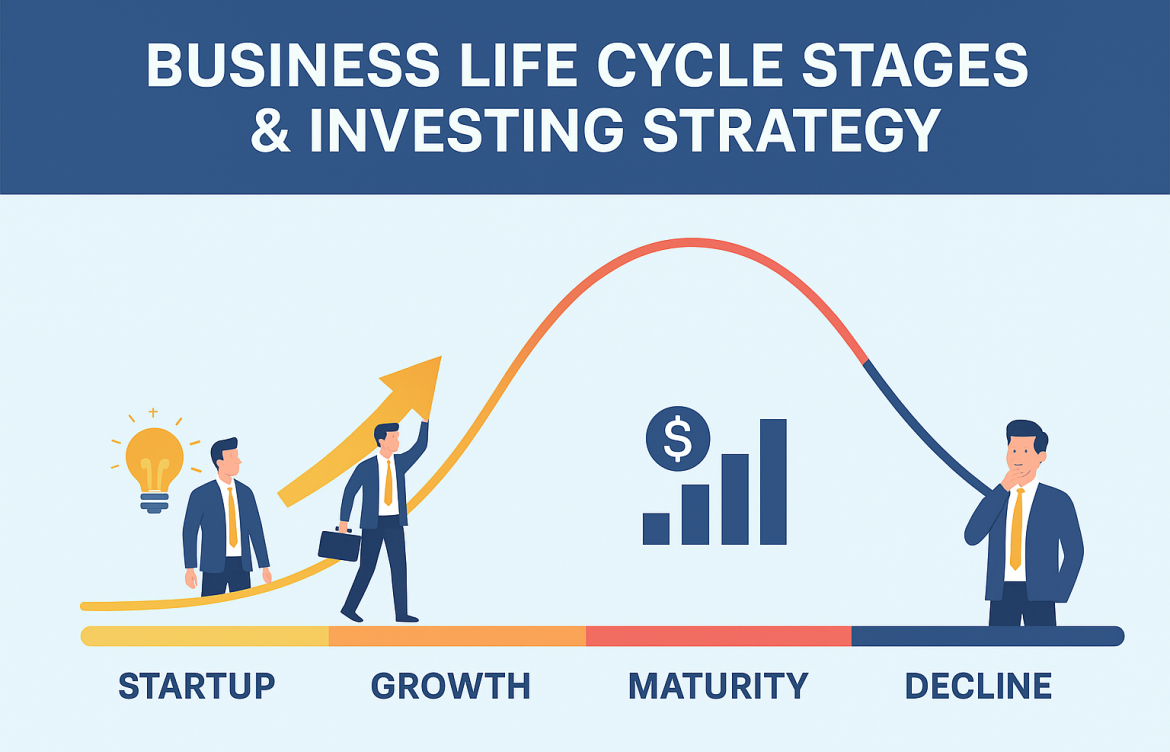

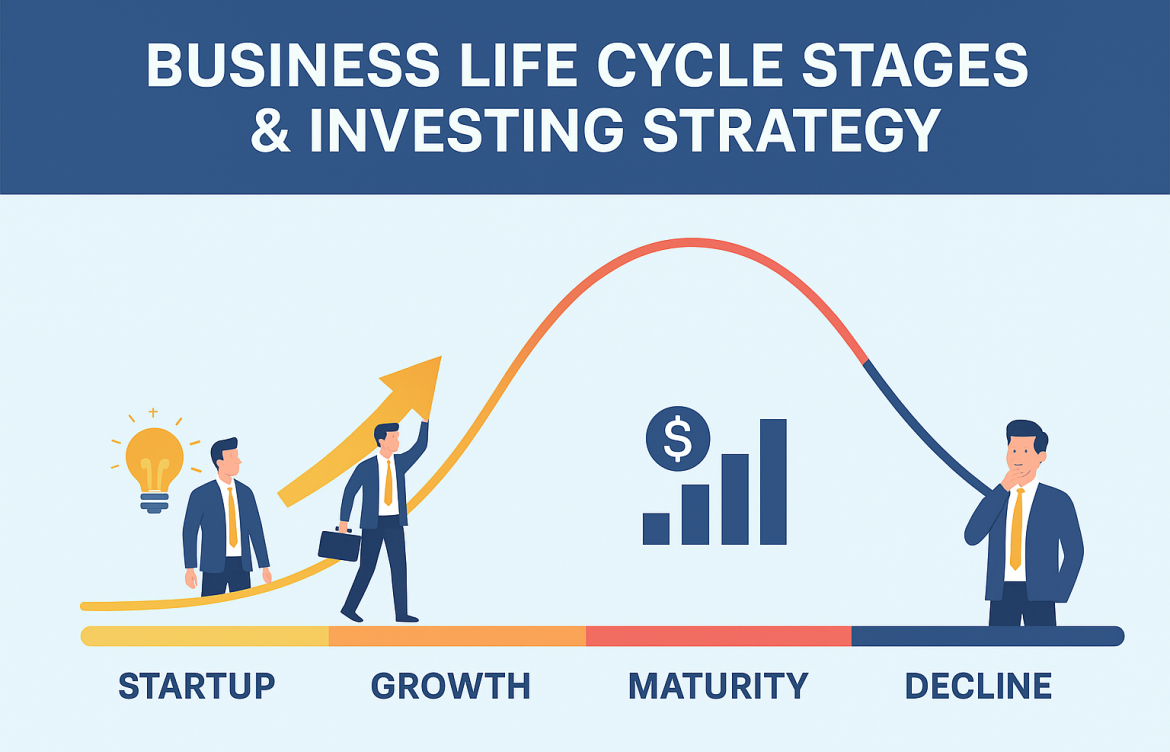

Business Life Cycle Stages & Investing Strategy

Business Life Cycle Stages & Investing Strategy When analyzing companies for investment, many beginners focus only on financial ratios or stock price movements. But there’s a

Business Life Cycle Stages & Investing Strategy When analyzing companies for investment, many beginners focus only on financial ratios or stock price movements. But there’s a

Impact of Forex Exposure on Company Earnings: What Investors Need to Know When analysing a company’s financial performance, most retail investors focus on revenue growth, profita

ROE vs ROCE: Which Metric Matters More for Investors? When evaluating a company for investment, one of the first questions investors ask is simple: How efficiently is this business

How to Read Shareholding Patterns: A Complete Guide for Retail Investors When you invest in a company, you aren’t just buying a stock — you’re buying a small ownership stake.

Insider Buying vs Selling: What It Means for Investors When it comes to understanding a company’s future prospects, investors often look beyond financial statements and quarterly

How to Analyze Sector Trends Before Investing: A Practical Guide for Retail Investors When it comes to building long-term wealth in the stock market, choosing which sector to inves

Understanding Leverage in Companies When analyzing a company for investment, one of the most critical—yet often overlooked—areas is leverage. Leverage simply refers to how much

How Mergers & Acquisitions Affect Stock Prices: A Complete Investor Guide Mergers and acquisitions (M&A) are among the most influential corporate events that can move stock

How to Spot Signs of Corporate Debt Stress In the world of investing, debt can be both a tool for growth and a trap for destruction. While prudent borrowing helps companies expand

Key Economic Indicators Every Investor Should Track Introduction Investing is not just about picking the right stocks or mutual funds—it’s about understanding the bigger pictur