Emerging Trends & Future Outlook: Long-Term Investment in Sugar Stocks

Emerging Trends & Future Outlook: Long-Term Investment in Sugar Stocks

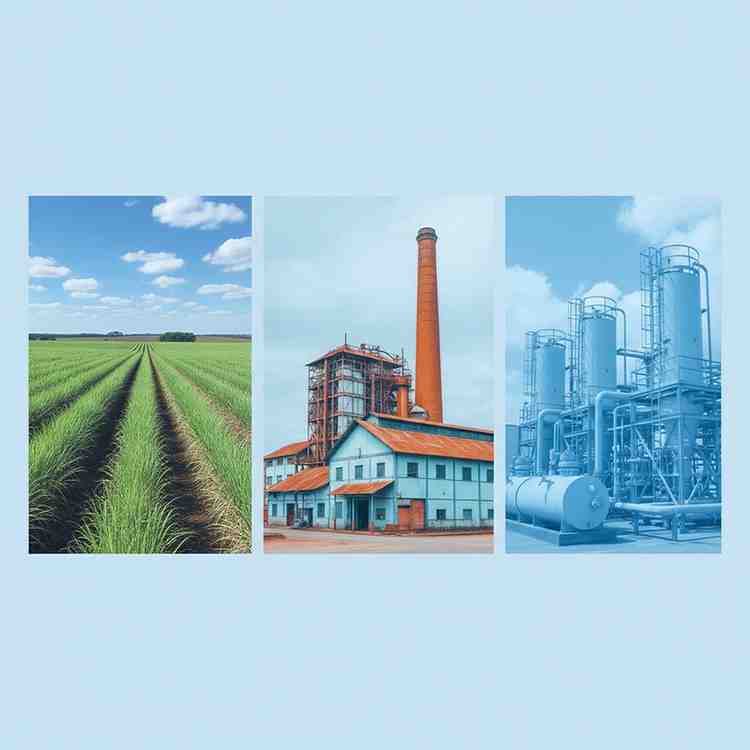

The Indian stock market presents a myriad of opportunities across various sectors, yet few are as deeply intertwined with agriculture, policy, and energy as the sugar industry. For the discerning investor, looking beyond the immediate cyclicality of commodity prices reveals a sector at a significant inflection point. The traditional view of sugar companies is slowly dissolving, replaced by a more nuanced understanding of their role as integrated bio-energy players. This analysis will delve into the emerging trends and the future outlook for long-term investment in sugar stocks, examining the pivotal factors that are reshaping the industry’s landscape.

Thank you for reading this post, don't forget to subscribe!The Decisive Influence of the Ethanol Blending Policy

A paradigm shift is underway within the Indian sugar sector, catalysed by the government’s ambitious Ethanol Blending Programme (EBP). This policy, which mandates the blending of ethanol with petrol, serves a dual purpose: it curtails the nation’s substantial oil import bill and provides a robust, alternative revenue stream for sugar mills. The Ethanol Blending Policy and its impact on sugar stocks and ethanol stocks cannot be overstated. It fundamentally alters the business model of sugar producers, transforming them from being solely dependent on the volatile prices of sugar to becoming key contributors to India’s energy security.

Historically, the industry has been plagued by periods of surplus sugar production, leading to depressed prices and strained financials for the mills. The EBP provides a structural solution to this issue by allowing mills to divert excess sugarcane juice and B-heavy molasses towards ethanol production. This strategic diversification not only ensures a stable offtake for their primary raw material but also fetches remunerative prices for ethanol, which are often more stable than sugar prices. Consequently, companies with significant distillery capacities are better insulated from the cyclical downturns of the sugar market. For investors considering long-term sugar stocks, a critical evaluation of a company’s ethanol production capacity and its alignment with the EBP’s trajectory is indispensable. The policy’s progressive targets offer a clear roadmap for growth in the biofuel and sugar industry, making it a central pillar of any investment thesis in this space.

AgriTech: Cultivating Efficiency from the Ground Up

While policy provides a favourable tailwind, the operational efficiency of sugar companies is what will separate the leaders from the laggards. This is where the burgeoning AgriTech sector comes into play. A comprehensive overview of the AgriTech industry reveals a suite of technologies poised to revolutionise sugarcane cultivation, which has traditionally been labour-intensive and reliant on antiquated farming practices.

Modern AgriTech solutions, such as precision agriculture, drip irrigation, and the use of drones for crop monitoring, are instrumental in enhancing yield and optimising resource utilisation. For instance, drip irrigation can lead to significant water savings and improved crop health, a crucial advantage in a country facing increasing water stress. Furthermore, advancements in biotechnology are leading to the development of high-yielding, drought-resistant, and disease-resilient sugarcane varieties.

For sugar mills, integrating AgriTech into their operations and promoting its adoption among their network of farmers is a strategic imperative. Companies that invest in or facilitate the use of these technologies can expect more consistent raw material supply, better quality sugarcane, and improved operational efficiencies. This technological adoption is a key, albeit often overlooked, factor for those assessing the long-term viability and profitability of sugar producers. An efficient, technology-driven supply chain is a strong indicator of a company’s resilience and its potential for sustained growth.

The Rise of Sugar Substitutes

No comprehensive analysis would be complete without addressing the primary challenge facing the industry: the growing health consciousness among consumers and the corresponding rise of sugar alternatives. The Sugar Substitute Market Trends in India indicate a clear shift in consumer preferences, particularly within the urban demographic. Heightened awareness regarding lifestyle diseases such as diabetes and obesity is fuelling the demand for low-calorie and zero-calorie sweeteners.

This trend poses a direct challenge to the traditional demand for sugar in the food and beverage sector. However, the impact is multifaceted. While the retail and direct consumption segments may witness a gradual moderation in growth, the industrial demand for sugar remains substantial. Furthermore, the per capita sugar consumption in India, while declining in some urban pockets, is still significant and has a considerable base in rural areas and in traditional sweets and confectionery markets.

For investors, it is crucial to understand how companies are positioning themselves in response to this shift. Some may choose to diversify their product portfolio to include specialty sugars or even their own line of sugar substitutes. Others might focus on optimising their operations for industrial supply and leveraging the ethanol opportunity to its fullest extent. Acknowledging this headwind and evaluating a company’s strategy to mitigate its impact is a vital component of due diligence for anyone considering a long-term position in this sector.

Conclusion

The narrative for Indian sugar stocks is being comprehensively rewritten. The sector is transitioning from a monolithic commodity play to a dynamic bio-energy and agricultural powerhouse. The confluence of a supportive regulatory framework through the ethanol policy, the transformative potential of AgriTech, and the strategic responses to evolving consumer health trends creates a complex but potentially rewarding investment landscape.

For those willing to look beyond short-term price fluctuations, the opportunity lies in identifying companies that are strategically positioned to capitalise on these shifts. These are the entities with robust distillery capacities, a forward-thinking approach to agricultural technology, and a resilient business model that can navigate the changing tides of consumer demand. The journey of the Indian sugar industry is evolving, and for the informed long-term investor, the future appears to hold a flavour of strategic growth.

Related Blogs:

Investing in India’s Green Energy Future: The Ethanol Play in Sugar Stocks

Fueling Growth beyond Sweeteners: The Rise of Integrated Sugar Companies & Their Stock

Ethanol Blending Program (EBP): The Game Changer for Indian Sugar Stocks

Best Sugar Stocks in India

Top 5 Sugar Stocks in India

Beyond Soft Drinks: Exploring Niche Summer Beverage Stocks in India

Best Ethanol Stocks in India

Top 5 Ethanol Stocks in India

Best Liquor Stocks in India

Top 5 Liquor Stocks in India

Best Green Energy Stocks in India 2025

Growth vs. Value Investing in Indian Green Energy Stock

Strategies for Investing in Green Energy Stocks in India

Top 5 Green Energy Stocks in India

Renewable Energy Stocks: A Core Component of a Robust 2025 Portfolio

How Investors Can Capitalize on the Growth of Renewable Energy in India

India’s Renewable Energy Revolution: Beyond Solar and Wind

Best Green Energy Stocks in India

Best Solar Stocks in India

Best Green Hydrogen Stocks in India

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.