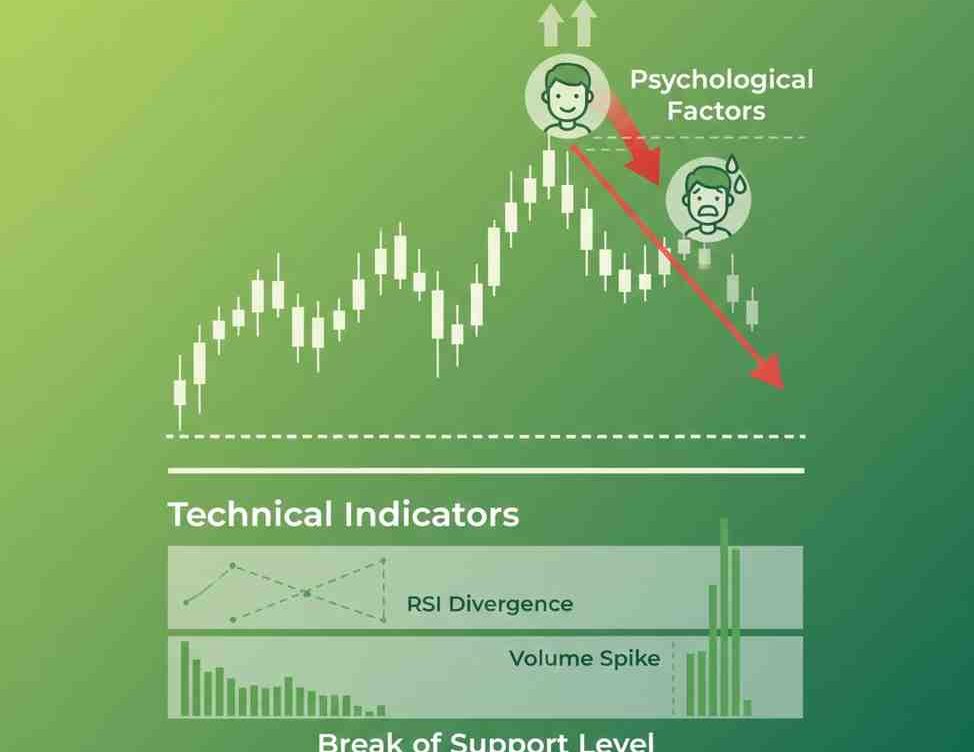

What Causes Market Reversals? Technical and Psychological Factors

What Causes Market Reversals? Technical and Psychological Factors Markets do not move in straight lines. Whether it is the Nifty 50, Bank Nifty, or a mid-cap stock, price trends ev

What Causes Market Reversals? Technical and Psychological Factors Markets do not move in straight lines. Whether it is the Nifty 50, Bank Nifty, or a mid-cap stock, price trends ev

The Rise of Digital Payments and Its Influence on Fintech-Linked Stocks Over the past decade, India’s financial ecosystem has undergone a structural transformation. Cash transact

Why Do Some Indian Sectors React Faster to Economic Data Than Others? Some Indian sectors react more quickly to economic data because their revenues and cash flows are directly tie

How Can SEBI Regulations Protect Retail Investors During Market Excesses? SEBI protects retail investors during speculative market phases through strict disclosure norms, surveilla

Reversal Trading vs Pullback Trading: Key Differences In active trading discussions, two terms frequently appear together — reversal and pullback. At first glance, they may seem

What Does Negative Operating Cash Flow Indicate About an Indian Company’s Business Model? Negative operating cash flow (OCF) indicates that an Indian company’s core business is

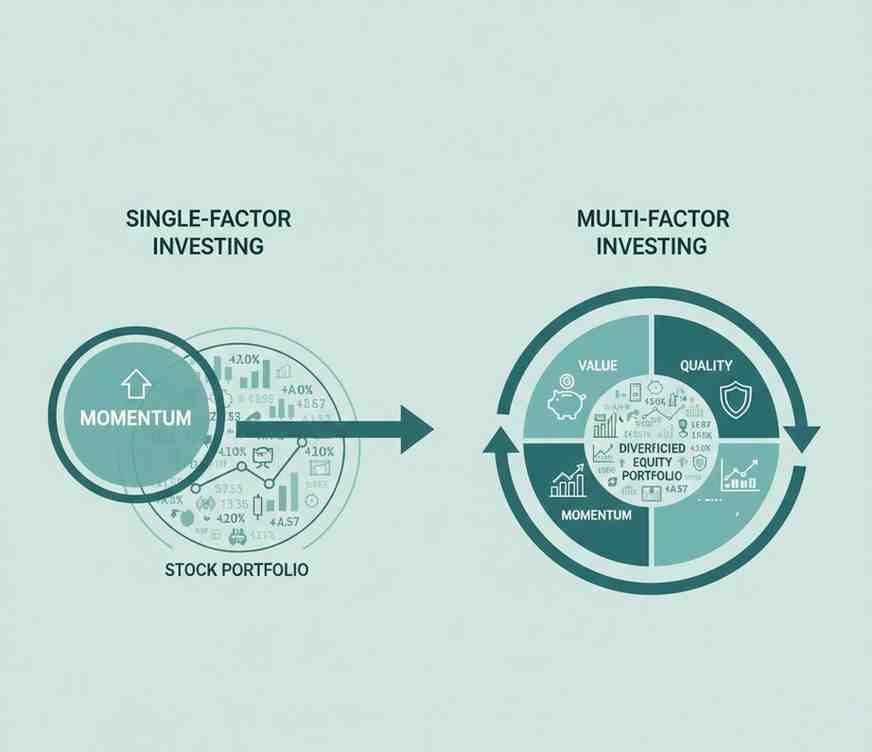

Multi-Factor vs Single-Factor Investing: What Investors Should Know Factor-based investing has steadily gained attention among Indian investors, especially as mutual funds and inde

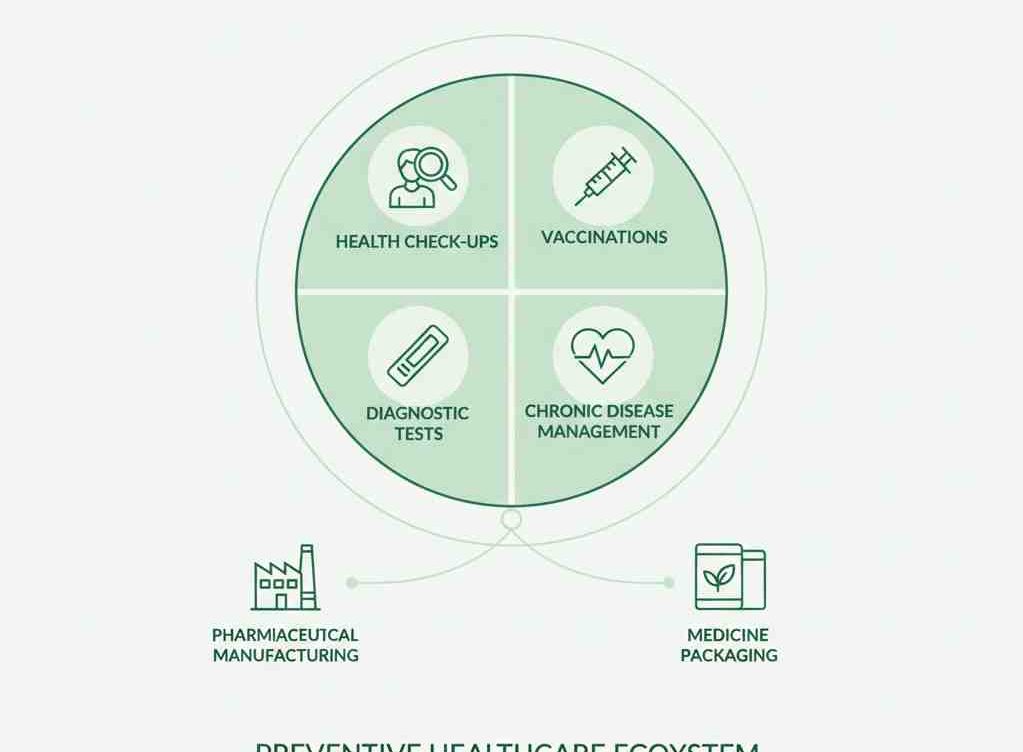

How Preventive Healthcare Trends Are Shaping Pharma Stocks in India Over the last decade, India’s healthcare conversation has gradually shifted from treatment to prevention. Regu

How Do Institutional Shareholding Changes Signal Shifts in Market Confidence on NSE & BSE? Changes in institutional shareholding on the NSE & BSE — especially by mutual f

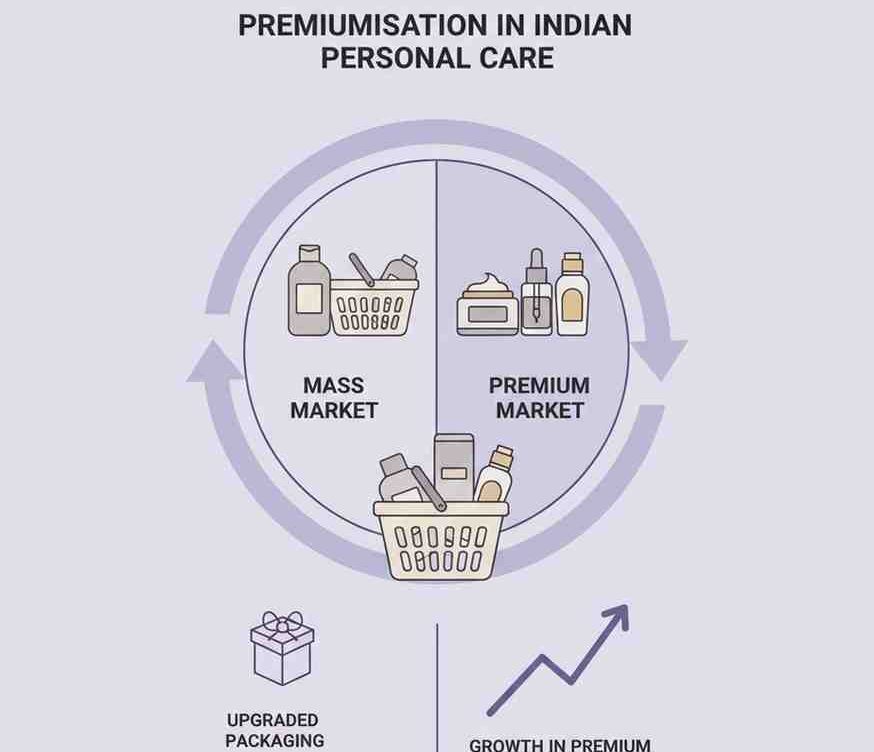

Premiumisation Trends and Their Impact on Indian Personal Care Stocks Walk into any supermarket or browse an online marketplace in India today, and a clear pattern emerges. Shelves