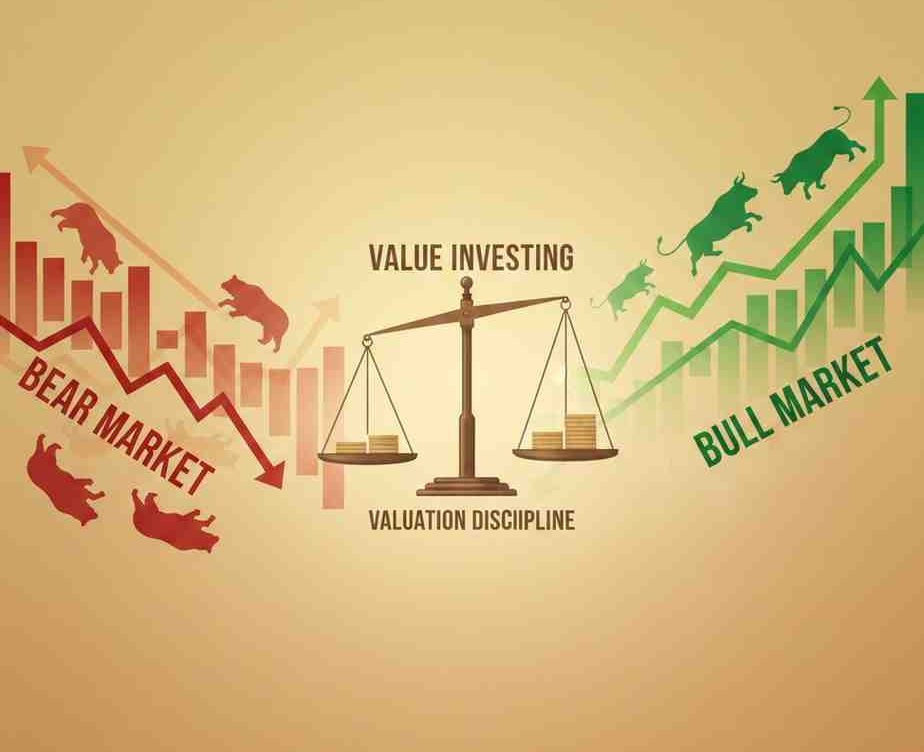

Is Value Investing More Effective in Bear Markets Than Bull Markets?

Is Value Investing More Effective in Bear Markets Than Bull Markets? Market cycles shape investor behaviour. When markets fall sharply, conversations often turn toward safety, marg

Is Value Investing More Effective in Bear Markets Than Bull Markets? Market cycles shape investor behaviour. When markets fall sharply, conversations often turn toward safety, marg

Value Investing Strategies During Recessions and Market Slowdowns Economic slowdowns and recessions often test investor confidence. Falling stock prices, uncertain earnings outlook

Value Investing in Mid-Cap and Small-Cap Stocks: Risks and Considerations Value investing has long appealed to investors who prefer buying fundamentally strong businesses at reason

Combining Value and Quality Factors in Equity Investing Equity investing is rarely about choosing one rigid style and sticking to it forever. Over time, many investors realise that

Value vs Growth: Investing in India’s Sugar and Ethanol Sector India’s sugar and ethanol sector has gradually evolved from a largely cyclical commodity space into a more divers

What Drives Value Investing in Different Economic Cycles Value investing has long been one of the most respected approaches in the stock market. Rooted in patience, discipline, and

What is Free Cash Flow & Why Investors Track It? When evaluating companies, most new investors tend to focus on metrics like revenue, net profit, and sometimes earnings per sha

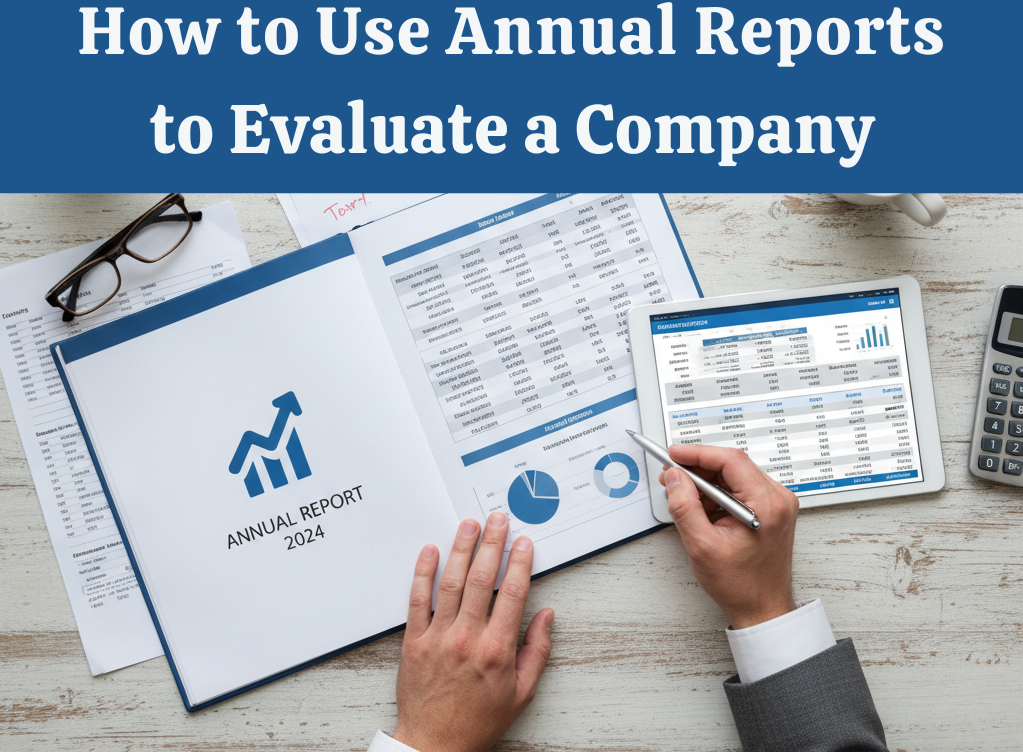

How to Use Annual Reports to Evaluate a Company When you invest in a company, you are essentially buying a share of its future. To make smart investment decisions, you need to unde

What Makes a Business Moat? Understanding Competitive Advantage When you study the world’s most successful companies — whether it’s Apple, HDFC Bank, Asian Paints, Titan, or

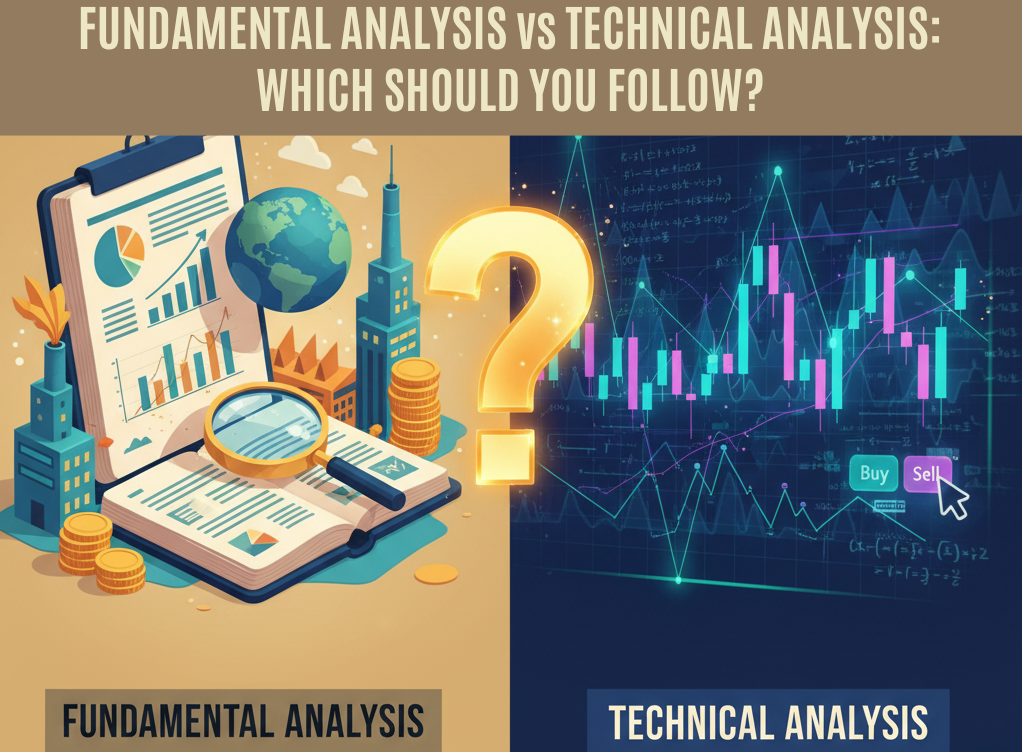

Fundamental Analysis vs Technical Analysis: Which Should You Follow? Investing in the stock market can feel overwhelming, especially when you encounter different methods of analyzi