ETFs vs Index Funds for SIP: Which Is More Suitable?

ETFs vs Index Funds for SIP: Which Is More Suitable?

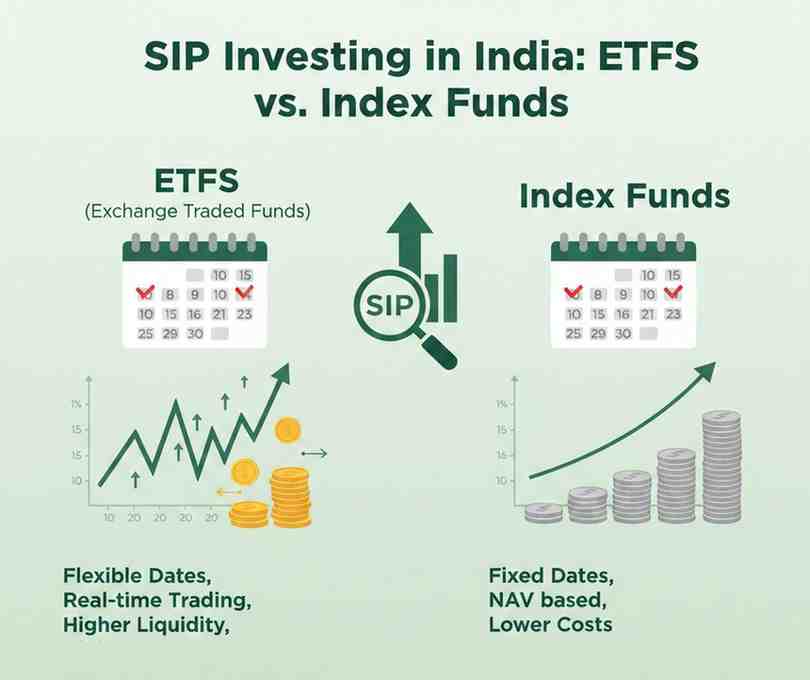

Systematic Investment Plans (SIPs) have become one of the most widely used ways for Indian investors to participate in equity markets. The discipline of investing a fixed amount at regular intervals helps manage market volatility and supports long-term wealth creation. As passive investing gains traction, many investors now face a common question: ETFs vs index funds for SIP— which is more suitable?

Thank you for reading this post, don't forget to subscribe!Both Exchange Traded Funds (ETFs) and index funds aim to replicate the performance of a market index such as the Nifty 50 or Sensex. However, their structure, execution, and suitability for SIP-based investing differ in meaningful ways. This article explores SIP in ETFs vs index funds from a practical, investor-centric perspective, focusing on how each option aligns with monthly investing habits in India.

Understanding SIPs in a Passive Investing

A SIP is not a product in itself but a method of investing. It allows investors to commit a fixed amount at predefined intervals—usually monthly—regardless of market levels. Over time, this approach helps average purchase costs and reduces the emotional impact of market fluctuations.

When applied to passive instruments, SIPs are commonly used to invest in:

- Index mutual funds

- ETFs that track the same indices

While the investment objective may be similar, the execution experience differs, which is where the comparison between index funds or ETFs for monthly SIP becomes relevant.

How SIPs Work in Index Funds

Index funds are mutual funds that replicate a specific index. SIPs in index funds operate in a familiar and automated manner.

Key characteristics:

- SIPs are processed at the day’s closing Net Asset Value (NAV)

- Investments are automated once instructions are registered

- Units are allotted without investor involvement in timing or pricing

- No demat or trading account is required

For many retail investors, this simplicity aligns well with long-term, habit-based investing. This is why index funds are often associated with ETFs vs index funds long-term SIP discussions, especially for salaried investors.

How SIPs Work in ETFs

ETFs are listed instruments traded on stock exchanges. SIPs in ETFs are structurally different from mutual fund SIPs.

Key characteristics:

- ETF purchases happen at real-time market prices

- SIPs are typically executed via standing instructions or broker-supported ETF SIP features

- A demat and trading account is mandatory

- Execution depends on market liquidity and bid-ask spreads

While SIP in ETFs vs index funds may appear similar in intent, ETF SIPs require more operational involvement. Investors need to ensure sufficient account balance and be comfortable with market-linked execution.

Cost Structure: A Practical Comparison

Cost is often cited as a deciding factor when evaluating the best option for SIP ETFs or index funds.

Index funds:

- Carry an expense ratio charged by the fund house

- Costs are embedded within NAV

- No brokerage or transaction charges (on direct plans)

ETFs:

- Generally have lower expense ratios

- May involve brokerage, exchange fees, and bid-ask spreads

- Costs vary depending on trade size and liquidity

In practice, the cost advantage of ETFs becomes more meaningful for larger investment amounts or lump-sum strategies. For smaller monthly SIPs, transaction-related costs can offset the lower expense ratio.

Liquidity and Execution Considerations

Liquidity plays a subtle but important role in ETFs vs index funds for SIP decisions.

- Index fund SIPs are unaffected by market liquidity, as purchases happen directly with the fund house.

- ETF liquidity depends on trading volumes and market depth.

For widely tracked indices, liquidity is usually sufficient. However, during volatile market conditions, ETF prices may deviate marginally from underlying NAV, which may affect SIP execution outcomes.

Discipline and Behavioural Factors

SIP investing is as much about behaviour as it is about returns.

- Index funds encourage a “set-and-forget” approach

- ETFs require active monitoring to ensure SIP execution

- The ability to trade ETFs intraday may introduce behavioural biases

From a behavioural perspective, index funds often support investment discipline more effectively, particularly for first-time investors evaluating index funds or ETFs for monthly SIP.

Taxation Overview

From a tax standpoint, ETFs and index funds tracking equity indices are treated similarly under current Indian tax laws.

- Short-term capital gains are taxed if units are sold within 12 months

- Long-term capital gains apply beyond 12 months, subject to prevailing rules

- Taxation applies only at redemption, not during SIP investments

Since tax rules are subject to change, investors typically review current regulations before making allocation decisions. Tax treatment does not materially differentiate SIP in ETFs vs index funds for most long-term investors.

Suitability Based on Investor Profile

Rather than framing the discussion as ETFs versus index funds in absolute terms, it is more practical to assess suitability.

Index funds may align better with:

- Investors seeking automated SIP execution

- Those without demat or trading accounts

- Individuals prioritising simplicity and consistency

- Long-term investors focused on discipline

ETFs may align better with:

- Investors comfortable with trading platforms

- Those investing larger monthly amounts

- Investors who actively monitor execution prices

- Portfolios where cost optimisation is a key objective

What Investors Are Really Asking

When users search for terms like ETFs vs index funds for SIP or SIP in ETFs vs index funds, they are typically looking for:

- Practical guidance, not product recommendations

- Clarity on execution and suitability

- Alignment with Indian market realities

- Simplicity, costs, and long-term usability

Conclusion

The debate around ETFs vs index funds for SIP is not about identifying a superior product, but about choosing a structure that aligns with an investor’s habits, comfort level, and operational preferences.

Index funds offer ease, automation, and behavioural simplicity, making them suitable for many monthly SIP investors. ETFs provide cost efficiency and trading flexibility but require greater involvement and awareness. When evaluating ETFs vs index funds long-term SIP, consistency and discipline often matter more than marginal differences in expense ratios.

For Indian retail investors, the more relevant question is not which option performs better in isolation, but which structure supports sustained investing over time. Aligning the investment vehicle with personal investing behaviour remains a key part of making SIPs effective.

Related Blogs:

Debt vs Equity Open-Ended Funds: How to Select Based on Risk Profile

Momentum Funds for Beginners: Factors to Consider Before You Start

What are Closed-Ended Mutual Funds?

Lump Sum Investments – How Is It Different from an SIP?

What Are Open Ended Mutual Funds?

What is Reversal Trading?

What Is an Auction Market and How Does It Work?

Understanding Mutual Fund SIP Returns: How to Calculate and Maximize Your Earnings

SIP Calculator and Inflation: Understanding How Inflation Impacts Your Mutual Fund Returns

SIP vs. Lumpsum: What’s the Best Way to Invest in Mutual Funds for Retirement?

How to Use a SIP Calculator for Investment Planning?

Reach Your Financial Milestones Sooner with Step-Up SIPs

What is a SIP Calculator and How Can It Help?

SIP vs Lump Sum: Which Investment Strategy Is Better?

Why Smart Investors in India are Choosing Systematic Investment Plan (SIPs)

How to Start a SIP for Your Child’s Education or Future Goals

The Power of SIPs: Why Consistency Beats Timing the Market

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Is SIP possible in ETFs in India?

Yes, SIPs can be done in ETFs through broker platforms, but they require a demat and trading account and are executed at market prices.

Are index funds better than ETFs for monthly SIPs?

Index funds are often preferred for monthly SIPs due to automated execution, NAV-based pricing, and ease of use, especially for long-term retail investors.

What is the main difference between SIP in ETFs vs index funds?

The key difference lies in execution. Index fund SIPs are processed automatically at NAV, while ETF SIPs involve market-based buying with liquidity and price considerations.

Do ETFs offer better returns than index funds for SIP?

Returns largely depend on the underlying index. Differences, if any, usually arise from expense ratios, tracking error, and execution efficiency rather than the SIP structure itself.

Which is more suitable for long-term SIP investors—ETFs or index funds?

Suitability depends on investor behaviour. Index funds suit those seeking simplicity and discipline, while ETFs may suit investors comfortable with active monitoring and market execution.