Top FMCG Stocks Benefiting from Festive Season Demand in India (2025)

Top FMCG Stocks Benefiting from Festive Season Demand in India (2025)

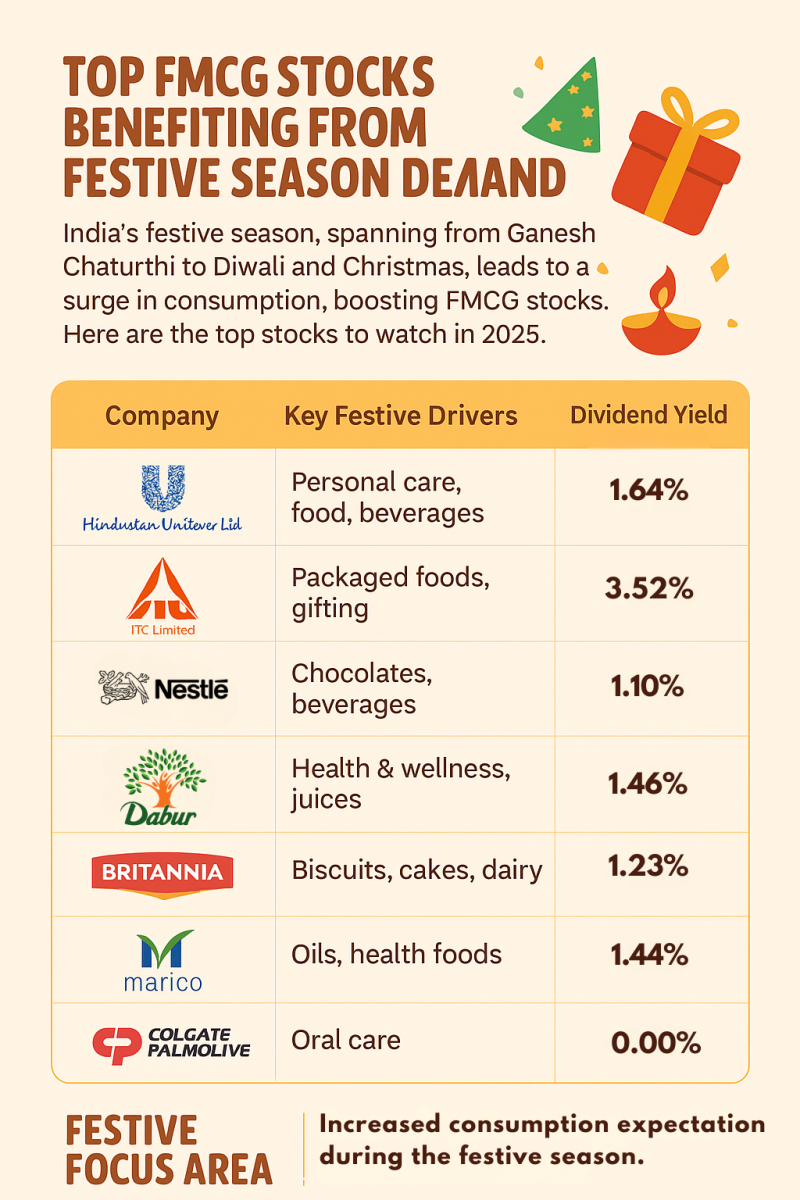

The festive season in India—spanning from Ganesh Chaturthi to Diwali and Christmas—is not just a time of celebration; it’s also a period of massive consumer spending. Families across the country spend on food, beverages, personal care, home essentials, and gifts, all of which fuel growth in the FMCG (Fast-Moving Consumer Goods) sector.

Thank you for reading this post, don't forget to subscribe!For investors, this makes FMCG stocks particularly attractive during the festive months. Let’s explore why these stocks gain momentum and which top FMCG companies could benefit the most in 2025.

Why FMCG Stocks Shine During Festive Season

-

Higher Consumer Spending: Demand for packaged food, snacks, beverages, and personal care products spikes.

-

Premium Product Sales: Companies push premium variants and festive gift packs, improving margins.

-

Rural Demand Surge: Rural spending often picks up due to higher agricultural income and government subsidies.

-

Marketing & Promotions: Aggressive campaigns and festive discounts lead to higher brand visibility and sales.

-

Stable Cash Flows: FMCG companies typically have consistent demand, which becomes even stronger during festivals.

Top FMCG Stocks to Watch in 2025

1. Hindustan Unilever Ltd (HUL)

-

Why it benefits: With a strong presence in home care, beauty, and food segments, HUL sees a significant uptick in sales during festivals. Brands like Surf Excel, Lux, Dove, Brooke Bond, and Kwality Wall’s are household favorites.

-

Festive Edge: Premium personal care products and packaged foods gain traction.

-

Dividend Yield (2025): ~1.64%

2. ITC Limited

-

Why it benefits: ITC dominates the packaged foods, snacks, and FMCG gifting category with brands like Aashirvaad, Sunfeast, Bingo!, and Fabelle Chocolates.

-

Festive Edge: Its gifting portfolio (luxury chocolates, atta packs, premium foods) drives strong seasonal sales.

-

Dividend Yield (2025): ~3.52% (among the best in FMCG sector)

3. Nestlé India

-

Why it benefits: With a strong brand lineup including Maggi, KitKat, Nescafé, and Milkmaid, Nestlé is a consistent festive performer.

-

Festive Edge: Chocolates and instant beverages see a spike in demand as gifting and convenience food consumption increases.

-

Dividend Yield (2025): ~1.1%

4. Dabur India

-

Why it benefits: Dabur has a strong foothold in ayurvedic products, health supplements, and personal care. Brands like Chyawanprash, Dabur Honey, Vatika, and Real Juices are household staples.

-

Festive Edge: Surge in demand for juices, health supplements, and grooming products.

-

Dividend Yield (2025): ~1.46%

5. Britannia Industries

-

Why it benefits: Known for biscuits, dairy, and bakery products, Britannia sees a huge boost in consumption and gifting demand during festive times.

-

Festive Edge: Its cakes, biscuits, and packaged dairy products are heavily consumed at gatherings and celebrations.

-

Dividend Yield (2025): ~1.23%

6. Marico Ltd

-

Why it benefits: With brands like Parachute, Saffola, and Livon, Marico is well-positioned in personal care and health foods.

-

Festive Edge: Higher demand for edible oils and personal grooming products.

-

Dividend Yield (2025): ~1.44%

7. Colgate-Palmolive India

-

Why it benefits: Oral care demand remains steady year-round, but festive shopping baskets often include Colgate premium products.

-

Festive Edge: Promotional packs and discounts push volumes during festive sales.

-

Dividend Yield (2025): ~0.0%

FMCG Sector Performance During Festive Season

Final Thoughts

FMCG stocks in India are often considered defensive bets because of their steady cash flows and essential product categories. During the festive season, they become even more attractive as consumer demand skyrockets.

For investors, focusing on companies with diverse product portfolios, strong rural penetration, and premium offerings can unlock strong short-term gains as well as long-term stability.

📌 In 2025, stocks like ITC, HUL, Nestlé, and Britannia are expected to be the biggest festive winners.