Using ATR (Average True Range) to Set Smart Stop-Losses

Using ATR (Average True Range) to Set Smart Stop-Losses

You’ve picked a solid trade. Everything aligns—trend, volume, price action.

But just one bad stop-loss placement, and you’re stopped out… before the actual move begins.

Sound familiar?

That’s where ATR (Average True Range) becomes a game-changer.

In this post, you’ll learn how to use ATR like a pro to place smarter stop-losses that:

- Adjust to volatility,

- Reduce premature exits, and

- Improve your risk-reward consistency.

What is ATR?

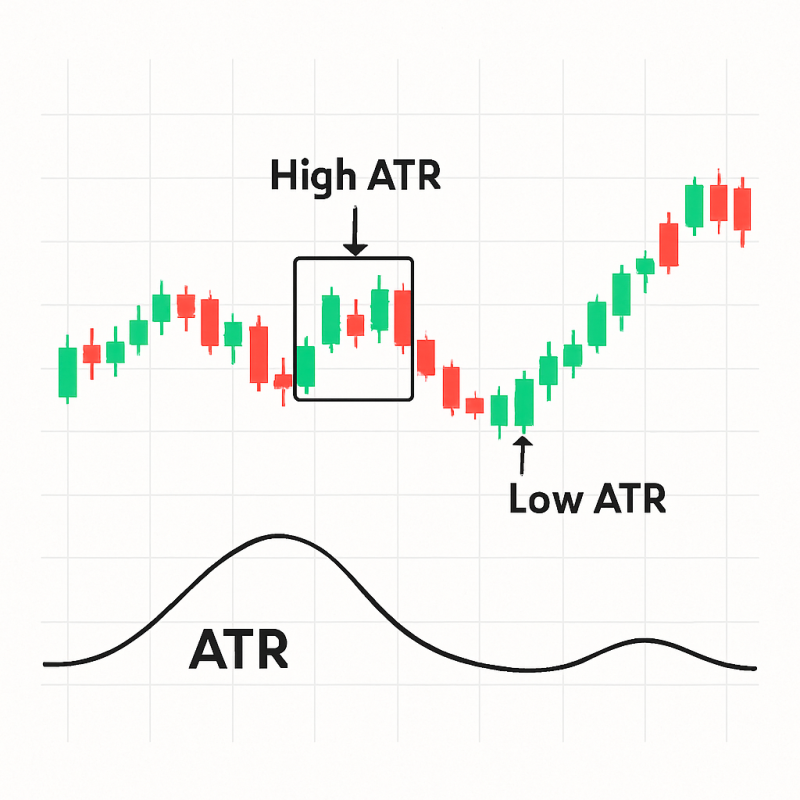

ATR is a volatility indicator developed by J. Welles Wilder.

It measures the average range (high to low) of a stock over a specific period.

📌 Formula:

ATR = (Previous ATR * (n – 1) + True Range) / n

🔎 In Simple Terms:

- A higher ATR means higher volatility (bigger moves per candle).

- A lower ATR means the stock is calm or consolidating.

Most traders use 14-period ATR on the daily timeframe.

Why Use ATR for Stop-Loss?

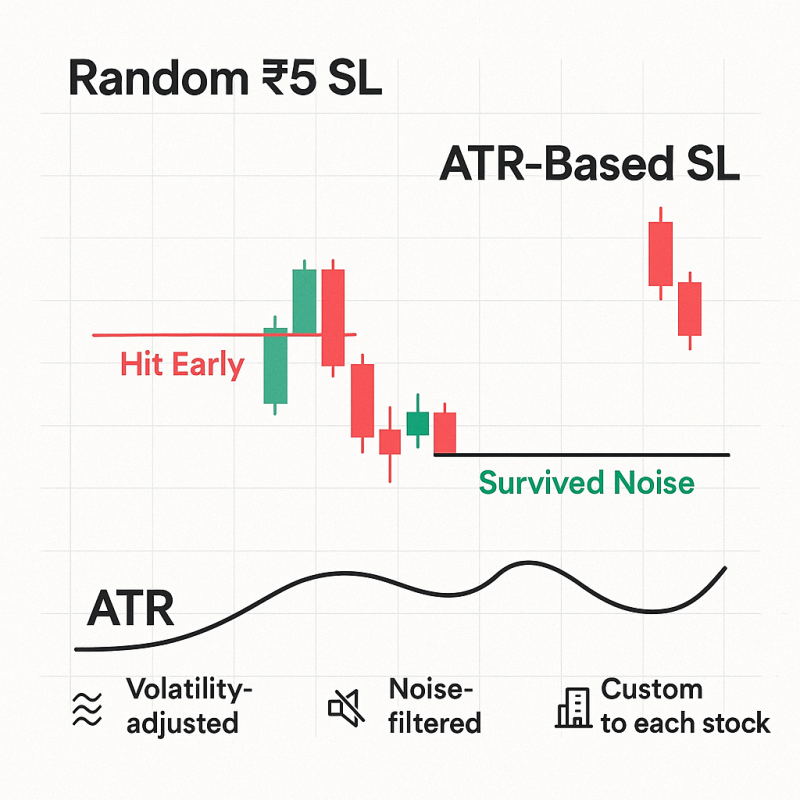

Placing stop-losses randomly (like “₹5 below entry”) often backfires.

Stocks don’t move in straight lines—they wiggle, consolidate, fake-out.

ATR helps by giving you a dynamic, volatility-based buffer.

✅ Benefits:

- Avoids getting stopped by market noise

- Adapts to each stock’s volatility (Infosys ≠ Zomato ≠ Adani)

- Gives you confidence in position sizing

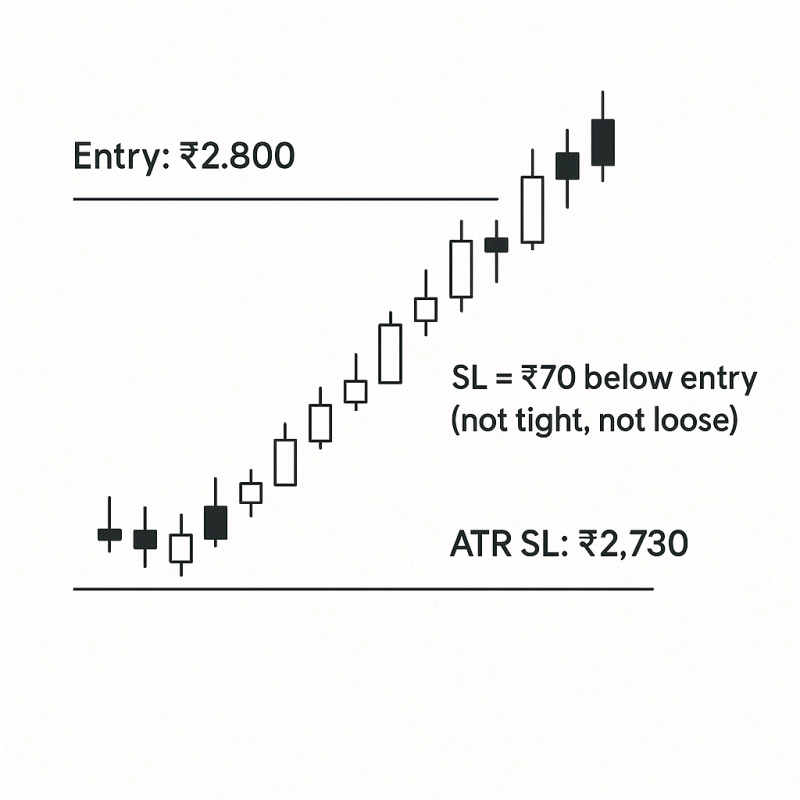

How to Set ATR-Based Stop-Loss

🧮 The Formula:

Stop-Loss = Entry Price ± (ATR x Multiplier)

- Use ATR x 1.5 or 2 as buffer

- “±” depends on trade direction:

- For longs, subtract

- For shorts, add

📌 Example:

Stock: Reliance Industries

Entry (Long): ₹2,800

ATR (14-day): ₹35

Multiplier: 2

Stop-Loss = 2800 – (35 × 2) = ₹2,730

➡️ So your SL is ₹70 away, not too tight, not too loose—just right for that stock’s range.

Position Sizing with ATR Stop

Once you’ve calculated your stop-loss using ATR, you can size your position like a pro.

🧮 Formula:

Position Size = Capital × Risk % ÷ (ATR × Multiplier)

Example:

- Capital: ₹1,00,000

- Risk per trade: 1% (₹1,000)

- ATR × 1.5 = ₹30

➡️ Position size = ₹1,000 ÷ ₹30 ≈ 33 shares

✅ Keeps your risk fixed, even if volatility fluctuates.

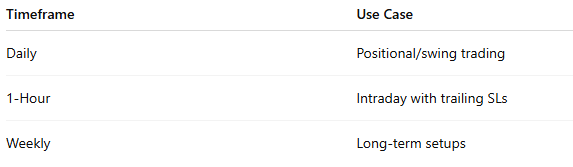

Which Timeframe to Use ATR On?

📌 For Nifty/Bank Nifty, use 15-min or hourly ATR for intraday scalps.

Pro Tips for ATR-Based Trading

- Avoid Low ATR Stocks:

Illiquid stocks may show low ATR—be cautious of false security. - Use Trailing ATR SLs:

As price moves in your favor, trail your SL using updated ATR.

(Ex: Parabolic SAR or ATR-based trailing indicators) - Pair with Structure:

ATR is not a standalone signal—combine it with support/resistance, price action. - Adjust Multiplier Based on Volatility:

- Trending market → use 1.5x

- Choppy market → use 2x+

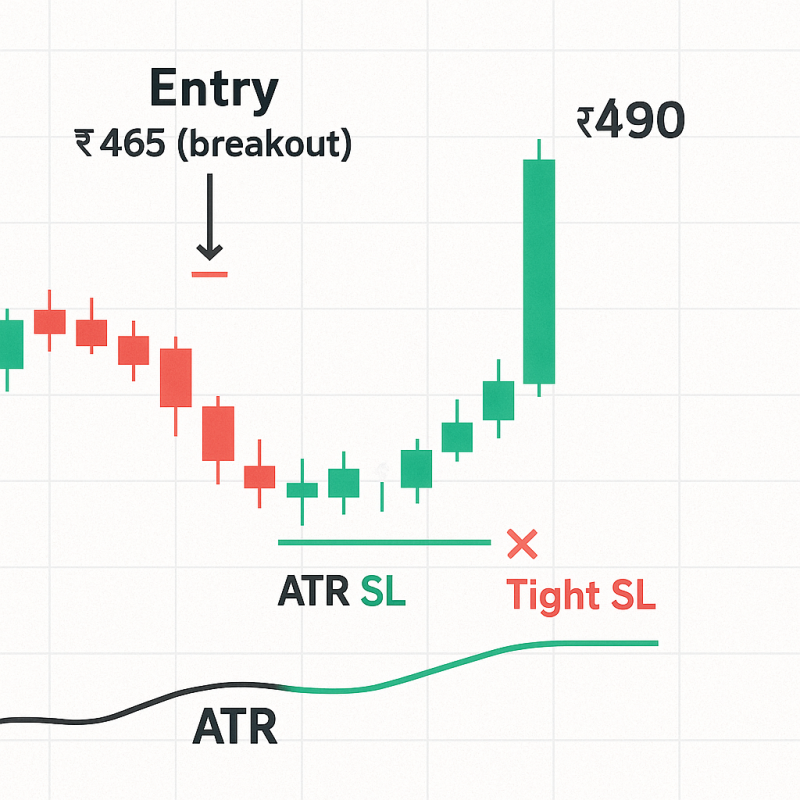

Real Chart Example (Wipro)

- ATR(14): ₹4

- Entry: ₹465 (Breakout of consolidation)

- ATR SL: ₹465 – ₹8 = ₹457

- Price hits ₹490 in 4 days without touching SL

A tight ₹2 SL would’ve triggered prematurely. ATR-based SL survived the noise.

When ATR Expands Suddenly

A sharp spike in ATR (like post-earnings or budget day) means:

- Volatility risk is high

- You need wider stops or skip trading altogether

ATR not only helps with SL—but also signals when not to trade.

Conclusion

ATR gives your stop-loss strategy a mathematical edge.

No more guessing. No more getting “wicked out.”

By using ATR:

- Your trades breathe better.

- Your losses are better managed.

- Your profits can run longer.

Related Blogs:

Stock Market Investment: Top 4 Equity Investment Tips for “Beginners”

What Is Fundamental Analysis? A Beginner’s Guide with Indian Context

How to Read a Company’s Balance Sheet: Step-by-Step with Indian Examples

Profit & Loss Statement: What Matters for Retail Investors in India

Cash Flow Statement: Why It’s More Important Than Net Profit

How to Analyze Management Quality Using Publicly Available Data

Key Financial Ratios Explained Simply (ROE, ROCE, D/E & More)

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.