Top Mistakes to Avoid While Investing in IPOs

Top Mistakes to Avoid While Investing in IPOs Initial Public Offerings (IPOs) often create a buzz—everyone wants to get in early and ride the next big growth story. While IPOs ca

Top Mistakes to Avoid While Investing in IPOs Initial Public Offerings (IPOs) often create a buzz—everyone wants to get in early and ride the next big growth story. While IPOs ca

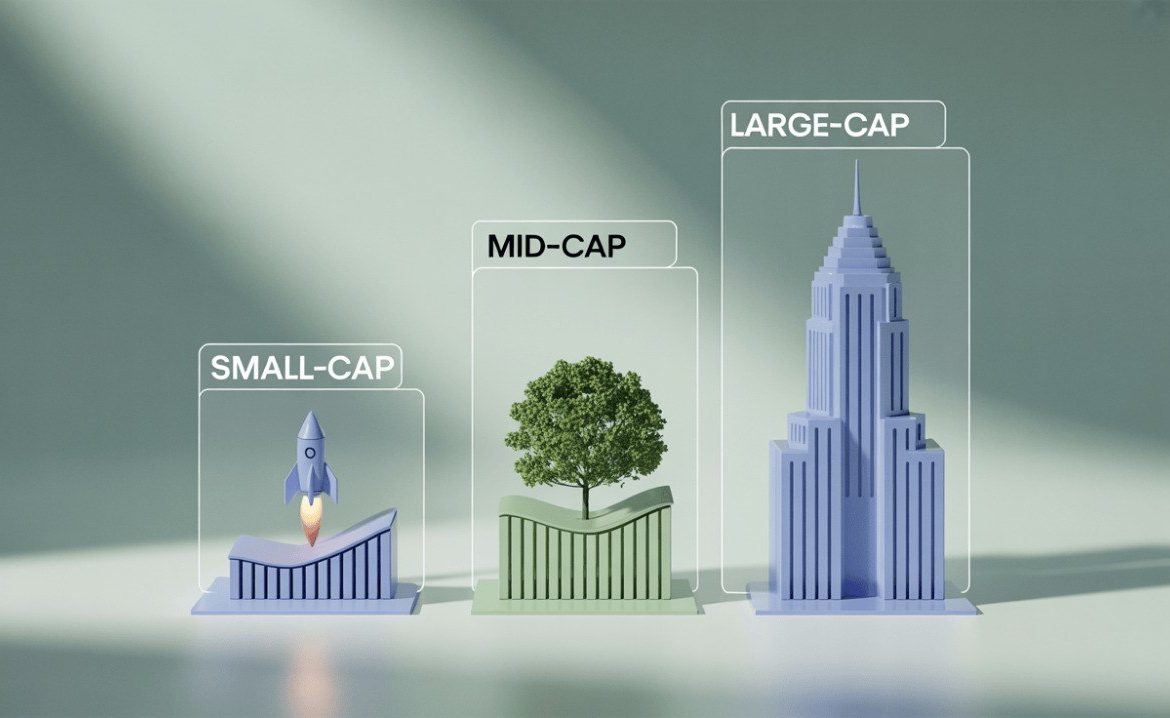

Understanding Market Capitalization: Small-Cap vs Mid-Cap vs Large-Cap When you hear terms like small-cap, mid-cap, or large-cap in investing—what exactly do they mean? These cat

Top 5 Mutual Fund Categories for Long-Term Wealth Creation If you’re investing for long-term goals like retirement, your child’s education, or wealth accumulation over 10�

How to Choose the Right Mutual Fund for Your Financial Goals With thousands of mutual funds available, picking the right one can feel overwhelming. But the secret to successful inv

ULIPs vs Mutual Funds: Which Is Better for Long-Term Wealth? When planning for long-term wealth creation, many investors find themselves choosing between ULIPs (Unit Linked Insuran

Understanding Sharpe Ratio: A Smart Way to Compare Funds When choosing between two mutual funds, most people look only at returns. But returns without understanding risk can be mis

SIP vs Lump Sum: Which Investment Strategy Is Better? When it comes to investing, especially in mutual funds or equities, one question often stumps investors: Should I invest a lum

How to Start Investing in the Stock Market with Just ₹500 Think stock market investing is only for the rich? Think again. Thanks to digital platforms, fractional investing, and l

NPS (National Pension System): A Tax-Saving Retirement Tool Planning for retirement doesn’t have to be overwhelming—especially when there’s a government-backed tool that offe

The Impact of Interest Rates on Your Investments Explained Interest rates don’t just affect your EMIs—they play a major role in how your investments perform. Whether it�