Premiumisation Trends and Their Impact on Indian Personal Care Stocks

Premiumisation Trends and Their Impact on Indian Personal Care Stocks

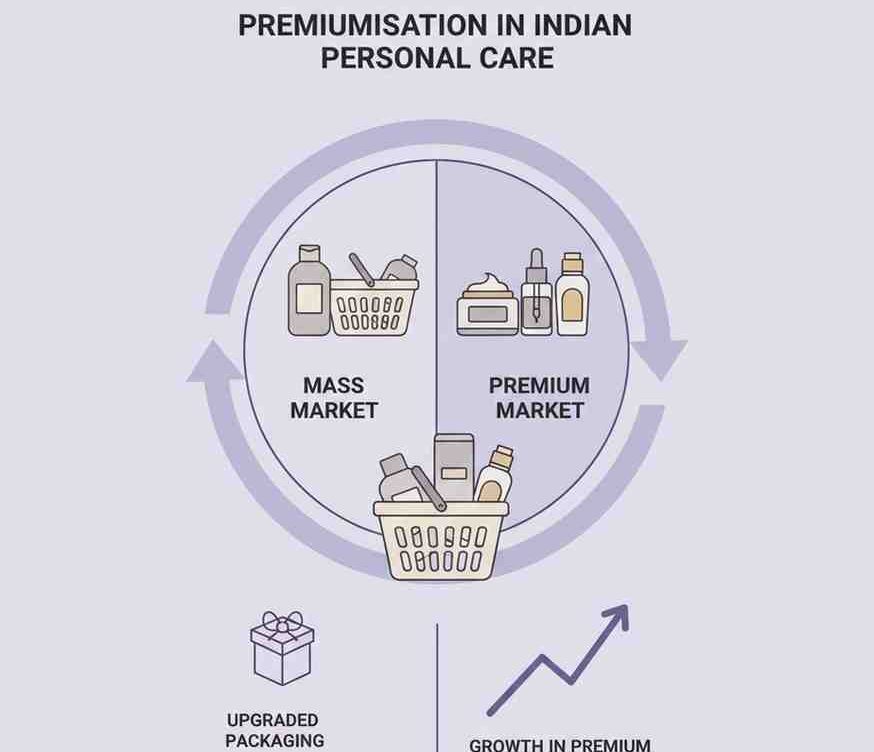

Walk into any supermarket or browse an online marketplace in India today, and a clear pattern emerges. Shelves that once carried largely mass-market soaps, shampoos, and creams now display a growing range of specialised, higher-priced products—targeted solutions, natural formulations, dermatology-backed brands, and lifestyle-oriented packaging. This shift reflects a broader phenomenon shaping consumer businesses: premiumisation.

Thank you for reading this post, don't forget to subscribe!For investors tracking consumer-facing companies, understanding premiumisation trends in India offers insight into how demand patterns are evolving and what that could mean for long-term revenue growth, margins, and brand strategies. Nowhere is this shift more visible than in the personal care segment.

What Premiumisation Means

Premiumisation refers to consumers gradually trading up from basic, low-cost products to higher-value offerings that promise better quality, convenience, efficacy, or brand experience. In India, this trend has gained traction due to several structural changes:

- Rising disposable incomes, especially in urban and semi-urban areas

- Greater health, hygiene, and self-care awareness

- Exposure to global brands and digital marketing

- Willingness to pay for perceived quality and personalisation

Unlike sudden consumption booms, premiumisation tends to unfold steadily. This makes it particularly relevant when analysing personal care market trends in India, where consumption is frequent and brand loyalty can be durable.

Why Personal Care Is at the Centre of Premiumisation

Personal care products occupy a unique position within FMCG. They are daily-use items, but they are also closely linked to personal identity, wellness, and lifestyle choices. As consumers become more discerning, they begin to differentiate between products based on:

- Ingredients and formulations

- Skin or hair-specific needs

- Brand credibility and positioning

- Sustainability and ethical considerations

This behavioural shift explains why premiumisation has become a key theme when evaluating the impact of premiumisation on personal care stocks.

Consumer Premiumisation and FMCG Growth

From a sectoral perspective, consumer premiumisation and FMCG growth are increasingly interconnected. While volume growth in mass categories may moderate over time, value growth can still be supported by:

- Higher average selling prices

- Improved product mix

- Expansion of premium sub-brands

- Increased share of organised retail and e-commerce

For personal care companies, this means growth is not solely dependent on selling more units, but on selling more value per unit. This dynamic has important implications for profitability and capital allocation.

Impact of Premiumisation on Personal Care Stocks

The impact of premiumisation on personal care stocks is best understood through three key dimensions: revenues, margins, and brand economics.

- Revenue Quality

Premium products typically carry higher price points and, in some cases, stronger repeat usage. This can lead to more stable revenue streams, particularly when brands successfully build consumer trust.

- Margin Structure

Premium offerings often come with better gross margins, although they may also require higher spending on marketing, innovation, and distribution. Over time, scale efficiencies can help offset these costs.

- Brand Longevity

Companies that manage premiumisation carefully can strengthen brand equity, making them less vulnerable to price-led competition. However, misaligned pricing or weak differentiation can limit success.

Investors analysing Indian personal care sector stocks often assess whether companies are genuinely building premium franchises or merely extending product lines without long-term traction.

Indian Personal Care Sector Stocks: Strategic Shifts

Listed personal care companies in India have responded to premiumisation in multiple ways:

- Launching premium variants within existing brands

- Acquiring or incubating niche personal care labels

- Expanding dermatology, ayurvedic, or science-backed ranges

- Strengthening digital and direct-to-consumer channels

These strategies aim to capture higher-value consumers while retaining mass-market reach. However, execution quality matters. Not every premium launch translates into sustained demand.

Risks and Limitations of Premiumisation

While premiumisation offers growth opportunities, it is not without risks—something investors should factor into their analysis.

- Affordability sensitivity: In periods of inflation or economic uncertainty, consumers may temporarily revert to value products.

- Competitive intensity: Premium categories often attract new entrants, increasing marketing and pricing pressure.

- Distribution challenges: Premium products may require different retail and online strategies than mass offerings.

These factors influence how reliably premiumisation translates into shareholder value.

What Investors Should Watch Going Forward

For investors tracking Indian personal care sector stocks, premiumisation should be viewed as a medium- to long-term theme rather than a short-term catalyst. Key aspects to monitor include:

- Consistency of premium product contribution to revenues

- Brand investment and innovation pipeline

- Pricing discipline and competitive positioning

- Ability to balance mass and premium segments

Premiumisation can support value growth, but outcomes depend on execution and consumer acceptance.

Conclusion

Premiumisation reflects a gradual but meaningful shift in how Indian consumers engage with personal care products. As awareness, aspirations, and purchasing power evolve, this trend is reshaping product portfolios and growth strategies across the sector.

For investors seeking to understand the impact of premiumisation on personal care stocks, the key lies in recognising premiumisation as a structural demand driver—one that influences revenue mix, margins, and brand strength over time. When analysed thoughtfully, it provides useful context for evaluating the long-term prospects of personal care companies within India’s evolving consumer economy.

Related Blogs:

How Global Partnerships and MNCs Influence Cosmetic Stocks in India

The Role of Consumer Trends in Shaping Cosmetic Stocks in India

How India’s Growing Beauty and Personal Care Market Impacts Cosmetic Stocks

Best Cosmetic Stocks in India

Top 5 Cosmetic Stocks in India

Beverage Stocks vs. FMCG Stocks: Which is a Better Investment?

Emerging Markets & FMCG Stocks: A Growth Story for Your Portfolio

Top 5 Beverage Stocks in India

Best Beverage Stocks in India

Top 5 Tea and Coffee Stocks in India

Best Liquor Stocks in India

Top 5 FMCG Stocks in India

Best FMCG Stocks to Buy in India

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

What does premiumisation mean in the personal care sector?

Premiumisation refers to consumers shifting from basic personal care products to higher-value offerings that focus on quality, ingredients, efficacy, or brand experience.

Why are premiumisation trends important for Indian personal care stocks?

Premiumisation trends influence revenue mix, pricing, and margins, making them a key factor when evaluating the long-term growth potential of personal care companies.

How does premiumisation affect FMCG growth in India?

Premiumisation supports value-led growth in FMCG by increasing average selling prices, even when volume growth moderates.

Are premium personal care products limited to urban consumers?

While adoption is higher in urban areas, premium personal care products are gradually expanding into semi-urban and online markets as awareness and access improve.

What risks should investors consider when analysing premiumisation?

Investors should consider affordability sensitivity, competitive intensity, marketing costs, and the ability of companies to sustain brand differentiation.