Key Economic Indicators Every Investor Should Track

Key Economic Indicators Every Investor Should Track

Introduction

Investing is not just about picking the right stocks or mutual funds—it’s about understanding the bigger picture that drives market movements. The health of an economy plays a vital role in determining corporate profits, interest rates, consumer spending, and ultimately, market sentiment.

This is where economic indicators come in. They provide a snapshot of the economy’s performance and help investors anticipate market trends.

Whether you’re a beginner or an experienced investor, tracking key economic indicators can help you make more informed decisions. Let’s explore the most important ones that every investor should monitor.

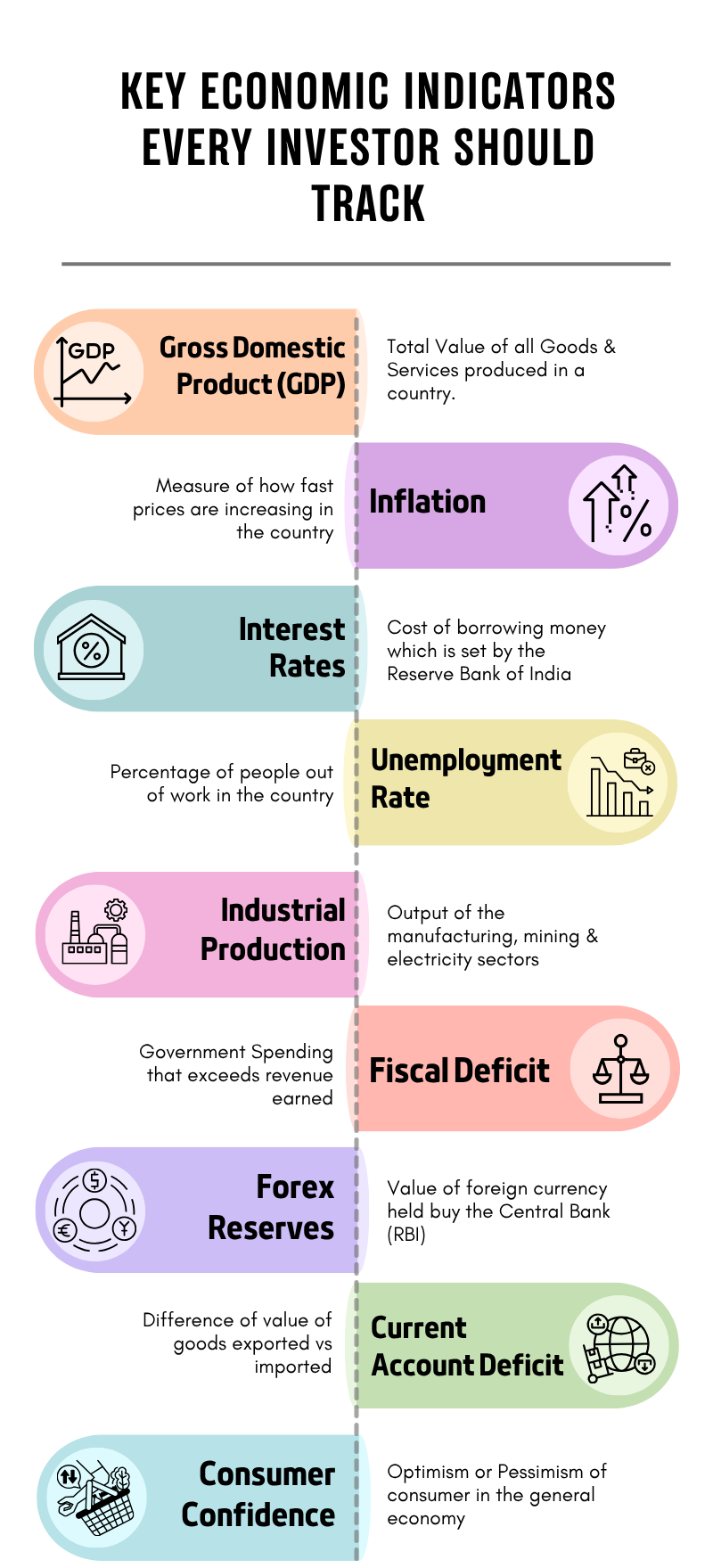

1. Gross Domestic Product (GDP)

What it is:

GDP represents the total value of all goods and services produced within a country over a specific period. It’s the most comprehensive measure of economic activity.

Why it matters:

A rising GDP indicates a growing economy, which usually leads to higher corporate earnings and bullish market sentiment. Conversely, a contracting GDP can signal economic slowdown or recession.

Investor takeaway:

Look for quarterly GDP growth trends rather than one-off numbers. If GDP growth is consistent, it usually supports equity market growth.

2. Inflation (Consumer Price Index – CPI & Wholesale Price Index – WPI)

What it is:

Inflation measures how fast the prices of goods and services are rising.

-

CPI (Consumer Price Index): Tracks changes in retail prices paid by consumers.

-

WPI (Wholesale Price Index): Reflects price changes at the wholesale level.

Why it matters:

Moderate inflation is a sign of a healthy economy, but high inflation erodes purchasing power and can lead to tighter monetary policies (like rate hikes by the RBI).

Investor takeaway:

If inflation rises sharply, it can hurt corporate profits and lead to market corrections. Defensive sectors like FMCG and utilities tend to perform better during high-inflation periods.

3. Interest Rates (RBI Repo & Reverse Repo Rates)

What it is:

The repo rate is the rate at which the Reserve Bank of India (RBI) lends money to commercial banks, while the reverse repo rate is what banks earn when they park excess funds with the RBI.

Why it matters:

Interest rates affect borrowing costs, consumer spending, and business investments. When rates rise, loan EMIs go up, and companies may reduce expansion plans—often cooling down markets.

Investor takeaway:

Rate cuts typically boost stock markets as borrowing becomes cheaper. Rate hikes can slow market momentum, but they may also strengthen the currency and control inflation.

4. Unemployment Rate

What it is:

The unemployment rate measures the percentage of people in the labor force who are jobless and actively seeking work.

Why it matters:

Employment levels reflect economic activity and consumer confidence. High unemployment reduces disposable income and affects demand-driven sectors.

Investor takeaway:

Rising employment levels usually support sectors like automobiles, real estate, and consumer goods, as people spend more when they have stable jobs.

5. Industrial Production (Index of Industrial Production – IIP)

What it is:

The IIP tracks the output of the manufacturing, mining, and electricity sectors.

Why it matters:

It helps gauge the industrial health of the economy. Strong industrial production indicates growing demand and expansion, which benefits cyclical stocks.

Investor takeaway:

Investors should look at monthly IIP trends to assess the performance of capital goods, metal, and manufacturing stocks.

6. Fiscal Deficit

What it is:

A fiscal deficit occurs when the government’s total expenditure exceeds its total revenue (excluding borrowings).

Why it matters:

High fiscal deficits can lead to increased government borrowing, potentially raising interest rates and crowding out private investment.

Investor takeaway:

A moderate fiscal deficit supports infrastructure and growth-oriented spending. But excessive deficits may fuel inflation and weaken investor confidence in the economy.

7. Foreign Exchange Reserves & Currency Movements

What it is:

Forex reserves represent a country’s holdings of foreign currencies, gold, and other international assets.

Why it matters:

Healthy reserves strengthen a nation’s ability to manage currency volatility and external shocks. A stable rupee attracts foreign investors (FIIs) to the stock market.

Investor takeaway:

Keep an eye on USD-INR trends. A depreciating rupee can benefit exporters (like IT and pharma) but hurt import-heavy sectors (like oil & chemicals).

8. Current Account Deficit (CAD)

What it is:

CAD measures the difference between the value of goods and services a country imports and exports.

Why it matters:

A widening CAD indicates that the country is importing more than it exports, which can pressure the currency and deter foreign investors.

Investor takeaway:

A stable or shrinking CAD signals strong trade fundamentals and supports long-term economic stability.

9. Consumer Confidence Index (CCI)

What it is:

The CCI reflects how optimistic or pessimistic consumers feel about their financial situation and the economy.

Why it matters:

High consumer confidence means more spending, boosting retail, auto, and housing sectors. Low confidence signals caution and reduced demand.

Investor takeaway:

Track CCI movements to gauge potential demand trends in consumer-driven sectors.

Conclusion

Understanding and tracking these key economic indicators allows investors to interpret market movements beyond daily noise.

Instead of reacting to every market swing, analyzing data-driven economic signals helps you stay grounded and strategic.

When combined with fundamental and technical analysis, these indicators offer a complete picture of market opportunities and risks.

In short: Smart investors don’t just invest in companies—they invest with an eye on the economy.

Related Blogs:

How Interest Rates Influence Stock Market Returns

How Global Events Impact the Indian Stock Market

The Role of RBI’s Monetary Policy in Stock Price Movements

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.