How to Identify Multi-bagger Stocks in the Indian Market

How to Identify Multi-bagger Stocks in the Indian Market

Every investor dreams of finding the next multibagger stock—one that multiplies wealth several times over a few years. While not every stock can become a multibagger, history shows that Indian markets have produced many such success stories: Infosys, Eicher Motors, Asian Paints, and more.

Thank you for reading this post, don't forget to subscribe!But how can investors identify potential multibaggers early? Let’s break it down.

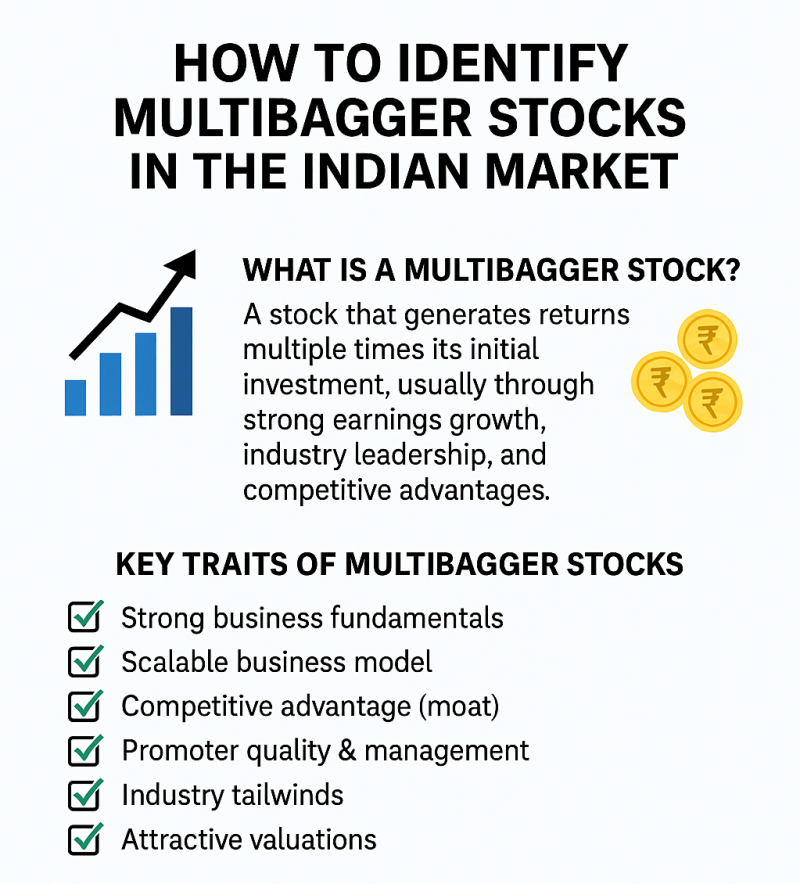

🚀 What is a Multibagger Stock?

A multibagger is a stock that generates returns multiple times its initial investment, usually through strong earnings growth, industry leadership, and competitive advantages.

For example, a stock bought at ₹100 that grows to ₹500 in a few years is considered a 5-bagger.

✅ Key Traits of Multibagger Stocks

1. Strong Business Fundamentals

Look for companies with:

-

Consistent revenue and profit growth

-

High Return on Equity (ROE) (above 15–20%)

-

Low or manageable debt-to-equity ratio

-

Strong free cash flow

Example: HDFC Bank’s long history of consistent growth has made it a compounder.

2. Scalable Business Model

The company should operate in a sector with huge growth potential and the ability to scale operations.

-

Example sectors: IT, Pharma, Renewable Energy, FMCG, EVs.

-

Scalable businesses grow rapidly without a proportional increase in costs.

3. Competitive Advantage (Moat)

Companies with strong brand value, patents, distribution networks, or cost advantages tend to outperform competitors.

Examples of moats:

-

Asian Paints: Distribution network

-

Infosys: Global IT outsourcing brand

-

Titan: Brand trust & scale

4. Promoter Quality & Management

The integrity, vision, and execution ability of promoters are critical.

-

Check promoter shareholding trends.

-

Avoid companies with frequent governance issues.

5. Industry Tailwinds

Multibaggers often emerge from sectors benefiting from long-term structural trends like:

-

Digital transformation

-

Green energy

-

Financial inclusion

-

Healthcare demand

6. Attractive Valuations

A great business bought at the wrong price may not deliver multibagger returns. Look for stocks with:

-

Reasonable P/E ratios compared to industry peers

-

Undervalued relative to future growth potential

📊 Checklist for Identifying Multi-baggers

| Criteria | What to Look For |

|---|---|

| Earnings Growth | >15% CAGR over 5–10 years |

| ROE/ROCE | Consistently above 15–20% |

| Debt-to-Equity Ratio | Below 0.5 (low leverage preferred) |

| Industry Growth Potential | High-growth sectors with demand tailwinds |

| Promoter Holding | Stable or increasing |

| Valuation | Reasonable P/E vs growth |

⚠️ Risks to Watch Out For

-

Overhyped stocks with no real earnings growth

-

High-debt companies vulnerable to interest rate hikes

-

Cyclical industries with unpredictable demand

-

Poor corporate governance

🏆 Final Thoughts

Identifying multibaggers requires a mix of fundamental analysis, patience, and conviction. It’s not about chasing quick gains but investing in quality companies with long-term growth potential.

Diversifying across sectors, staying updated with industry trends, and regularly tracking company performance can help you discover the next multibagger in the Indian market.

As legendary investor Peter Lynch said: “The person that turns over the most rocks wins the game.”

Start turning those rocks in India’s high-growth sectors today!