Gap Up & Gap Down: How to Trade Market Gaps on NSE with Confidence

Gap Up & Gap Down: How to Trade Market Gaps on NSE with Confidence

Markets don’t always open where they left off. Sometimes, they jump higher or plunge lower at the opening bell.

Thank you for reading this post, don't forget to subscribe!These are called Gap Ups and Gap Downs—and they can signal strong momentum, news-based moves, or even traps set by smart money.

If you know how to read them, market gaps can offer high-probability intraday or swing trades—especially in Nifty, Bank Nifty, and liquid F&O stocks.

Let’s break down how to spot and trade gap setups with confidence on NSE.

What Are Gaps?

A gap occurs when a stock or index opens above or below the previous day’s closing price, with no trading in between.

📈 Gap Up

Open price > Previous day’s high

✅ Indicates bullish strength

📉 Gap Down

Open price < Previous day’s low

❌ Indicates bearish pressure

Types of Gaps (With NSE Examples)

-

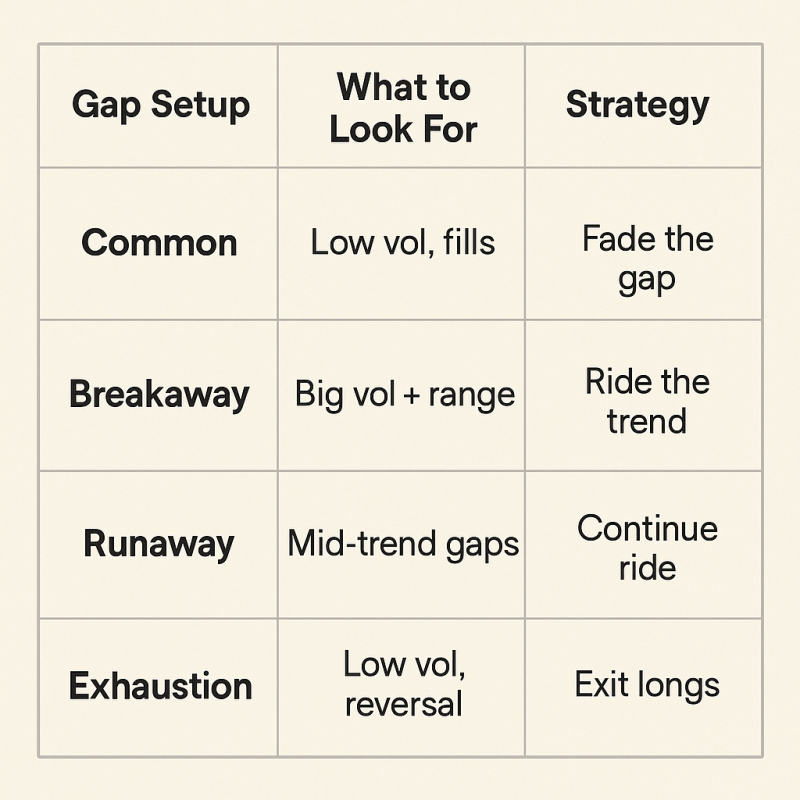

Common Gap

- Seen in sideways markets

- Usually gets filled quickly

🪫 Example: Low volume gaps in ITC, HUL

-

Breakaway Gap

- Appears after a long consolidation

- Marks beginning of new trend

💥 Example: Infosys gap-up after earnings

-

Runaway (Continuation) Gap

- Appears mid-trend

- Confirms strength and trend continuation

📈 Example: Reliance gap-up during rally phase

-

Exhaustion Gap

- Occurs at trend end

- Low volume, traps retail traders

⚠️ Example: Bank Nifty sudden gap-up followed by selloff

How to Trade Gaps on NSE

📌 1. Pre-Market Analysis

- Check SGX Nifty for cues

- Look for overnight news (earnings, RBI policy, global cues)

📌 2. Mark Previous Day’s High, Low & Close

- These levels act as support/resistance

- Gaps beyond these areas = strong signals

📌 3. Volume Confirmation at Open

- High volume = valid gap

- Low volume = likely to fill quickly

📌 4. Gap Fill Strategy

- If price starts retracing into the gap, look for it to fill the gap

- Works best on common gaps or failing breakaway gaps

📌 5. Gap and Go Strategy

- Price opens with a gap and continues in that direction

- Ideal when combined with high volume and no early rejection

🛠 Use 5-min candles + VWAP for early confirmation

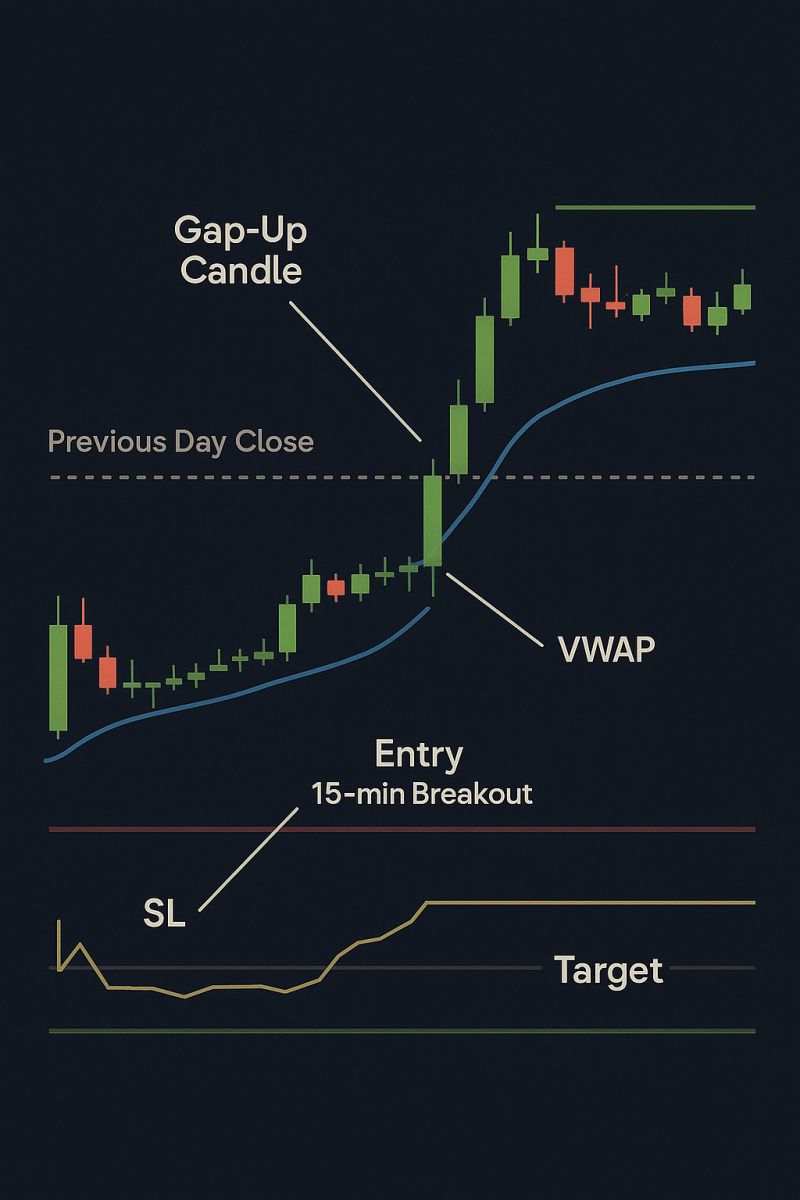

Real NSE Example: Gap-Up in Nifty

- Previous Close: 22,200

- Opens at: 22,400 (Gap Up)

- Breaks 22,450 (first 15-min high)

- Strong volume: Long trade with SL at VWAP

🎯 Target: Next resistance zone (e.g., 22,600)

Gap Trading Traps to Avoid

❌ Trading gaps without volume confirmation

❌ Chasing price too late after a gap move

❌ Ignoring market structure (news, trend, global cues)

Pro Tips for Gap Trading in Indian Markets

✅ Use 15-min candle close for confirmation

✅ Combine with VWAP, support/resistance zones, and FII/DII flows

✅ Monitor sector moves (if Nifty gaps up, check if BFSI/IT support it)

📌 Tools to Use

- NSE Option Chain: For support/resistance clues

- TradingView Gap Indicators

- Pre-market data: SGX Nifty, Global indices

- Volume analysis: Check first 15-min bars

Conclusion

Gap ups and downs are not random—they’re footprints of institutional activity, earnings surprises, and trader sentiment shifts.

Mastering gap trading helps you catch momentum moves early and avoid being trapped in reversals.

“Don’t fear the gap—learn to ride its momentum.”

Related Blogs:

Stock Market Investment: Top 4 Equity Investment Tips for “Beginners”

What Is Fundamental Analysis? A Beginner’s Guide with Indian Context

How to Read a Company’s Balance Sheet: Step-by-Step with Indian Examples

Profit & Loss Statement: What Matters for Retail Investors in India

Cash Flow Statement: Why It’s More Important Than Net Profit

How to Analyze Management Quality Using Publicly Available Data

Key Financial Ratios Explained Simply (ROE, ROCE, D/E & More)

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.