Understanding Mutual Funds vs Direct Equity in India

Understanding Mutual Funds vs Direct Equity in India

For Indian investors, building wealth through the stock market has become increasingly accessible thanks to digital platforms, low-cost brokerages, and the rising popularity of mutual funds. But when it comes to choosing an investment avenue, many wonder: Should I invest in mutual funds or directly in equities?

Thank you for reading this post, don't forget to subscribe!Both options have their merits and drawbacks, and the right choice often depends on your risk appetite, investment knowledge, and long-term financial goals. Let’s break it down.

What are Mutual Funds?

Mutual funds pool money from multiple investors and invest it in a diversified portfolio of equities, debt, or hybrid instruments. They are managed by professional fund managers.

-

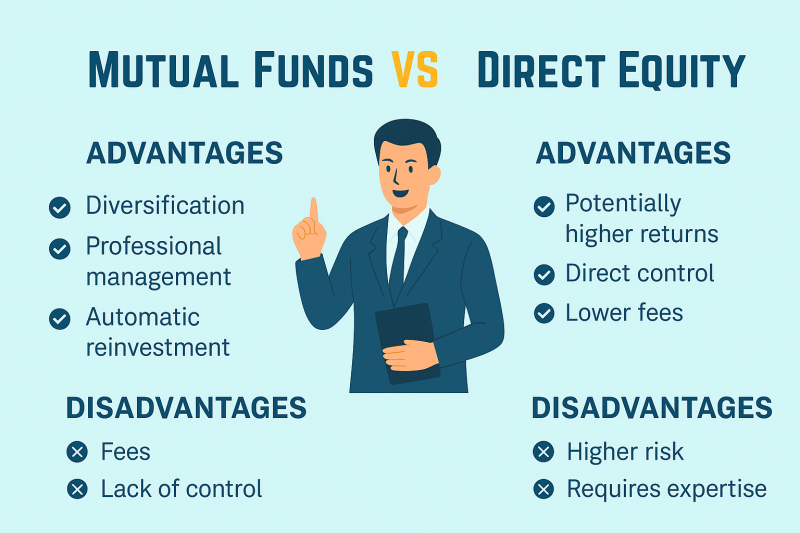

Advantages:

-

Professional fund management

-

Diversification reduces risk

-

SIPs (Systematic Investment Plans) enable disciplined investing

-

Lower entry barrier (can start with as little as ₹500)

-

-

Disadvantages:

-

Management fees (expense ratio)

-

Returns may lag direct equities during strong bull runs

-

Limited control over stock selection

-

Best suited for: Beginner and moderate investors looking for stable, risk-adjusted returns.

What is Direct Equity?

Direct equity means buying shares of companies directly on stock exchanges (NSE or BSE) via a demat and trading account.

-

Advantages:

-

Potential for higher returns

-

Direct control over portfolio (choice of companies, sectors)

-

Beneficial for active traders or seasoned investors

-

-

Disadvantages:

-

High risk due to market volatility

-

Requires in-depth research and market knowledge

-

Emotional decision-making can lead to losses

-

Best suited for: Experienced investors with time, skill, and risk-taking ability.

Key Differences Between Mutual Funds & Direct Equity

| Factor | Mutual Funds | Direct Equity |

|---|---|---|

| Management | Professional fund manager | Self-managed |

| Diversification | High (basket of stocks) | Limited (depends on individual selection) |

| Risk Level | Moderate (spread across sectors) | High (concentrated risk) |

| Returns | Steady, market-linked, risk-adjusted | Can be very high or very low |

| Control | Limited (fund manager decides) | Full (investor decides) |

| Entry Barrier | Low (SIPs from ₹500) | Higher (requires lump-sum investments) |

| Time Commitment | Low | High (research & monitoring required) |

Which is Better for You?

-

Choose Mutual Funds if:

-

You are a beginner in investing

-

You want professional management and diversification

-

You prefer a disciplined, long-term approach with lower risk

-

-

Choose Direct Equity if:

-

You have strong stock market knowledge

-

You can handle volatility and risk

-

You want full control over your portfolio and aim for higher returns

-

Final Thoughts

There’s no one-size-fits-all answer to Mutual Funds vs Direct Equity. In fact, many smart investors in India combine both—allocating a large portion to mutual funds for stability and wealth building, while selectively investing in direct equities for higher growth potential.

The key is to align your choice with your financial goals, risk tolerance, and time horizon.