Evaluating Capital Expenditure Capex Plans Before Investing

Evaluating Capital Expenditure (Capex) Plans Before Investing Capital Expenditure (Capex) is one of the most important indicators of a company’s long-term growth potential. Wheth

Evaluating Capital Expenditure (Capex) Plans Before Investing Capital Expenditure (Capex) is one of the most important indicators of a company’s long-term growth potential. Wheth

How Currency Fluctuations Impact Foreign Investor Flows (FII/FPI) Foreign Institutional Investors (FIIs) and Foreign Portfolio Investors (FPIs) have a significant influence on stoc

Dividend Yield vs Dividend Payout: What Investors Should Focus On For many retail investors, the word dividend instantly sparks interest—after all, who doesn’t like getting reg

Understanding Asset Allocation for Equity Investors Most new investors spend a lot of time trying to pick the perfect stock—but far fewer spend time understanding how to allocate

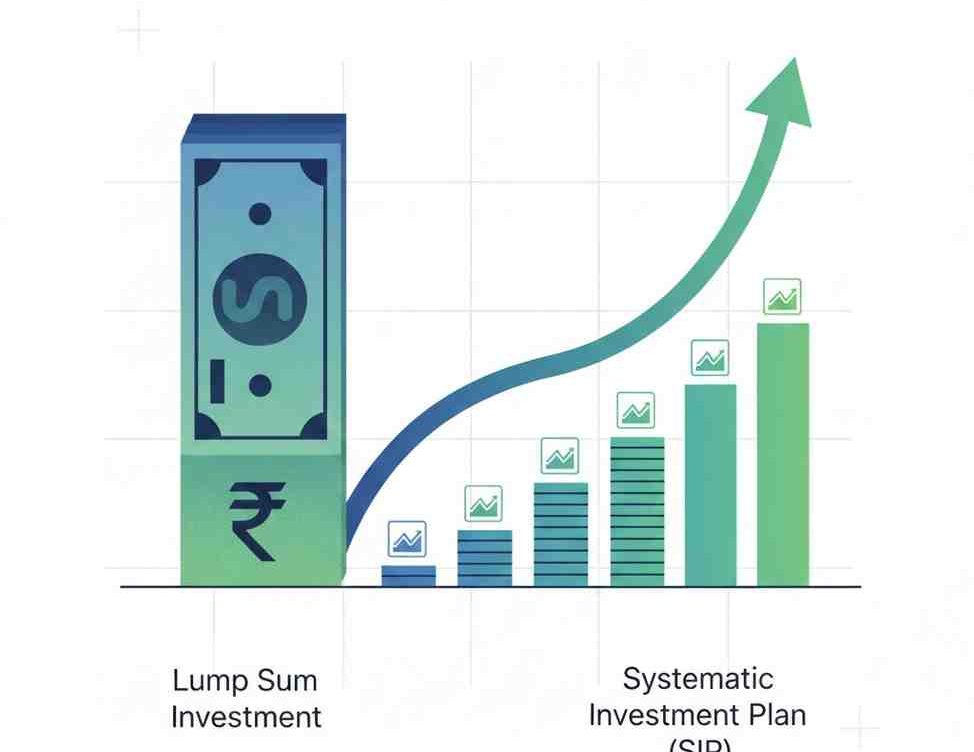

Lump Sum Investments – How Is It Different from an SIP? When it comes to investing in mutual funds, most individuals come across two commonly discussed approaches—lump sum inve

How Sector Rotation Shapes Market Trends Market cycles are constantly evolving, and with them, the performance of different sectors. Some sectors shine during economic expansions,

How to Evaluate Management Quality: A Key Pillar of Smart Investing When you invest in a company, you aren’t just buying its products, assets, or financial ratios—you’re buyi

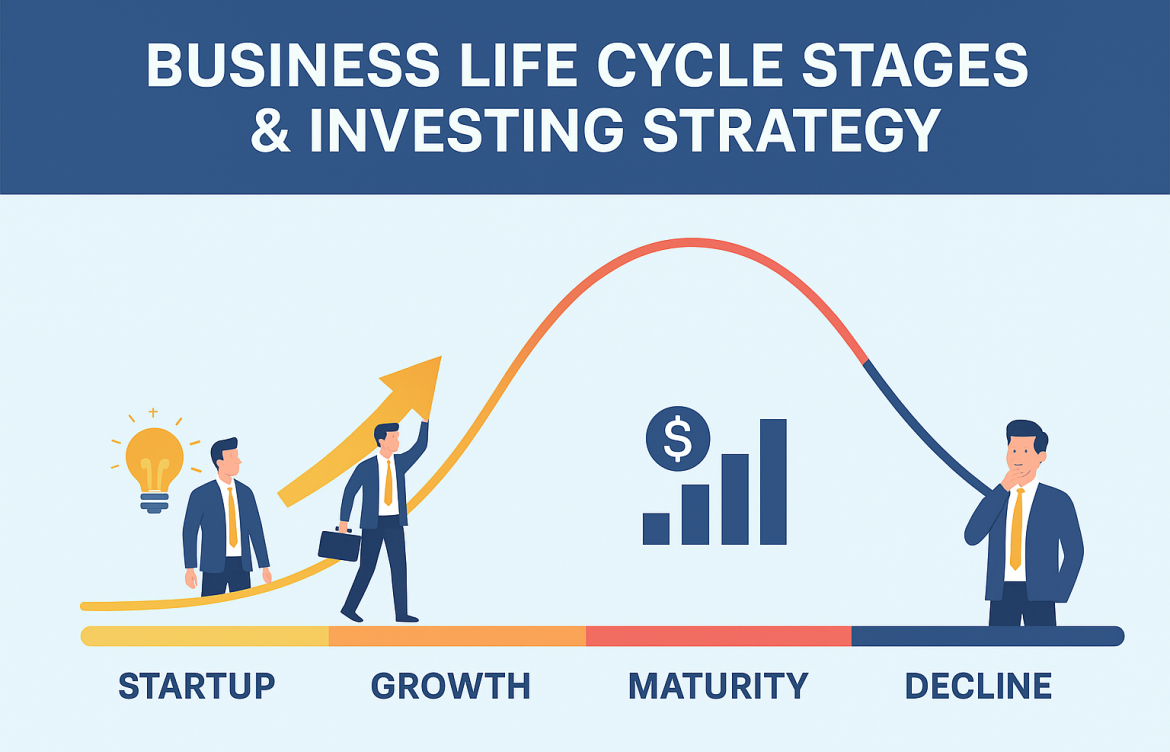

Business Life Cycle Stages & Investing Strategy When analyzing companies for investment, many beginners focus only on financial ratios or stock price movements. But there’s a

Top Reasons to Invest in Commodities in India For many Indian investors, commodities may seem like an unfamiliar or specialised asset class compared to equities and mutual funds. H

Impact of Forex Exposure on Company Earnings: What Investors Need to Know When analysing a company’s financial performance, most retail investors focus on revenue growth, profita