How NAV Works in Open-Ended Funds: Pricing, Valuation, and Market Impact

How NAV Works in Open-Ended Funds: Pricing, Valuation, and Market Impact

When investors look up a mutual fund scheme, one of the first figures they notice is the Net Asset Value, commonly known as NAV. For many, NAV becomes a reference point for deciding whether a fund looks “cheap” or “expensive.” In reality, NAV plays a different role altogether, especially in open-ended mutual funds. Understanding how NAV works in open-ended funds helps investors make clearer, more rational decisions and avoid common misconceptions.

Thank you for reading this post, don't forget to subscribe!This blog explains the concept of NAV, how it is calculated, how pricing and valuation work in open-ended funds, and the impact of market movements on NAV, with specific relevance to Indian investors.

Understanding NAV in Open-Ended Mutual Funds

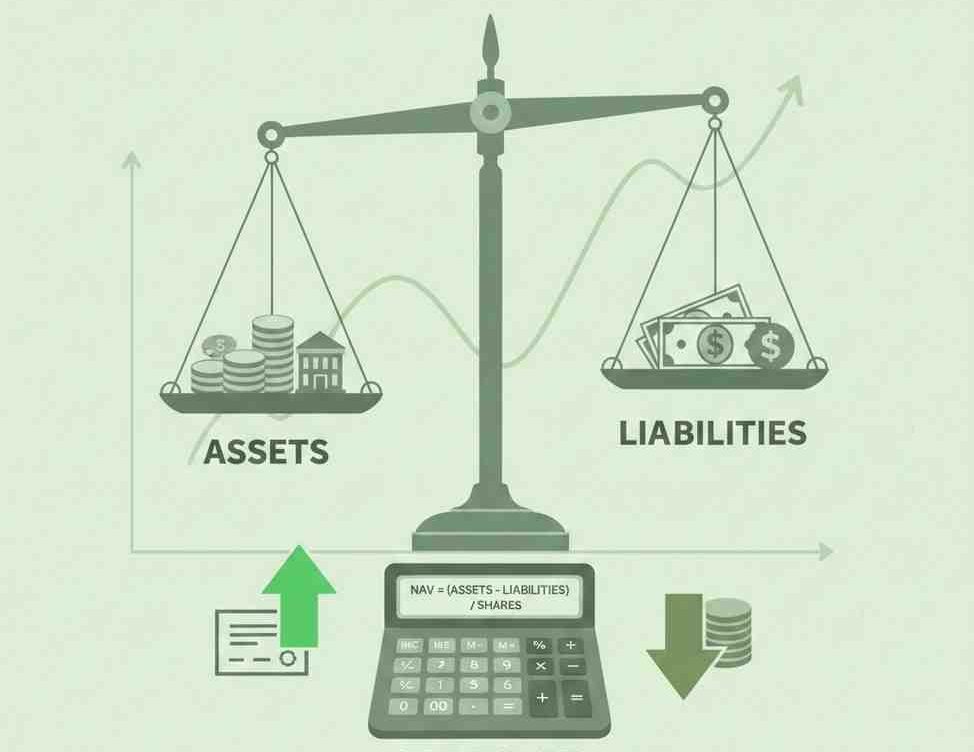

NAV represents the per-unit value of a mutual fund scheme. Simply put, it reflects the market value of the fund’s total assets after accounting for its liabilities, divided by the number of outstanding units.

In the Indian mutual fund ecosystem, open-ended funds allow investors to buy or redeem units on any business day at the prevailing NAV. This makes NAV the cornerstone of transactions, valuation, and performance tracking. When discussing open-ended mutual fund NAV explained in simple terms, it is best seen as a daily snapshot of the fund’s value rather than a price tag in the traditional sense.

How NAV Is Calculated in Mutual Funds

NAV calculation in mutual funds follows a standardised process governed by SEBI regulations in India. Fund houses compute NAV at the end of each trading day based on the closing prices of securities in the portfolio.

The formula for NAV is:

NAV = (Total value of assets – Total liabilities) ÷ Total number of outstanding units

Assets include equity shares, debt instruments, cash balances, and accrued income. Liabilities may consist of expenses payable, management fees, and other operational costs. The final NAV is published after market hours and becomes applicable for transactions based on the cut-off timing.

This transparent method ensures consistency across fund houses and allows investors to compare schemes more effectively.

NAV and Mutual Fund Pricing

A common misunderstanding among investors is equating NAV with stock prices. Mutual fund pricing and valuation operate differently from equity markets. A mutual fund unit does not become more attractive simply because its NAV is lower.

For example, a fund with a NAV of ₹20 is not inherently better or worse than one with a NAV of ₹200. What matters is the underlying portfolio, investment strategy, and performance over time. NAV adjusts daily to reflect changes in the market value of the fund’s holdings, not investor demand and supply in isolation.

In open-ended funds, pricing is straightforward. Units are always bought or redeemed at NAV, without negotiation or market bidding. This structure reduces complexity and aligns transactions with the actual value of the fund.

Role of Valuation in Determining NAV

Valuation is central to how NAV works in open-ended funds. Equity securities in the portfolio are valued at their closing market prices, while debt instruments are valued using mark-to-market principles or amortisation, depending on their category and maturity.

For debt funds, valuation also takes into account interest accruals and changes in yields. This explains why NAVs of debt funds can fluctuate even when there are no visible market shocks. The valuation framework ensures that NAV reflects real-time economic conditions and asset quality.

Accurate valuation helps protect investor interests by ensuring fair entry and exit prices.

Impact of Market Movements on NAV

The impact of market movements on NAV is most visible in equity-oriented open-ended funds. When equity markets rise, the value of stocks held in the portfolio increases, leading to a higher NAV. Conversely, market declines result in lower NAVs.

Debt funds are influenced by interest rate movements, credit spreads, and liquidity conditions. A rise in interest rates may reduce the value of existing bonds, causing NAVs to decline, while falling rates can have the opposite effect.

Global events, domestic economic data, policy announcements, and corporate earnings all contribute to market movements that ultimately affect NAV. Understanding this linkage helps investors contextualise daily NAV changes without reacting impulsively.

NAV and Investment Decisions

NAV is an important metric, but it should not be the sole basis for investment decisions. Investors often assume that buying a fund at a lower NAV offers more upside. In practice, returns are driven by percentage growth, not absolute NAV levels.

When evaluating open-ended funds, factors such as portfolio composition, fund objective, expense ratio, consistency of performance, and alignment with financial goals deserve greater attention. NAV serves as a reference point for tracking performance and understanding entry and exit values, not as an indicator of value by itself.

For Indian investors, especially first-time mutual fund participants, recognising this distinction can prevent common errors and improve long-term outcomes.

NAV in the Context of Systematic and Lump Sum Investments

NAV plays a different role depending on how investments are made. In systematic investment plans (SIPs), units are purchased at varying NAVs over time. This naturally averages out the cost of investment and reduces the need to time the market.

In lump sum investments, the entire amount is invested at a single NAV. While market timing can influence short-term outcomes, long-term performance still depends more on market participation and asset allocation than on the entry NAV alone.

Understanding how NAV works in open-ended mutual funds helps investors choose investment methods that align with their comfort level and financial planning approach.

Regulatory Oversight and Transparency in NAV Disclosure

In India, mutual fund NAV disclosure is tightly regulated. Fund houses must publish daily NAVs on their websites and through industry platforms such as AMFI. This transparency supports informed decision-making and builds trust in the mutual fund ecosystem.

SEBI’s valuation and disclosure guidelines aim to ensure that NAV reflects fair market value and that investors receive consistent pricing regardless of transaction size or timing within the cut-off framework.

Conclusion

NAV is a foundational concept in mutual fund investing, particularly in open-ended schemes. By understanding how NAV works in open-ended funds, investors gain clarity on pricing, valuation, and the impact of market movements on their investments. NAV calculation in mutual funds follows a structured and transparent process, making it a reliable indicator of a fund’s daily value.

For Indian investors, the key takeaway is to view NAV as an informational metric rather than a decision trigger. When combined with a clear understanding of mutual fund pricing and valuation, NAV becomes a useful tool for monitoring performance and aligning investments with long-term financial goals. A well-informed approach allows investors to engage with mutual funds more confidently and consistently over time

Related Blogs:

Debt vs Equity Open-Ended Funds: How to Select Based on Risk Profile

Momentum Funds for Beginners: Factors to Consider Before You Start

What are Closed-Ended Mutual Funds?

Lump Sum Investments – How Is It Different from an SIP?

What Are Open Ended Mutual Funds?

What is Reversal Trading?

What Is an Auction Market and How Does It Work?

Understanding Mutual Fund SIP Returns: How to Calculate and Maximize Your Earnings

SIP Calculator and Inflation: Understanding How Inflation Impacts Your Mutual Fund Returns

SIP vs. Lumpsum: What’s the Best Way to Invest in Mutual Funds for Retirement?

How to Use a SIP Calculator for Investment Planning?

Reach Your Financial Milestones Sooner with Step-Up SIPs

What is a SIP Calculator and How Can It Help?

SIP vs Lump Sum: Which Investment Strategy Is Better?

Why Smart Investors in India are Choosing Systematic Investment Plan (SIPs)

How to Start a SIP for Your Child’s Education or Future Goals

The Power of SIPs: Why Consistency Beats Timing the Market

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

What is NAV in open-ended mutual funds?

NAV, or Net Asset Value, represents the per-unit value of a mutual fund scheme after accounting for its assets and liabilities.

How is NAV calculated in mutual funds?

NAV is calculated by dividing the total value of the fund’s assets minus liabilities by the total number of outstanding units.

Does a lower NAV mean a mutual fund is cheaper?

No, a lower NAV does not indicate a cheaper or better fund. Returns depend on percentage growth, not the absolute NAV value.

How often is NAV updated for open-ended funds?

In India, NAV for open-ended mutual funds is calculated and published at the end of every business day.

How do market movements impact NAV?

Market movements affect the value of securities in a fund’s portfolio, which directly influences daily changes in NAV.

Is NAV important when investing through SIPs?

Yes, NAV determines the number of units allotted in each SIP instalment, but long-term returns depend more on market participation than timing.

Can NAV fluctuate even in debt mutual funds?

Yes, debt fund NAVs can change due to interest rate movements, credit conditions, and valuation of underlying securities.