakout: Signals potential weakness and selling pressure.

In NSE stocks, breakout strategies are especially effective in highly liquid counters like Reliance, Infosys, HDFC Bank, and Bank Nifty.

Entry Rules for Breakout Trading

To filter real breakouts from fake ones, follow these rules:

- Identify Strong Levels

- Use trendlines, moving averages, and previous swing highs/lows.

- Example: If Infosys repeatedly fails near ₹1,600, a breakout above that level is significant.

- Wait for Volume Confirmation

- Breakouts backed by above-average volume are more reliable.

- NSE intraday data often shows volume spikes during valid breakouts.

- Use Multi-Timeframe Analysis

- Confirm breakout levels on daily and weekly charts.

- A resistance breakout on daily + weekly charts has higher conviction.

- Don’t Chase Immediately

- Wait for a candle close above resistance (not just a spike).

- Avoid jumping in on the first tick above the level.

Exit Rules for Breakout Trading

Profits in breakout trading depend on discipline in booking gains.

- Partial Profit Booking

- Exit 50% at the first resistance target.

- Example: If Reliance breaks ₹2,700, the first profit zone may be around ₹2,770–2,800.

- Ride the Trend with a Trailing Stop

- Use moving averages (20 EMA / Supertrend) as trailing stops.

- This ensures you capture bigger moves while locking in profits.

- Pre-Defined Targets

- Measure the height of the consolidation range and project it.

- Example: If HDFC Bank consolidates between ₹1,450–₹1,500 (50-point range), breakout above ₹1,500 may target ₹1,550.

Stop-Loss Rules for Breakout Trading

The most crucial part of any breakout strategy is risk management.

- Place SL Just Below/Above Breakout Level

- For upside breakout, place stop-loss just below resistance.

- For downside breakout, place stop-loss just above support.

- Use ATR (Average True Range)

- ATR helps in setting dynamic stop-loss based on volatility.

- If Bank Nifty ATR is 250 points, keep SL at least 1× ATR away from breakout.

- Never Risk More Than 1–2% of Capital

- Even strong breakouts can fail. Risk management ensures survival.

Example: Breakout Trade in Indian Stock

Let’s take Tata Motors as an example:

- Resistance Level: ₹1,000 (multiple rejections earlier).

- Breakout: Stock closes above ₹1,000 with strong volume.

- Entry: Buy near ₹1,005–1,010 after confirmation.

- Stop-Loss: ₹980 (below breakout zone).

- Target: ₹1,050–1,060 (based on consolidation range).

- Result: High probability trade with risk-reward of 1:2+.

Pro Tips to Avoid Fake Breakouts

✔ Avoid trading low-volume breakouts.

✔ Check broader Nifty/Bank Nifty trend before entering.

✔ Use RSI/MACD to confirm momentum.

✔ Stay patient — breakouts after long consolidations are more reliable.

Final Thoughts

Breakout trading in NSE stocks can deliver quick and powerful moves when executed with discipline. The key lies in:

- Entering only on volume-backed breakouts

- Following strict stop-loss rules

- Booking profits systematically

Whether you trade Infosys, Reliance, Tata Motors, or Bank Nifty, the principles remain the same: respect levels, manage risk, and let profits run.

👉 Mastering breakout strategies can make you a more confident swing or positional trader in Indian markets.

Related Blogs:

Stock Market Investment: Top 4 Equity Investment Tips for “Beginners”

What Is Fundamental Analysis? A Beginner’s Guide with Indian Context

How to Read a Company’s Balance Sheet: Step-by-Step with Indian Examples

Profit & Loss Statement: What Matters for Retail Investors in India

Cash Flow Statement: Why It’s More Important Than Net Profit

How to Analyze Management Quality Using Publicly Available Data

Key Financial Ratios Explained Simply (ROE, ROCE, D/E & More)

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.