Why NAV-Based Pricing Gives Transparency in Open-Ended Funds

Why NAV-Based Pricing Gives Transparency in Open-Ended Funds For most retail investors in India, mutual funds are often the first step into market-linked investing. Yet, despite th

Why NAV-Based Pricing Gives Transparency in Open-Ended Funds For most retail investors in India, mutual funds are often the first step into market-linked investing. Yet, despite th

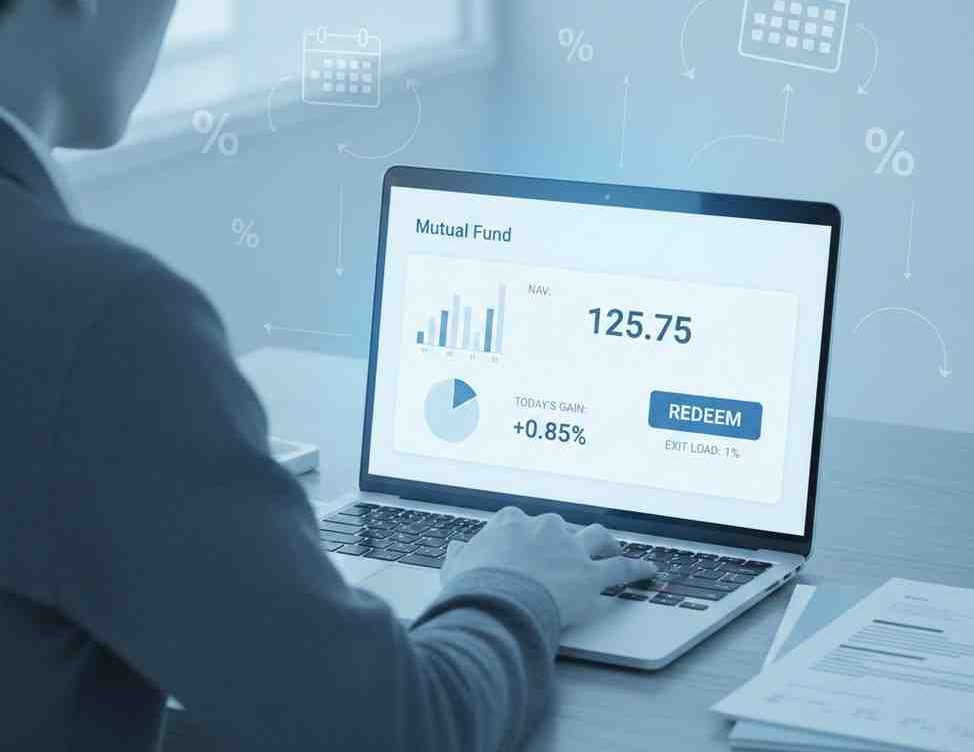

How Redemptions Work in Open-Ended Mutual Funds: Timelines and Exit Load Structure Open-ended mutual funds are often chosen for their flexibility. Investors can enter or exit these

Open-Ended Mutual Funds vs ETFs: Understanding the Key Differences For many Indian investors, choosing the right investment vehicle often comes down to a familiar comparison: open-

Risk Factors in Open-Ended Mutual Funds and How to Manage Them Open-ended mutual funds are often seen as a flexible and accessible investment option, especially for Indian investor

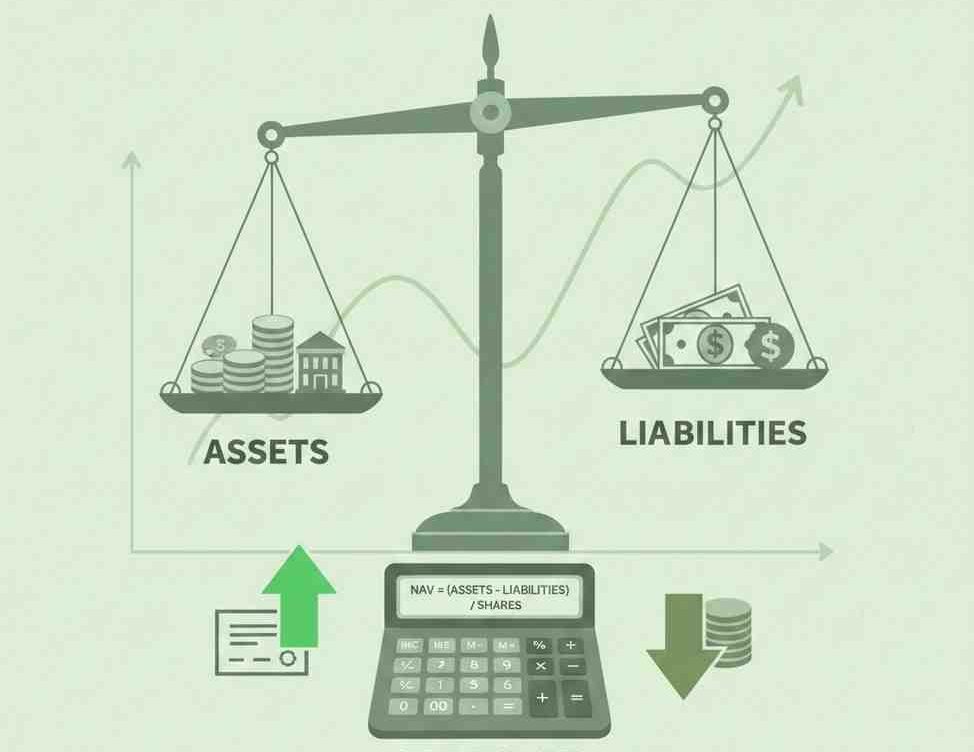

How NAV Works in Open-Ended Funds: Pricing, Valuation, and Market Impact When investors look up a mutual fund scheme, one of the first figures they notice is the Net Asset Value, c

Debt vs Equity Open-Ended Funds: How to Select Based on Risk Profile When investors begin exploring mutual funds, one of the most common questions they face is whether to invest in

Momentum Funds for Beginners: Factors to Consider Before You Start Momentum-based investing has gained attention among Indian investors who are looking to participate in market tre

Growth Option vs IDCW – Which One to Choose While Investing in Mutual Funds? When investing in mutual funds, one of the first choices investors come across is selecting between t

What Are Open Ended Mutual Funds? When individuals start exploring investment opportunities in the mutual fund market, one of the first terms they come across is open ended mutual

Portfolio Allocation Strategies for Long-Term Growth Building wealth in the stock market isn’t just about picking the right stocks — it’s about allocating your investments wi