Understanding Institutional Buying: How to Track Bulk & Block Deals in the Indian Stock Market

Understanding Institutional Buying: How to Track Bulk & Block Deals in the Indian Stock Market

When you hear that “smart money” is moving into a stock, it often means institutional investors are taking positions. In the Indian markets, this “smart money” usually comes from Foreign Institutional Investors (FIIs), Domestic Institutional Investors (DIIs), mutual funds, insurance companies, and even big individual investors.

Thank you for reading this post, don't forget to subscribe!One of the most transparent ways to spot this activity is by keeping an eye on bulk deals and block deals — both of which are disclosed daily on the NSE and BSE websites. For investors who are learning how to analyse stocks in India, or anyone looking for stock analysis for beginners, this can be an important tool in your research kit.

What Are Bulk Deals and Block Deals?

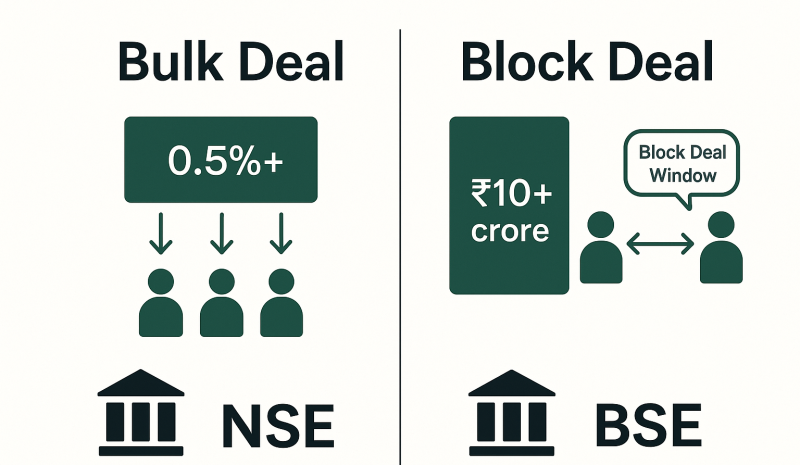

Bulk Deal

A bulk deal happens when the quantity bought or sold is more than 0.5% of the total equity shares of a listed company in a single trading day. These transactions are reported to the exchange and made public before the market closes.

- Example: If a company has 10 crore shares outstanding, a bulk deal would mean buying or selling more than 5 lakh shares in one day.

Block Deal

A block deal is even bigger — it’s a single transaction of shares worth ₹10 crore or more between two parties. These trades happen through a special trading window that operates only for a short time during the trading session (usually the first 15 minutes after the market opens).

- Example: A mutual fund buying ₹50 crore worth of shares directly from another investor via the block deal window.

Why Should Investors Track Institutional Buying?

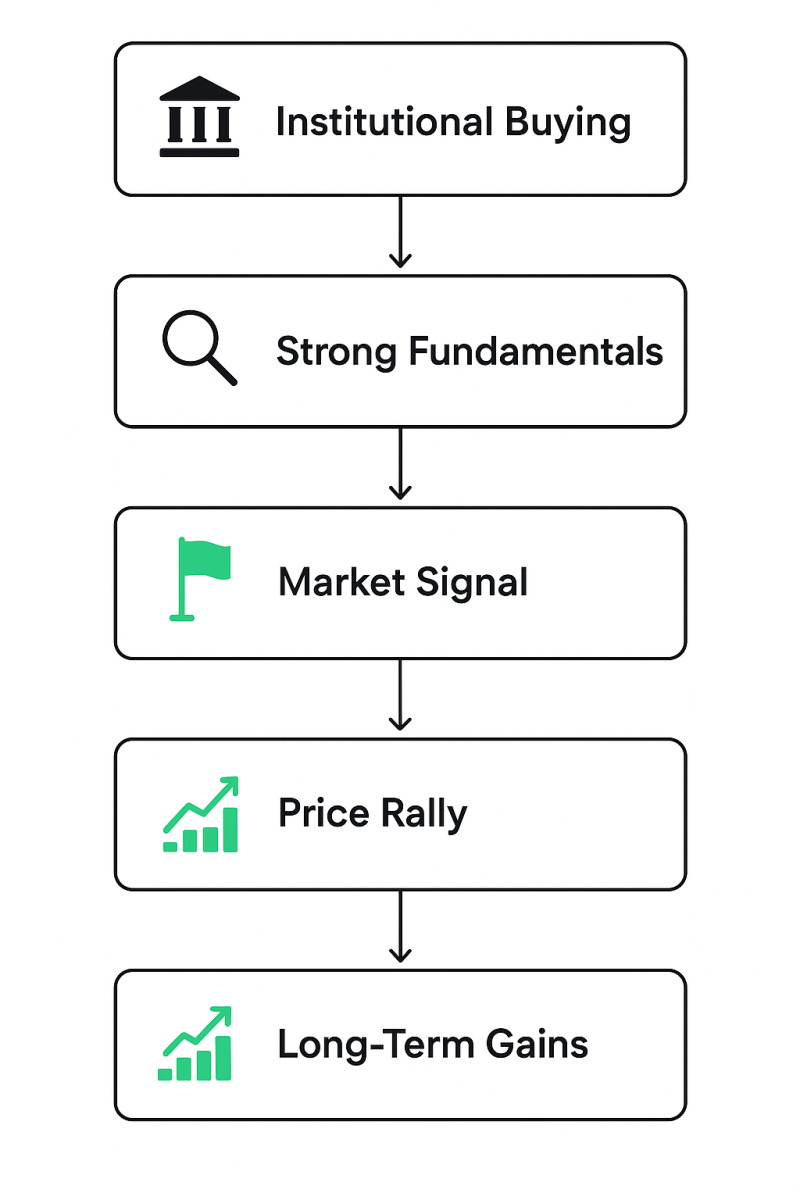

Big institutions rarely make random trades. They have research teams doing deep fundamental analysis of stocks, studying the company’s financials, industry trends, and long-term growth potential before committing large sums of money.

Here’s why tracking them matters:

- Strong Conviction in Fundamentals

If a reputed FII or DII is buying, it often means the stock passes their strict screening process. - Market Signaling Effect

Other investors tend to follow institutional buying, which can push the price higher. - Early Entry Opportunities

Spotting accumulation early gives you the chance to enter before a major rally. - Best Stocks for Long Term Investment in India

Many bulk/block deals are in fundamentally strong companies that institutions intend to hold for years.

How to Track Bulk & Block Deals in India

- Check Official Exchange Disclosures

- NSE: https://www.nseindia.com → Go to “Market Data” → “Bulk Deals” or “Block Deals” section.

- BSE: https://www.bseindia.com → Under “Markets” → “Bulk/Block Deals.”

- Look for Repeat Buying

If the same investor or institution buys in multiple sessions, it’s a strong sign of stock accumulation.

- Study the Buyer’s Profile

Well-known mutual funds, pension funds, or big-name FIIs are more reliable indicators than small unknown buyers.

- Compare with Price & Volume Action

Use technical analysis of stocks to see if the buying is leading to a breakout or strong support zone.

Combining Bulk/Block Deal Data with Analysis

- Technical Analysis

- Identify key support and resistance levels.

- Use moving averages and volume indicators to confirm momentum.

- Watch for price consolidations before a breakout.

- Fundamental Analysis

- Study earnings growth, ROE, ROCE, and debt-to-equity ratio.

- Compare the stock with industry peers.

- Check if the company fits the criteria for best stocks for long term investment in India.

- Stock Analysis for Beginners Tip

- Don’t just follow one deal blindly. Cross-check with the company’s quarterly results, management commentary, and sector outlook.

Common Mistakes to Avoid

- Assuming All Big Buys Are Bullish

Sometimes deals happen because of index rebalancing or internal transfers — not necessarily a bullish signal. - Ignoring the Time Frame

Institutions may buy for short-term reasons like arbitrage. That doesn’t make it a safe long-term pick. - Not Doing Your Own Research

Always combine bulk/block deal data with how to do fundamental analysis and technical analysis.

Final Takeaway

Tracking bulk and block deals is like getting a peek into the playbook of the biggest market players. It’s a powerful tool, but it works best when combined with fundamental analysis of stocks, technical analysis of stocks, and a solid understanding of how to analyse stocks in India.

If you can identify consistent institutional buying in fundamentally strong companies, you may spot some of the best stocks for long term investment in India — often before the crowd catches on.

Related Blogs:

Stock Market Investment: Top 4 Equity Investment Tips for “Beginners”

What Is Fundamental Analysis? A Beginner’s Guide with Indian Context

How to Read a Company’s Balance Sheet: Step-by-Step with Indian Examples

Profit & Loss Statement: What Matters for Retail Investors in India

Cash Flow Statement: Why It’s More Important Than Net Profit

How to Analyze Management Quality Using Publicly Available Data

Key Financial Ratios Explained Simply (ROE, ROCE, D/E & More)

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.