Long-Term vs Short-Term Investing: Which is Better for You?

Long-Term vs Short-Term Investing: Which is Better for You?

Investing in the stock market is one of the most effective ways to build wealth, but the strategies you choose can make all the difference. Two of the most common approaches are long-term investing and short-term investing. Both have their pros and cons, and the right choice depends on your financial goals, risk tolerance, and investment style.

Thank you for reading this post, don't forget to subscribe!In this blog, we’ll break down the key differences between the two, their advantages and drawbacks, and how to decide which one works best for you.

What is Long-Term Investing?

Long-term investing refers to buying and holding assets for an extended period — usually five years or more. The goal is to benefit from compounding returns, consistent growth, and reduced volatility over time.

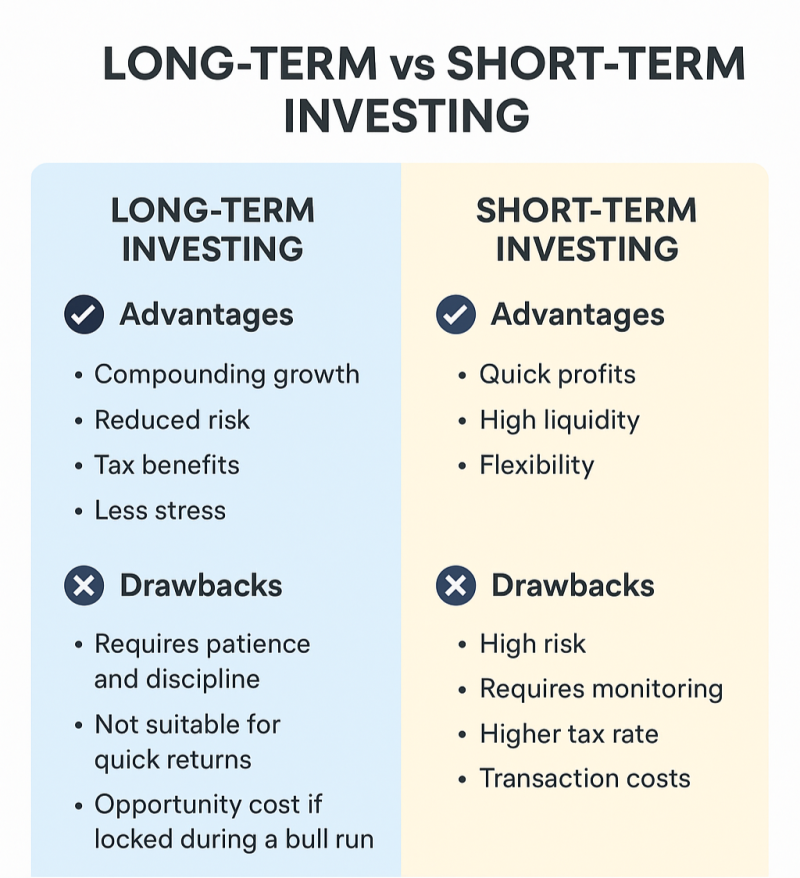

Advantages of Long-Term Investing

-

Compounding Growth: The longer you stay invested, the more your returns compound.

-

Reduced Risk: Short-term volatility becomes less relevant over the years.

-

Tax Benefits: In India, long-term capital gains (LTCG) are taxed at a lower rate compared to short-term gains.

-

Less Stress: You don’t need to monitor markets daily.

Drawbacks

-

Requires patience and discipline.

-

Not suitable for those seeking quick returns.

-

Opportunity cost if money is locked in during a bull run.

Example: Investors who bought Infosys shares in the 1990s and held them long-term have seen exponential growth.

What is Short-Term Investing?

Short-term investing involves holding assets for a few days, weeks, or months, with the aim of taking advantage of price fluctuations. This includes swing trading, intraday trading, and speculation.

Advantages of Short-Term Investing

-

Quick Profits: Opportunity to earn returns in a short period.

-

High Liquidity: Money is not tied up for years.

-

Flexibility: Investors can adjust portfolios quickly based on market conditions.

Drawbacks

-

High risk due to volatility.

-

Requires time, expertise, and constant monitoring.

-

Short-term capital gains (STCG) are taxed at a higher rate (15% in India).

-

Transaction costs eat into profits.

Example: Traders who timed the 2020 market crash and recovery made significant short-term gains, but those who mistimed faced heavy losses.

Comparison: Long-Term vs Short-Term Investing

| Factor | Long-Term Investing | Short-Term Investing |

|---|---|---|

| Time Horizon | 5+ years | Days to months |

| Risk | Lower (in the long run) | High (volatile) |

| Returns | Moderate but consistent | Potentially high, but uncertain |

| Taxation (India) | LTCG tax: 10% above ₹1 lakh | STCG tax: 15% |

| Monitoring | Minimal | Constant monitoring |

| Best For | Retirement planning, wealth building | Active traders, opportunistic gains |

Which Strategy is Right for You?

-

Choose Long-Term Investing if you:

-

Have long-term financial goals (retirement, children’s education).

-

Prefer stability and compounding growth.

-

Don’t want to spend hours tracking the market daily.

-

-

Choose Short-Term Investing if you:

-

Have a higher risk appetite.

-

Can dedicate time to analyze charts, news, and technical indicators.

-

Want to take advantage of short-term opportunities.

-

👉 Many investors combine both strategies, keeping a core portfolio for the long term while allocating a smaller portion for short-term trades.

Final Thoughts

There’s no single answer to whether long-term or short-term investing is better. It all depends on your goals, risk tolerance, and investment style. Long-term investing is generally safer and wealth-building, while short-term investing offers high-risk, high-reward opportunities.

For most investors, a balanced approach — with a strong long-term base and occasional short-term trades — works best in achieving financial success.