What are Closed-Ended Mutual Funds?

What are Closed-Ended Mutual Funds?

For many investors in India, mutual funds are a practical route to building long-term wealth. But while most people are familiar with open-ended funds, closed-ended mutual funds often remain less understood. These funds come with a defined structure, a fixed tenure, and distinct operational features. Understanding the closed-ended mutual funds meaning, their functioning, and how they differ from open-ended schemes can help investors make better decisions based on their financial goals.

Thank you for reading this post, don't forget to subscribe!This article explores how these funds work, their features, potential advantages, and considerations to keep in mind before investing.

Understanding the Closed-Ended Mutual Funds Meaning

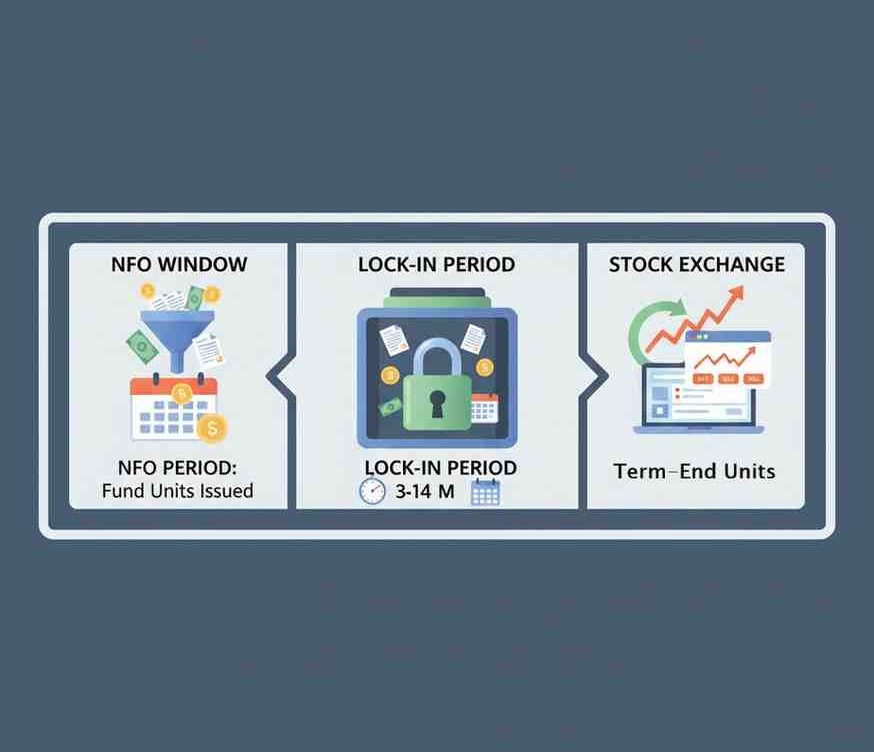

A closed-ended mutual fund is a type of investment scheme that comes with a predefined maturity period. Investors can subscribe to these funds only during the New Fund Offer (NFO) period. Once the NFO window closes, no fresh investments or redemptions can be made directly with the fund house until the maturity date.

This structure sets closed-ended funds apart from open-ended funds, which allow ongoing purchases and redemptions throughout the year.

In the Indian context, closed-ended funds are commonly structured for specific investment themes, targeted strategies, or tenure-based wealth creation. They often appear in categories such as Fixed Maturity Plans (FMPs), interval funds, or specialty strategies with a lock-in period.

How Closed-Ended Funds Work?

To understand how closed-ended funds work, it helps to break down their lifecycle into a few stages:

- New Fund Offer (NFO) Period

The fund is first launched through an NFO. Investors can purchase units at a fixed price, usually ₹10 per unit. This is the only time when investors can enter the scheme directly through the fund house.

- Allotment and Portfolio Building

Once the NFO closes, the fund manager begins deploying the collected corpus into the underlying securities based on the fund’s objective—equities, debt instruments, hybrid assets, or a mix of both.

- Listing on the Stock Exchange

After allotment, the units of a closed-ended fund are listed on Indian stock exchanges such as the National Stock Exchange of India and the BSE. Investors can buy or sell units on the exchange, similar to equity shares. However, liquidity varies depending on demand and supply.

- Fixed Maturity and Redemption

Investors cannot redeem units with the AMC before maturity. The investment is automatically redeemed at the end of the tenure—usually 3 to 5 years—when the fund liquidates its portfolio and distributes proceeds.

This defined structure guides investor expectations from the beginning, as the tenure and investment strategy remain stable throughout the lifecycle.

Closed-Ended Fund Investment Features

Closed-ended funds offer a distinctive approach to investing. Here are some of the commonly observed features associated with these schemes:

- Fixed Tenure

Every closed-ended scheme operates with a predetermined duration. This encourages disciplined investing and helps investors stay committed to a long-term strategy.

- Limited Entry Window

The NFO period acts as the exclusive entry point. Once closed, no further subscriptions are allowed. This differs from open-ended funds that accept investments anytime.

- Exchange-Traded Units

Units are tradable on exchanges, offering liquidity even though the fund itself does not permit redemptions before maturity. However, liquidity depends on market interest and may not always be sufficient.

- Stable Asset Base

Unlike open-ended funds, closed-ended funds do not face unpredictable inflows or outflows. This stable corpus allows fund managers to implement long-term strategies without concerns about sudden redemption pressure.

- NAV Movement Reflects Portfolio Strategy

The Net Asset Value (NAV) of the fund moves in line with the performance of underlying assets. But exchange prices of units may differ from NAV due to market demand and supply.

Difference Between Open-Ended and Closed-Ended Funds

When evaluating mutual fund options, understanding the difference between open-ended and closed-ended funds can guide investors toward structures that match their needs.

- Liquidity and Access

- Open-ended funds: Allow continuous buying and selling with the fund house.

- Closed-ended funds: Only tradable on exchanges after the NFO; redemption with the AMC happens only at maturity.

- Flexibility of Investment

- Open-ended funds are more flexible for systematic investment plans (SIPs) or lump-sum investments anytime.

- Closed-ended funds restrict investments to the NFO period only.

- Corpus Stability

- Open-ended funds continuously receive inflows and outflows, which may impact portfolio management.

- Closed-ended funds maintain a fixed corpus, helping managers execute strategies without frequent portfolio adjustments.

- Tenure

- Open-ended schemes have no maturity period.

- Closed-ended schemes always come with a fixed tenure.

- Price Discovery

- Open-ended units are purchased or redeemed at the fund’s NAV.

- Closed-ended units may trade at a premium or discount to the NAV on the exchange.

Benefits of Closed-Ended Mutual Funds

Investors often evaluate the benefits of closed-ended mutual funds before allocating capital, especially if they prefer disciplined structures. Some of the practical benefits include:

- Encourages Long-Term Investment Horizon

The lock-in structure naturally supports long-term investing by reducing the temptation to exit during short-term market fluctuations. This is particularly useful for investors aiming for goal-based planning.

- Stable Corpus Helps Portfolio Execution

With no redemption pressure, the fund manager can remain fully invested. This can support strategies that require time-bound execution, such as holding bonds until maturity or following a dedicated equity theme.

- Suitable for Targeted Strategies

Closed-ended funds are often used for specific themes or strategies such as fixed maturity plans, opportunities in certain sectors, or unique investment cycles. Investors seeking structured exposure may find them useful.

- Exchange-Based Liquidity

Even though redemption is not available before maturity, investors can still exit through the exchange. This creates a secondary market option for liquidity, subject to demand.

- Clear Visibility of Tenure

With clarity on investment duration, investors can align these funds with medium-term financial goals, such as funding education expenses, small business plans, or home renovation projects.

Things to Consider Before Investing

While closed-ended funds offer structure, they also come with certain considerations:

- Liquidity is not guaranteed on exchanges, especially for less popular schemes.

- Entry is limited to the NFO period, requiring timely decision-making.

- Exchange price may differ from NAV, affecting exit value if sold before maturity.

- Limited flexibility when compared to open-ended funds.

- Returns depend on the fund’s performance, asset allocation, and market conditions.

Investors should assess whether the fixed tenure aligns with their goals and whether they are comfortable committing funds for the locked-in period.

Who Should Consider Closed-Ended Funds?

These funds can be suitable for:

- Investors comfortable with a defined investment horizon

- Those who prefer structure and discipline in their investments

- Individuals aiming for theme-based or maturity-linked strategies

- Investors who do not require immediate liquidity

As with any financial product, evaluating risk appetite and reading scheme documents is essential.

Conclusion

Closed-ended mutual funds offer a structured investment approach with a clear timeline, stable corpus, and defined objective. Understanding how closed-ended funds work, their features, and their distinction from open-ended schemes can help investors decide whether these funds fit their financial strategy.

For Indian investors seeking a disciplined, tenure-based investment path or targeted strategies, closed-ended funds can serve as an option—provided the investor is comfortable with limited liquidity and a fixed holding period.

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

What is a closed-ended mutual fund?

A closed-ended mutual fund is an investment scheme with a fixed maturity period. Investors can subscribe only during the New Fund Offer (NFO) period, and the units are later listed on the stock exchange for trading.

How do closed-ended funds differ from open-ended funds?

Open-ended funds allow continuous buying and selling directly through the fund house, while closed-ended funds can only be bought during the NFO and later traded on exchanges. Closed-ended schemes also come with a fixed tenure.

Can I redeem my closed-ended fund before maturity?

Direct redemption with the fund house is not permitted before maturity. However, you can sell your units on the exchange, subject to liquidity and market demand.

Are closed-ended funds suitable for SIP investments?

No. SIPs are not available in closed-ended funds because investments can only be made during the NFO period.

How is the NAV of a closed-ended fund determined?

The Net Asset Value (NAV) is calculated based on the market value of the underlying securities. However, the trading price on the exchange may differ from the NAV due to demand and supply factors.

What happens when the fund reaches maturity?

At maturity, the fund liquidates its portfolio and returns the proceeds to investors. The redemption amount is credited to the registered bank account.

Do closed-ended funds offer tax benefits?

Some closed-ended equity-linked schemes, such as ELSS with a 3-year lock-in, offer tax benefits under Section 80C. Other closed-ended funds follow regular mutual fund taxation rules based on asset type and holding period.

Are closed-ended funds risky?

The risk level depends on the fund’s asset allocation—equity-oriented schemes carry market risk, while debt-oriented schemes carry interest-rate and credit risks. Investors should evaluate the risk-return profile before investing.

Who should consider investing in closed-ended funds?

These funds may suit investors comfortable committing money for a fixed period, looking for structured strategies, and not requiring frequent liquidity.

How do I buy or sell closed-ended fund units?

You can buy units during the NFO. After listing, you can buy or sell units on the stock exchange through your trading account, similar to equity shares.