Understanding Buyback Programs and Their Impact on Share Prices

Understanding Buyback Programs and Their Impact on Share Prices

Stock buybacks—also known as share repurchase programs—often make headlines and trigger immediate reactions in share prices. When a company announces a buyback, investors usually interpret it as a positive signal, but the real impact of buybacks is more nuanced. For retail and emerging investors, understanding why companies buy back shares and how these programs influence stock prices is essential to making informed investment decisions.

Thank you for reading this post, don't forget to subscribe!This blog explains what buybacks are, why companies use them, how they affect share prices, and what investors should watch out for before cheering a buyback announcement.

What Is a Share Buyback?

A share buyback occurs when a company repurchases its own shares from the open market or through a tender offer. These shares are usually extinguished or held as treasury stock, reducing the total number of shares outstanding.

In simple terms:

Buybacks shrink the share count, increasing each remaining shareholder’s ownership stake in the company.

Companies typically fund buybacks using:

-

Excess cash reserves

-

Free cash flows

-

Proceeds from asset sales

-

Occasionally, debt

Buybacks have become an increasingly popular way for companies to return capital to shareholders, alongside dividends.

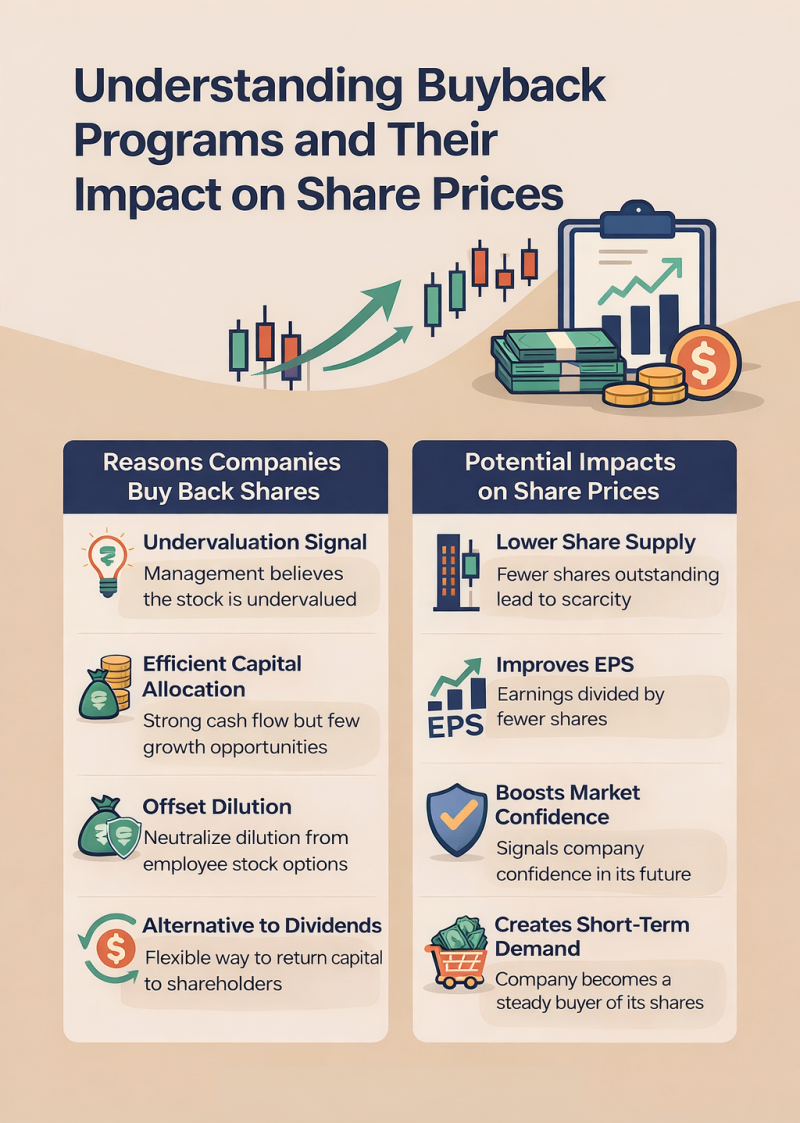

Why Do Companies Announce Buyback Programs?

Not all buybacks are created equal. The intent behind the buyback matters more than the announcement itself.

1. Signal of Undervaluation

Management may believe the company’s shares are trading below intrinsic value. By buying back stock, the company signals confidence in its future prospects.

This often leads to:

-

Improved investor sentiment

-

Short-term price appreciation

-

Increased credibility of management guidance

However, investors should verify whether the valuation truly supports this claim.

2. Efficient Capital Allocation

When companies generate strong cash flows but lack attractive reinvestment opportunities, returning capital via buybacks can be a rational decision.

This is common in:

-

Mature businesses

-

Stable industries

-

Companies with limited expansion opportunities

In such cases, buybacks can enhance shareholder value by avoiding inefficient capital deployment.

3. Improving Financial Ratios

Reducing the number of outstanding shares boosts per-share metrics such as:

-

Book Value per Share

Even if total profits remain unchanged, EPS rises simply due to fewer shares—a key reason buybacks often support stock prices.

4. Offset Dilution from ESOPs

Companies issuing employee stock options may use buybacks to neutralize dilution. This ensures that existing shareholders are not disadvantaged by an expanding share base.

In such cases, buybacks are more defensive than value-enhancing.

5. Alternative to Dividends

Buybacks offer flexibility:

-

No obligation to repeat them annually

-

Tax-efficient in some jurisdictions

-

Adjustable based on market conditions

This makes buybacks attractive compared to regular dividend commitments.

How Buybacks Impact Share Prices

The impact of a buyback on share prices depends on several factors—timing, scale, funding, and market perception.

1. Immediate Demand Boost

When a company buys its own shares from the market, it becomes a steady buyer, increasing demand. This often provides short-term price support, especially in low-volatility or range-bound markets.

2. Reduction in Share Supply

Fewer shares outstanding means:

-

Each share represents a larger claim on earnings

-

Scarcity value improves

-

Per-share metrics rise

This structural effect can support higher valuations over time.

3. Sentiment and Signaling Effect

Buybacks are often interpreted as a vote of confidence by management. This signaling effect can:

-

Attract long-term investors

-

Reduce downside risk

-

Improve market perception

However, sentiment-driven gains may fade if fundamentals don’t improve.

4. EPS Growth Without Earnings Growth

While buybacks mechanically boost EPS, investors should ask:

Is EPS growth coming from better business performance or just fewer shares?

Markets eventually reward real earnings growth more than financial engineering.

Buybacks vs Dividends: Which Is Better?

Both methods return capital, but they serve different purposes.

| Buybacks | Dividends |

|---|---|

| Flexible | Recurring obligation |

| Improves EPS | Direct cash income |

| Signals undervaluation | Signals cash-flow stability |

| May support valuation | Appeals to income investors |

From an investor’s perspective, the best companies often balance both—returning capital while retaining enough cash for growth.

When Buybacks Create Value

Buybacks genuinely add value when:

1. Shares Are Undervalued

Buying cheap shares benefits remaining shareholders.

2. Company Has Strong Free Cash Flow

Buybacks funded from surplus cash—not debt—are healthier.

3. Core Business Is Stable

Predictable earnings support sustainable capital returns.

4. Capital Allocation Discipline Exists

Management prioritizes long-term value over short-term optics.

When Buybacks Destroy Value

Buybacks can harm shareholders when:

1. Shares Are Overvalued

Buying back expensive stock destroys value.

2. Funded Through Excessive Debt

Rising leverage increases financial risk.

3. Used to Mask Weak Growth

Artificial EPS growth without improving fundamentals misleads investors.

4. Timed Poorly

Many companies buy aggressively near market peaks and stop during downturns—the opposite of what benefits shareholders.

How Investors Should Analyze Buyback Announcements

Before reacting to a buyback announcement, retail investors should evaluate:

1. Buyback Size

Is it meaningful relative to:

-

Market capitalisation

-

Free cash flow

-

Cash reserves

Small buybacks often have limited long-term impact.

2. Funding Source

Prefer buybacks funded through:

-

Internal accruals

-

Excess cash

Be cautious if debt increases significantly.

3. Valuation at Buyback Price

Compare buyback price with:

-

Historical valuations

-

Intrinsic value estimates

A buyback at high multiples is a red flag.

4. Consistency

Companies with disciplined, long-term buyback programs tend to create more value than one-off announcements.

5. Management Track Record

Past capital allocation decisions offer clues about future behavior.

Buybacks and Long-Term Investors

For long-term investors, buybacks matter less as short-term price catalysts and more as capital allocation signals.

Well-executed buybacks can:

-

Improve return on equity

-

Enhance long-term compounding

-

Reduce dilution

-

Signal financial strength

Poorly executed buybacks, however, often indicate:

-

Lack of growth opportunities

-

Short-term earnings management

-

Weak strategic vision

Indian Market Perspective

In India, buybacks are regulated and typically occur through:

-

Tender offers

-

Open market purchases

Tender offers often include a premium, benefiting shareholders who participate, while open market buybacks support prices over time.

Retail investors should understand the structure before reacting.

Final Thoughts

Buyback programs can be powerful tools for enhancing shareholder value—but only when executed with discipline, transparency, and long-term intent. While buyback announcements often lift share prices in the short run, sustainable gains depend on business fundamentals, valuation discipline, and capital allocation quality.

For retail and emerging investors, the key is not to ask:

“Is the company buying back shares?”

But rather:

“Is this buyback truly good for shareholders?”

When you learn to answer that question, buybacks become not just news events—but valuable investment insights.

Related Blogs:

How Market Liquidity Influences Stock Price Movements

Understanding Promoter Holding: Why It Matters

How to Evaluate Management Quality: A Key Pillar of Smart Investing

How to Use Annual Reports to Evaluate a Company

What is Free Cash Flow & Why Investors Track It?

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.