Business Life Cycle Stages & Investing Strategy

Business Life Cycle Stages & Investing Strategy

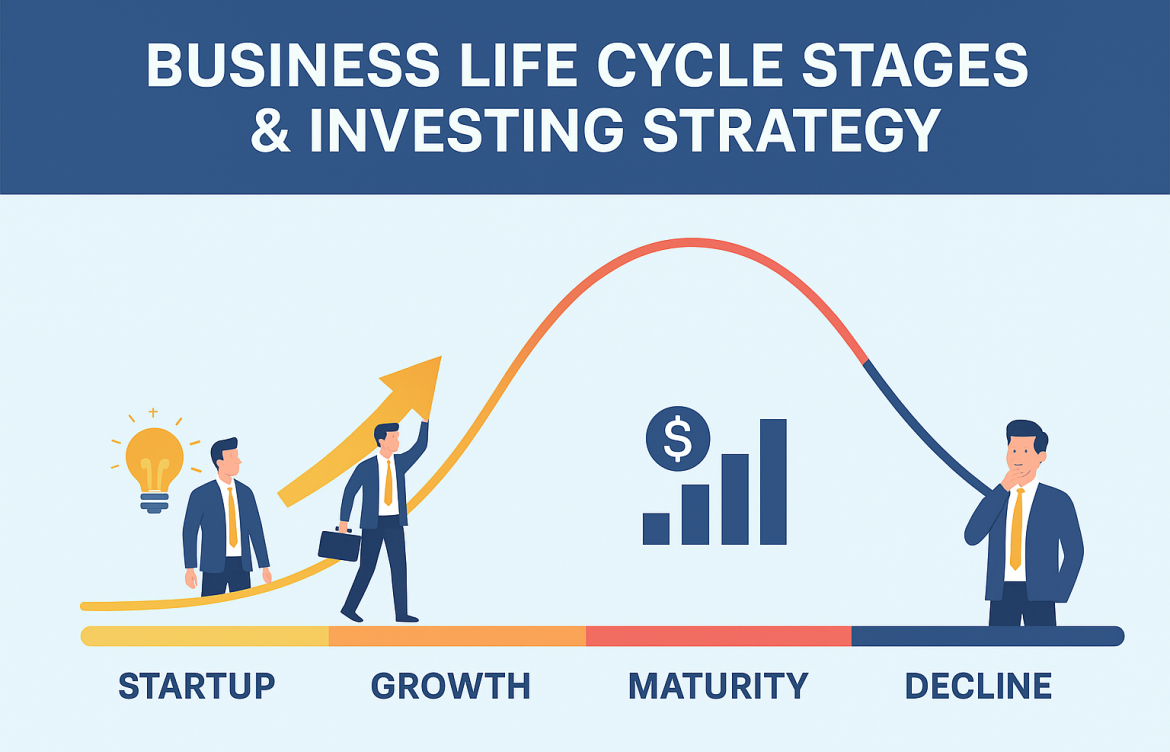

When analyzing companies for investment, many beginners focus only on financial ratios or stock price movements. But there’s a bigger, often overlooked factor that plays a powerful role in shaping a company’s future: its stage in the business life cycle.

Thank you for reading this post, don't forget to subscribe!Understanding where a company stands in its life cycle helps you estimate its growth potential, risk profile, cash flow behavior, and valuation trends. Simply put—investing without understanding the business life cycle is like driving without knowing the road ahead.

This guide breaks down the key business life cycle stages and the right investing strategy for each stage.

🔵 What Is the Business Life Cycle?

Every company progresses through predictable phases—just like humans—from launch to growth, maturity, and sometimes decline.

These stages help investors assess:

-

Expected growth rate

-

Profitability trends

-

Cash flow stability

-

Risk levels

-

Suitable valuation metrics

Understanding the stage allows you to align expectations and choose the right investment approach.

🔵 The 5 Stages of a Business Life Cycle

Below are the typical stages companies move through and what they mean for you as an investor.

1️⃣ Seed & Startup Stage

Characteristics:

-

Negative cash flows

-

Little to no profits

-

High burn rate

-

Heavy dependency on external funding

-

Unproven business model

Investor Behavior:

This phase is usually suited to venture capital, angel investors, and high-risk takers.

Risks:

Very high. Many startups fail due to weak business models or lack of product-market fit.

Investment Strategy:

For retail investors, this stage often isn’t accessible unless through:

-

Startup platforms

-

Pre-IPO opportunities

-

Technology or innovation-focused funds

Ideal Investor:

High-risk investors with long horizons.

2️⃣ Growth Stage (Early Growth)

Characteristics:

-

Rapid revenue growth

-

Expanding customer base

-

Improving margins

-

Increased reinvestment into operations

-

Market share capture

Investment Opportunities:

This stage offers the highest potential returns in the stock market.

Examples include sectors like EVs, fintech, cloud software, specialty chemicals, or companies shortly after IPOs.

Risks:

-

Volatility remains high

-

Valuations may be expensive

-

Execution risk still exists

Investment Strategy:

-

Look at revenue CAGR, market size, and competitive advantage

-

Use growth metrics: P/S ratio, EV/Sales, future earnings potential

-

Do not overpay for hype—focus on fundamentals

Ideal Investor:

Investors seeking growth with moderate risk appetite.

3️⃣ High-Growth to Maturity Transition

Characteristics:

-

Growth stabilizes but remains healthy

-

Strong brand recognition

-

Higher and consistent profits

-

Reduced reinvestment needs

-

Sustainable cash flows

These companies are moving from “rapid expansion” to “steady performance.”

Investment Opportunities:

This stage balances growth and stability—ideal for long-term investors.

Risks:

-

Growth may unexpectedly slow

-

Increased competition

Investment Strategy:

-

Focus on PE ratio, ROCE, and free cash flow

-

Favor companies with moats (distribution, IP, brand strength)

-

Great stage for SIP investing

Ideal Investor:

Long-term investors who want compounders.

4️⃣ Maturity Stage

Characteristics:

-

Slow but steady growth

-

High cash reserves

-

Strong dividends

-

Stable business model

-

Lower innovation, higher efficiency

Sectors like FMCG, utilities, and large-cap IT often fall in this category.

Investment Opportunities:

-

Highly stable returns

-

Good for downside protection

-

Attractive dividends

Risks:

-

Limited upside

-

Vulnerability to disruption

-

Slower long-term wealth creation

Investment Strategy:

-

Focus on dividend yield, ROE, and cash flow stability

-

Great for income-focused investors

-

Add during corrections for safety

Ideal Investor:

Conservative investors looking for stability and steady returns.

5️⃣ Decline Stage

Characteristics:

-

Falling revenue & profits

-

Disrupted by technology or competition

-

Cost-cutting measures

-

Weakening balance sheet

-

Possible restructuring

Examples can include outdated tech companies, disrupted telecom players, or shrinking manufacturers.

Investment Opportunities:

Rare, but some can offer turnaround stories.

Risks:

-

Value traps

-

No clear revival path

-

High debt burden

Investment Strategy:

-

Avoid unless there’s a strong revival plan

-

Look for management change, debt reduction, and pivot strategies

Ideal Investor:

Experienced investors and turnaround specialists.

🔵 Aligning Your Investment Strategy with the Life Cycle

| Stage | Risk Level | Potential Returns | Best Strategy |

|---|---|---|---|

| Seed/Startup | Very High | Very High | Venture-style investing |

| Growth | High | High | Growth investing, momentum investing |

| Transition | Moderate | High | SIPs, quality compounding |

| Maturity | Low | Moderate | Dividend investing, value investing |

| Decline | Very High | Low | Turnaround investing (advanced) |

🔵 Key Indicators to Identify a Company’s Life Cycle Stage

-

Revenue Growth Rates

High for growth companies, declining for mature/declining companies. -

Profit Margins

Improving margins signal transition to maturity. -

Cash Flow Trends

Mature companies generate excess cash. -

Capital Expenditure (Capex)

High capex = growth stage.

Low capex = maturity. -

Debt Levels

High debt may be seen in expansion or decline. -

Market Share Movement

Growth companies gain share; declining companies lose share. -

Product Innovation Frequency

Growth stage innovates rapidly; maturity slows down.

🔵 Final Thoughts

Understanding which stage a business is in is one of the most underrated skills in investing. It shapes your expectations and helps you avoid common mistakes like:

-

Expecting a mature company to show high growth

-

Entering a declining company thinking it’s undervalued

-

Ignoring risk in fast-growing companies

When used thoughtfully, the business life cycle can turn you into a more strategic, disciplined, and successful investor.

Related Blogs:

How to Use Annual Reports to Evaluate a Company

Value Investing as a Stock Market Investing Strategy in 2025

Growth Investing vs. Value Investing: Which Strategy Is Right for You?

How to Analyze Sector Trends Before Investing: A Practical Guide for Retail Investors

What Drives Value Investing in Different Economic Cycles

How to Use Fundamental Analysis for Indian Stocks

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.