What is Free Cash Flow & Why Investors Track It?

What is Free Cash Flow & Why Investors Track It?

When evaluating companies, most new investors tend to focus on metrics like revenue, net profit, and sometimes earnings per share (EPS). While these are important, they do not always tell the complete story about a company’s financial health.

Thank you for reading this post, don't forget to subscribe!A company may report high profits on paper, but still struggle to generate cash needed for day-to-day operations, debt payments, or future growth. That’s where Free Cash Flow (FCF) becomes a powerful indicator.

In this blog, we’ll break down:

-

What Free Cash Flow means

-

How to calculate it

-

Why investors track FCF closely

-

Signs of strong vs weak FCF

-

Real-world examples

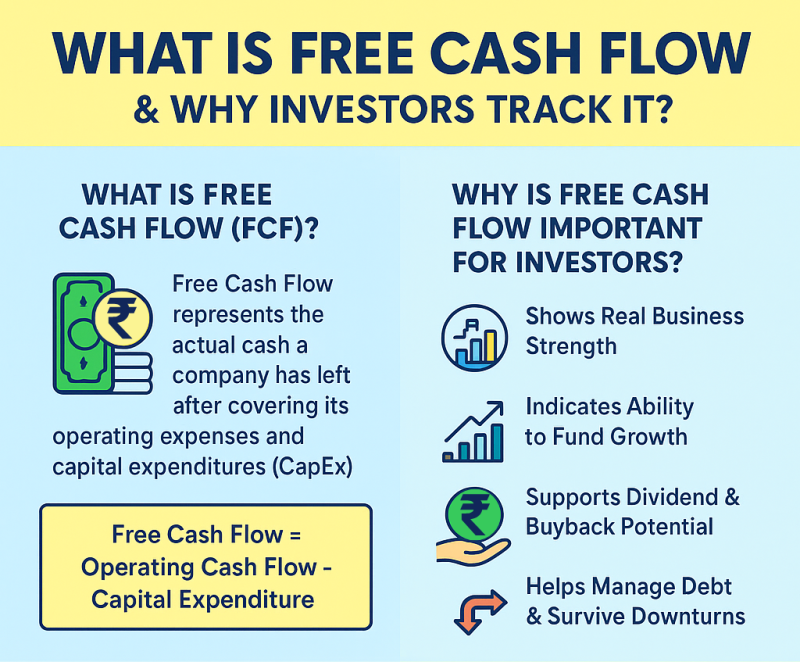

What is Free Cash Flow (FCF)?

Free Cash Flow represents the actual cash a company has left after covering its operating expenses and capital expenditures (CapEx).

In simple terms:

FCF shows how much cash a company can deploy freely — to pay dividends, reduce debt, reinvest in growth, or simply save for future opportunities.

Formula

Free Cash Flow = Operating Cash Flow – Capital Expenditure\textbf{Free Cash Flow = Operating Cash Flow – Capital Expenditure}

-

Operating Cash Flow (OCF): Cash generated from core business operations.

-

Capital Expenditure (CapEx): Money spent on long-term assets like machinery, technology, buildings, etc.

Why is Free Cash Flow Important for Investors?

1. Shows Real Business Strength

Profits can be influenced by accounting adjustments, but cash is actual money in hand.

A company with steady, increasing FCF is usually financially healthy and stable.

2. Indicates Ability to Fund Growth

Companies with strong FCF can:

-

Expand into new markets

-

Launch new products

-

Upgrade technology and infrastructure

Without relying on debt or equity dilution.

3. Supports Dividend & Buyback Potential

Companies with consistent free cash flow are more likely to:

-

Pay steady dividends

-

Execute share buybacks—which increases shareholder value

4. Helps Manage Debt & Survive Downturns

When markets slow down, companies with strong cash flow survive better.

They can maintain operations without seeking emergency capital.

What Does Strong vs Weak Free Cash Flow Indicate?

| Scenario | Interpretation | Investor View |

|---|---|---|

| Consistently Rising FCF | Company is generating more cash and scaling effectively | Positive — Indicates strong financial health |

| Stable but Low FCF | Company is managing costs but growth investment is limited | Neutral — Watch how management plans expansion |

| Negative FCF | Cash outflow > Cash inflow | Not always bad — could indicate heavy growth investment; analyze context |

Important: Negative FCF is not automatically bad.

Early-stage or fast-growing companies often reinvest heavily to build capabilities.

Example: A Simple FCF Calculation

Suppose a company reports:

| Financial Item | Amount |

|---|---|

| Operating Cash Flow | ₹500 crore |

| Capital Expenditure | ₹150 crore |

FCF = ₹500 crore – ₹150 crore = ₹350 crore\textbf{FCF = ₹500 crore – ₹150 crore = ₹350 crore}

This means the company has ₹350 crore of free cash to use for dividends, buybacks, debt repayment, or expansion.

Case Study Examples (Indian Market)

1. Infosys

-

Stable operations, low capital-intensive business model.

-

Consistently strong free cash flow.

-

Allows regular dividends, bonuses, and buybacks.

Investor takeaway: A prime example of a healthy FCF-driven business.

2. Bharti Airtel

-

Heavy CapEx due to telecom network expansion.

-

Even with high revenues, FCF has fluctuated historically.

Investor takeaway: Understand sector needs — high-growth infrastructure businesses need constant reinvestment.

3. DMart (Avenue Supermarts)

-

Strong operating model and efficient cash cycle.

-

Reinvests earnings into expanding stores — sometimes lowering near-term FCF.

Investor takeaway: Negative or modest FCF can be strategic during expansion.

How to Use FCF as an Investor

Before investing, check:

✅ Trend Over Time (3–5 Years)

Look for consistent or increasing free cash flow.

✅ FCF vs Net Profit

If profit grows but FCF doesn’t, check:

-

Inventory buildup

-

High receivables

-

Rising operating costs

✅ FCF Yield

FCF Yield = FCF ÷ Market Capitalization\textbf{FCF Yield = FCF ÷ Market Capitalization}

A higher FCF yield generally suggests better value.

Key Takeaways

| Concept | What It Means for Investors |

|---|---|

| FCF shows real cash strength | Helps evaluate long-term sustainability |

| Strong FCF enables dividends & expansion | Good sign for stable growth companies |

| Negative FCF is not always bad | Evaluate growth strategy and capital allocation |

| Trends matter more than single numbers | Analyze multiple years, not one-time results |

Final Thoughts

Free Cash Flow is one of the most reliable indicators of a company’s true financial health.

It cuts through accounting adjustments and shows whether the business is actually generating liquid, usable cash.

As an investor, focusing on FCF helps you:

-

Avoid companies that only look profitable on paper

-

Identify businesses with real, sustainable growth potential

-

Make smarter long-term investment decisions

If you learn to evaluate FCF effectively, you are already ahead of most new investors.

Related Blogs:

How to Use Annual Reports to Evaluate a Company

How to Analyze Management Quality Using Publicly Available Data

How to Read a Company’s Balance Sheet Before Investing

What Is Fundamental Analysis? A Beginner’s Guide

Understanding the Income Statement: A Beginner’s Guide

Understanding Cash Flow Statements for Investors

The Role of Corporate Governance in Investing

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.