Price Volume Breakout: A Proven Setup for Swing Traders

Price Volume Breakout: A Proven Setup for Swing Traders

In the Indian stock market, price and volume are two of the most important data points you can study. While price tells you where the market is moving, volume reveals the strength and conviction behind that move. When these two align in the right way, you get a price-volume breakout — a high-probability trade setup that swing traders swear by.

Thank you for reading this post, don't forget to subscribe!Whether you are a beginner learning how to analyse stocks in India or an experienced trader looking for consistent setups, the price-volume breakout strategy is worth mastering.

What is a Price Volume Breakout?

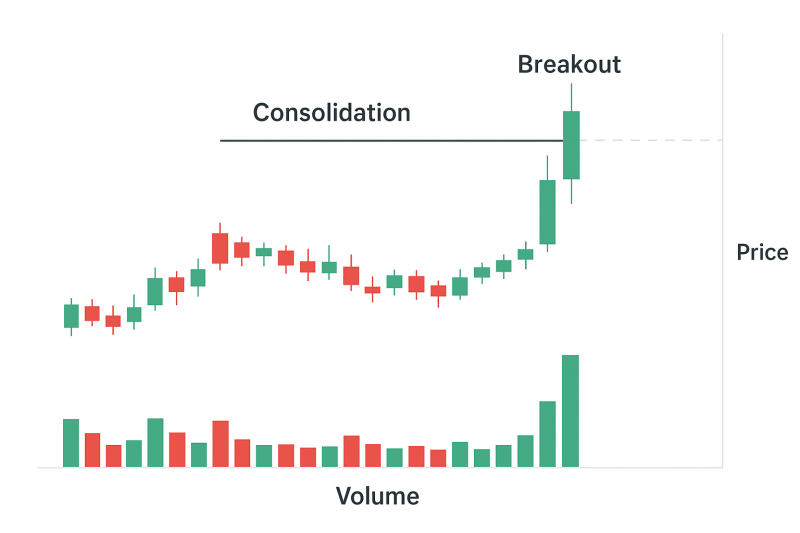

A price breakout happens when the stock price moves above a key resistance level (or below a support level in case of a breakdown).

A volume breakout occurs when trading volume spikes significantly above its average levels.

When both happen together, it signals strong buying or selling pressure — often from institutional investors who have done deep fundamental analysis of stocks before committing big money.

Why Price + Volume Matters for Swing Traders

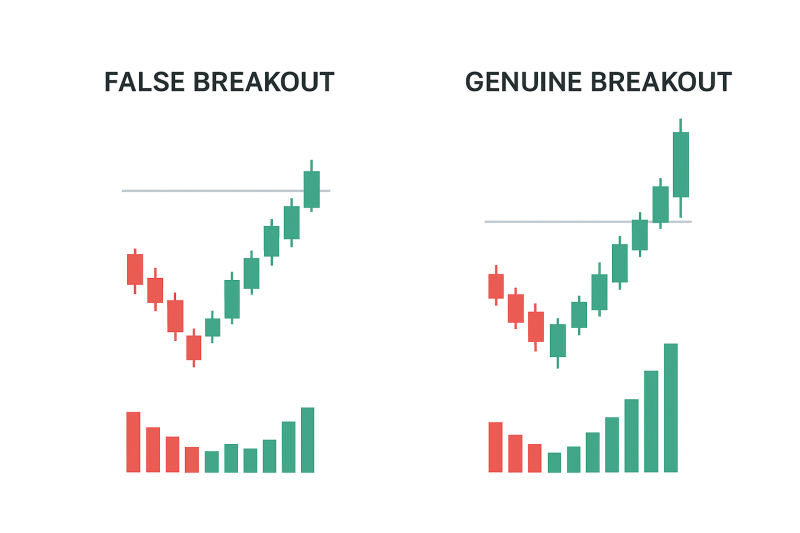

- Price alone can mislead: Sometimes prices jump on low volume, but those moves rarely sustain.

- Volume confirms conviction: High volume means more market participants agree with the move.

- Institutional footprints: Bulk buying from FIIs or DIIs is usually visible in big volume spikes.

The Price Volume Breakout Setup

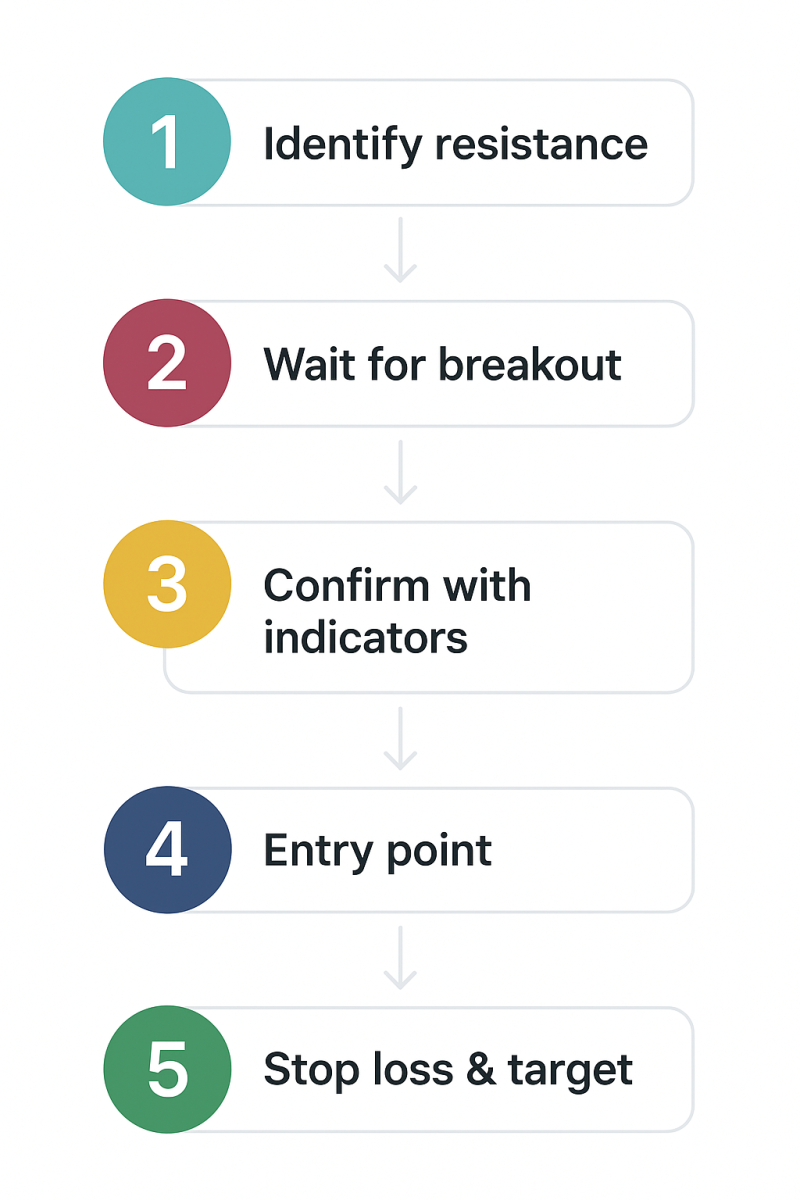

Here’s a simple technical analysis of stocks framework you can use:

- Identify Resistance Levels

- Look for a price level where the stock has struggled to move past multiple times.

- Wait for Breakout with Volume Spike

- Volume should be at least 1.5x to 2x the average of the past 20 days.

- Confirm with Technical Indicators

- Use moving averages (20 EMA & 50 EMA) to ensure the stock is in an uptrend.

- RSI above 60 indicates bullish momentum.

- Entry Point

- Enter when the price closes above the breakout level with strong volume.

- Stop Loss & Target

- Place stop-loss just below the breakout level.

- Set target based on recent swing highs or 1:2 risk-reward ratio.

Example: Hypothetical Price Volume Breakout in an Indian Stock

Imagine Infosys consolidating between ₹1,450 and ₹1,500 for several weeks.

Suddenly, it closes at ₹1,520 with double the average volume.

This is a classic price-volume breakout signal for swing traders to consider.

Combining with Fundamental Analysis for Long-Term Investing

While this setup works well for swing trading, combining it with how to do fundamental analysis makes it even more powerful.

For example:

- Check if the company has strong ROE, ROCE, and low debt.

- Study earnings growth and industry outlook.

- Make sure the stock fits your criteria for best stocks for long term investment in India.

⚠️ Common Mistakes to Avoid

- Chasing False Breakouts: Always wait for closing confirmation with volume.

- Ignoring Market Sentiment: News events can cause temporary spikes.

- Over-leveraging: Keep position sizes in check, especially in volatile markets.

Final Takeaway

The price-volume breakout is one of the most reliable swing trading setups for Indian markets. When combined with technical analysis of stocks and a pinch of fundamental analysis, it can help traders capture powerful short- to medium-term moves — and sometimes even identify potential multi-bagger stocks early.

Related Blogs:

Stock Market Investment: Top 4 Equity Investment Tips for “Beginners”

What Is Fundamental Analysis? A Beginner’s Guide with Indian Context

How to Read a Company’s Balance Sheet: Step-by-Step with Indian Examples

Profit & Loss Statement: What Matters for Retail Investors in India

Cash Flow Statement: Why It’s More Important Than Net Profit

How to Analyze Management Quality Using Publicly Available Data

Key Financial Ratios Explained Simply (ROE, ROCE, D/E & More)

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.