Understanding Earnings Quality: Cash Profits vs Accounting Profits

Understanding Earnings Quality: Cash Profits vs Accounting Profits When companies announce quarterly results, investors often focus on headline profit numbers—net profit, EPS gro

Understanding Earnings Quality: Cash Profits vs Accounting Profits When companies announce quarterly results, investors often focus on headline profit numbers—net profit, EPS gro

Combining Value and Quality Factors in Equity Investing Equity investing is rarely about choosing one rigid style and sticking to it forever. Over time, many investors realise that

How Budget Expectations Influence Stock Market Positioning Every year, well before the Union Budget is presented, Indian stock markets begin to react—not to what the government h

Evaluating Geographic Diversification: A Key Metric for Stability When investors think about diversification, they usually focus on owning multiple stocks across sectors. While sec

How Management Commentary in Earnings Calls Can Reveal Future Risks For many retail investors, earnings season begins and ends with headline numbers—revenue growth, profit margin

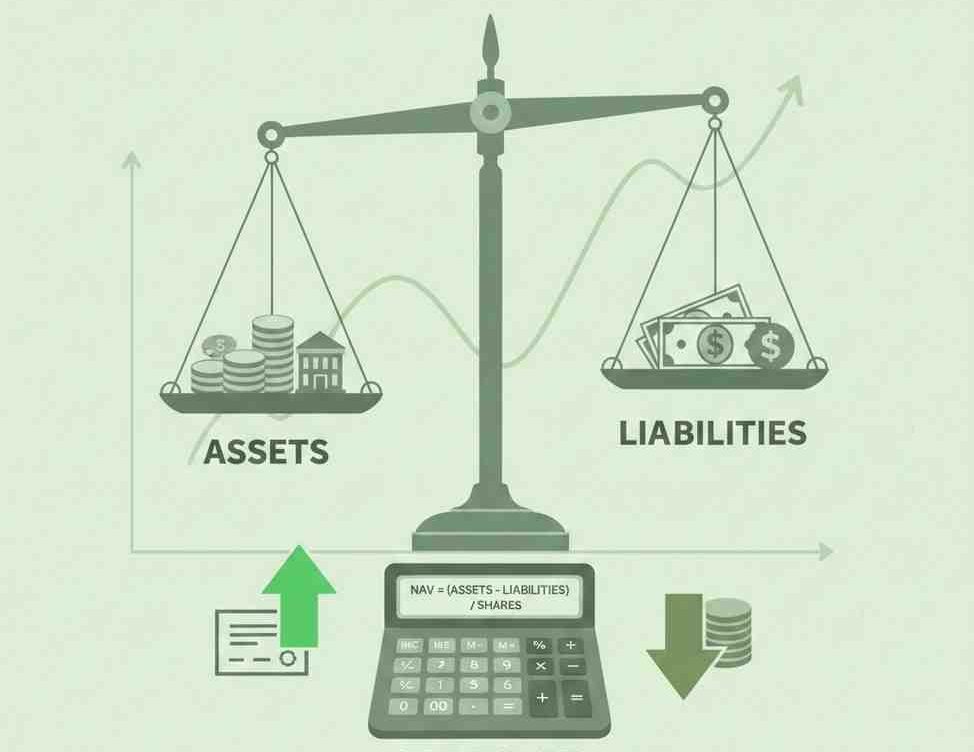

How NAV Works in Open-Ended Funds: Pricing, Valuation, and Market Impact When investors look up a mutual fund scheme, one of the first figures they notice is the Net Asset Value, c

Why Free Float Adjustments Matter in Index Rebalancing Market indices like the NIFTY 50 or Sensex play a central role in how capital flows through financial markets. Millions of in

ETF vs Stocks Explained: Key Differences Every Investor Should Know For investors navigating the Indian equity market, one of the most common questions is whether to invest in exch

The Role of Inventory Cycles in Predicting Company Performance For most investors, company performance is judged by revenue growth, profit margins, and earnings per share. Yet, one

Understanding Buyback Programs and Their Impact on Share Prices Stock buybacks—also known as share repurchase programs—often make headlines and trigger immediate reactions in s