Premiumisation Trends and Their Impact on Indian Personal Care Stocks

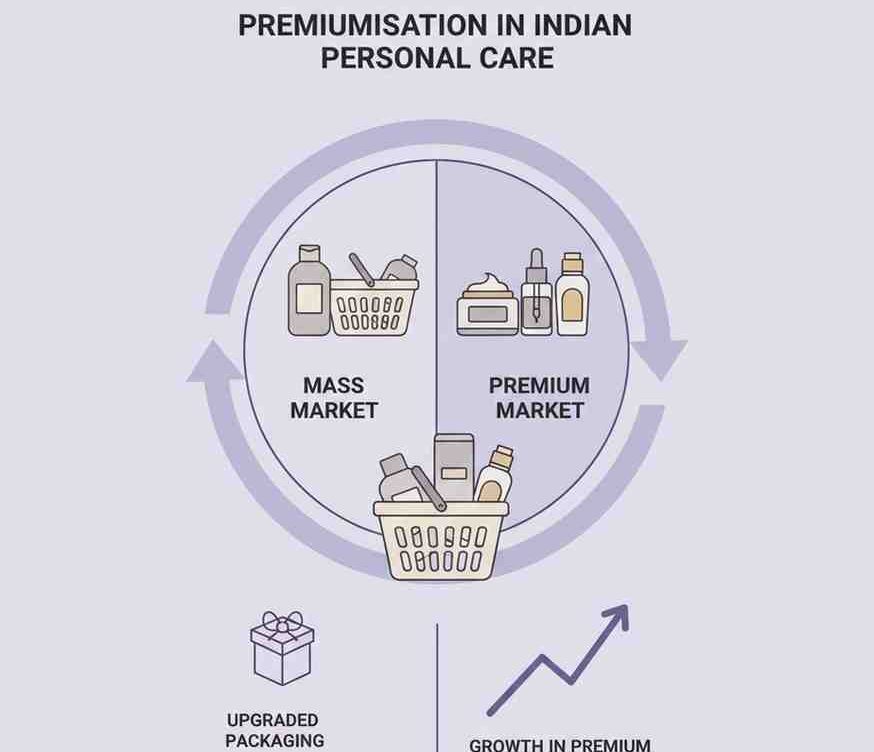

Premiumisation Trends and Their Impact on Indian Personal Care Stocks Walk into any supermarket or browse an online marketplace in India today, and a clear pattern emerges. Shelves