ETF vs Stocks Explained: Key Differences Every Investor Should Know

ETF vs Stocks Explained: Key Differences Every Investor Should Know

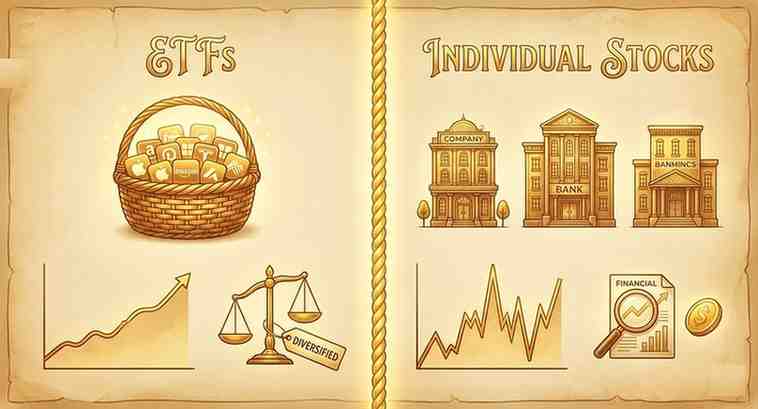

For investors navigating the Indian equity market, one of the most common questions is whether to invest in exchange-traded funds (ETFs) or individual stocks. Both instruments offer exposure to equities, yet they differ significantly in structure, risk profile, cost, and effort required. Understanding these differences is essential for making informed investment decisions aligned with personal financial goals.

Thank you for reading this post, don't forget to subscribe!What Are ETFs and Stocks?

Before comparing ETFs and stocks, it is important to understand what each represents.

What Is an ETF?

An ETF is a market-traded investment fund that holds a basket of assets such as stocks, bonds, or commodities. Most equity ETFs in India track indices like the Nifty 50, Sensex, or sector-specific benchmarks. ETFs trade on stock exchanges just like shares, with prices fluctuating throughout the trading day.

From an investor’s perspective, ETFs provide exposure to multiple companies through a single investment.

What Are Individual Stocks?

Stocks represent ownership in a specific company. When an investor buys shares of a listed Indian company, they become a partial owner and directly participate in the company’s financial performance, including price appreciation and dividends.

Unlike ETFs, individual stocks are concentrated investments tied to the fortunes of one business.

ETF vs Individual Stocks: Structural Differences

One of the most important distinctions between ETFs and stocks lies in their structure.

Diversification

ETFs are inherently diversified. A single ETF can hold shares of 30, 50, or even hundreds of companies, depending on the index it tracks. This diversification helps spread risk across multiple businesses and sectors.

In contrast, investing in individual stocks exposes investors to company-specific risks such as management decisions, regulatory issues, or earnings volatility. Building diversification through stocks alone often requires investing in multiple companies, which may increase capital and effort requirements.

Investment Management Style

ETFs are typically passive instruments that aim to replicate an index rather than outperform it. Their performance closely mirrors the underlying benchmark, subject to minor tracking differences.

Stock investing, on the other hand, is an active process. Investors must research companies, monitor financial statements, and stay informed about industry developments. Returns depend heavily on stock selection and timing.

Risk and Volatility: How Do They Differ?

Risk considerations are central to the ETF vs stocks discussion.

Risk in ETFs

Since ETFs hold multiple securities, the impact of poor performance by any single company is limited. Market-wide risks still apply, but company-specific shocks are largely absorbed through diversification. This makes ETFs relatively less volatile compared to individual stocks, especially broad-market ETFs.

Risk in Individual Stocks

Individual stocks can deliver higher returns if the company performs well, but they also carry higher downside risk. Poor earnings, governance concerns, or sector disruptions can significantly affect stock prices. Investors must be comfortable with higher volatility and the possibility of underperformance.

Cost Structure and Expense Considerations

Costs play a meaningful role in long-term investment outcomes.

ETF Costs

ETFs typically charge a low expense ratio, as they are passively managed. In India, many equity ETFs have expense ratios that are lower than actively managed mutual funds. Investors may also incur brokerage charges when buying or selling ETF units, similar to stock trades.

Stock Investment Costs

While stocks do not have an expense ratio, investors may face higher indirect costs. Frequent trading can increase brokerage fees, and poor investment decisions can result in opportunity costs. Additionally, stock investing often requires time and resources for research.

When evaluating ETF investing vs stock investing, costs should be assessed alongside effort and expertise.

Liquidity and Market Access

Both ETFs and stocks are traded on Indian stock exchanges, but liquidity dynamics can differ.

ETFs tracking popular indices generally have good liquidity, supported by market makers. However, some niche or sector-specific ETFs may experience lower trading volumes.

Individual stocks, particularly large-cap companies, tend to have high liquidity. Smaller or less-traded stocks may face liquidity constraints, which can affect entry and exit prices.

ETFs vs Stocks for Beginners

For first-time investors, the choice between ETFs and stocks often depends on experience and comfort with market risk.

ETFs are commonly considered suitable for beginners because they:

- Provide instant diversification

- Require limited company-level analysis

- Offer predictable performance relative to an index

Stock investing may appeal to beginners who are willing to invest time in learning fundamental and technical analysis, but it also involves a steeper learning curve.

For investors starting their equity journey, ETFs can serve as a foundation while gradually building exposure to individual stocks.

Which Is Better ETF or Stocks?

The question of which is better ETF or stocks does not have a universal answer. The choice depends on several factors:

- Investment goals: Long-term wealth creation, income generation, or tactical trading

- Risk tolerance: Comfort with volatility and short-term fluctuations

- Time commitment: Ability to research and monitor investments

- Market knowledge: Understanding of businesses, sectors, and economic cycles

ETFs may suit investors seeking market-linked returns with lower involvement, while stocks may suit those aiming to outperform the market through active selection.

Taxation Considerations in India

From a taxation perspective, equity ETFs and equity stocks are treated similarly in India. Gains are classified as short-term or long-term based on the holding period. Dividends received from ETFs or stocks are taxable as per the investor’s applicable income tax slab.

Understanding tax implications is essential when evaluating net returns from either investment route.

Aligning ETFs and Stocks with Investment Strategy

Rather than viewing ETFs and stocks as mutually exclusive, many investors combine both. ETFs can provide core portfolio stability, while selective stock investments can offer growth opportunities.

This blended approach allows investors to benefit from diversification while retaining flexibility to express specific market views.

Conclusion

Understanding ETF vs stocks differences helps investors make informed decisions in line with their financial objectives and risk appetite. ETFs offer diversification, simplicity, and cost efficiency, while individual stocks provide opportunities for targeted exposure and active participation in company growth.

For Indian investors, the choice between ETFs and stocks should be guided by investment horizon, experience level, and the ability to manage risk. By evaluating these factors thoughtfully, investors can structure portfolios that reflect both market participation and individual preferences.

Related Blogs:

Rebalancing with ETFs vs. Index Funds: What Investors Need to Know

Beginner’s Guide to Gold and Silver ETF Investment in India

What are Closed-Ended Mutual Funds?

ETFs versus Index Funds

Lump Sum Investments – How Is It Different from an SIP?

What Are Open Ended Mutual Funds?

What is Reversal Trading?

What Is an Auction Market and How Does It Work?

Understanding Mutual Fund SIP Returns: How to Calculate and Maximize Your Earnings

SIP Calculator and Inflation: Understanding How Inflation Impacts Your Mutual Fund Returns

SIP vs. Lumpsum: What’s the Best Way to Invest in Mutual Funds for Retirement?

How to Use a SIP Calculator for Investment Planning?

Reach Your Financial Milestones Sooner with Step-Up SIPs

What is a SIP Calculator and How Can It Help?

SIP vs Lump Sum: Which Investment Strategy Is Better?

Why Smart Investors in India are Choosing Systematic Investment Plan (SIPs)

How to Start a SIP for Your Child’s Education or Future Goals

The Power of SIPs: Why Consistency Beats Timing the Market

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

What is the main difference between ETFs and individual stocks?

The primary difference between ETFs and individual stocks lies in diversification and structure. An ETF represents a basket of securities that tracks an index or sector, while an individual stock represents ownership in a single company. This makes ETFs more diversified by design, whereas stocks carry company-specific risk.

Are ETFs safer than stocks for Indian investors?

ETFs generally involve lower risk compared to individual stocks because they spread investments across multiple companies. However, they are still subject to market fluctuations. Stocks can be more volatile since their performance depends on the financial health and outlook of one company.

Are ETFs suitable for beginners in India?

Yes, ETFs are often considered suitable for beginners. They offer market exposure, diversification, and ease of trading without requiring extensive company-level research. For investors new to equity markets, ETFs can provide a structured way to participate in market growth.

Which is better ETF or stocks for long-term investing?

Whether ETFs or stocks are better for long-term investing depends on the investor’s goals and involvement level. ETFs may suit those seeking steady, market-linked returns, while stocks may suit investors who actively research companies and are comfortable with higher volatility.

How are ETFs and stocks taxed in India?

Equity ETFs and equity stocks are taxed similarly in India. Short-term and long-term capital gains apply based on the holding period, and dividends are taxable as per the investor’s income tax slab. Tax rules may change, so investors should stay updated.

Do ETFs pay dividends like stocks?

Some ETFs distribute dividends received from underlying stocks, while others reinvest them. Individual stocks may pay dividends depending on the company’s profitability and dividend policy. Dividend treatment varies by product and issuer.

Can investors combine ETFs and stocks in one portfolio?

Yes, many investors use both ETFs and stocks in the same portfolio. ETFs can provide diversification and stability, while stocks can offer focused exposure to specific companies or sectors. This approach allows for balanced risk management.

What are the costs involved in ETF investing vs stock investing?

ETF investing involves an expense ratio charged by the fund and brokerage costs for trading. Stock investing does not have an expense ratio, but frequent trading may increase brokerage charges. Overall costs depend on investment frequency and strategy.

Do ETFs require a demat account in India?

Yes, ETFs are traded on stock exchanges, so investors need a demat and trading account to buy and sell ETF units, similar to individual stocks.

How should investors choose between ETFs and stocks?

Investors should consider factors such as risk tolerance, investment horizon, time available for research, and financial goals. Understanding these aspects helps determine whether ETFs, stocks, or a combination of both is appropriate.