How Multi-Factor Investing Improves Portfolio Stability

How Multi-Factor Investing Improves Portfolio Stability

Investors often discover that markets do not reward a single style consistently. Phases where value stocks perform well can be followed by periods dominated by momentum or quality-driven companies. This uneven performance across styles is one of the main reasons why many long-term investors and portfolio analysts have shown growing interest in multi-factor investing.

Thank you for reading this post, don't forget to subscribe!Rather than relying on one investment factor, multi-factor approaches aim to combine several well-researched factors within a single portfolio framework. The objective is not to chase returns but to create portfolio stability in investing by reducing dependence on any one market condition or style. For Indian retail investors seeking to understand how factor-based approaches work, this article explains the concept, rationale, and relevance of multi-factor investing in a neutral and educational manner.

Understanding Investment Factors

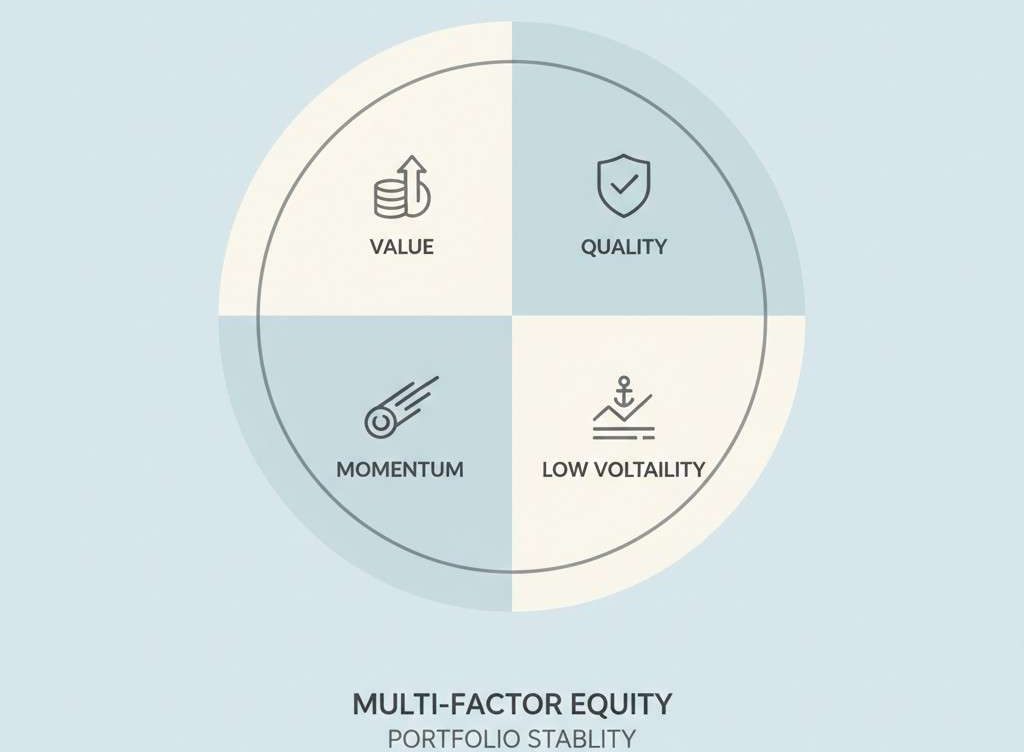

In equity investing, a “factor” refers to a specific characteristic that helps explain differences in stock returns over time. Commonly discussed factors include value, quality, momentum, low volatility, and size. Each factor tends to perform differently depending on economic cycles, interest rate environments, and market sentiment.

For example, value-oriented stocks may attract attention during economic recoveries, while quality or low-volatility stocks are often studied during uncertain market phases. This variation highlights why relying on a single factor can expose portfolios to extended periods of underperformance.

What Is Multi-Factor Investing?

Multi-factor investing involves combining two or more investment factors within a portfolio or strategy. Instead of selecting stocks based on one attribute, investors use a systematic framework that evaluates multiple characteristics simultaneously.

From an academic and practical standpoint, this approach is designed to smooth outcomes over time. When one factor underperforms, another may offer relative support, helping to maintain balance. This is where the concept of diversification across investment factors becomes relevant.

For Indian investors, multi-factor strategies are increasingly discussed in the context of factor-based mutual funds and smart beta indices, which aim to follow transparent and rules-based methodologies.

Why Single-Factor Strategies Can Be Volatile

Single-factor strategies often go through long cycles of relative strength and weakness. A value-focused portfolio, for instance, may lag broader markets during growth-driven rallies. Similarly, momentum-oriented strategies can struggle during sharp market reversals.

Such fluctuations can test investor patience and increase the likelihood of behavioural errors, such as exiting strategies at unfavourable times. From a portfolio construction perspective, this inconsistency can reduce overall stability, especially for investors with medium- to long-term goals.

This is where factor-based investment strategies that blend multiple factors aim to address a key concern: reducing reliance on any one source of return.

How Multi-Factor Investing Supports Portfolio Stability

The primary appeal of multi-factor investing lies in its potential to improve portfolio stability in investing. By combining factors that respond differently to market conditions, portfolios may experience less pronounced swings compared to single-factor approaches.

For instance, quality-oriented stocks with strong balance sheets may help cushion drawdowns during periods of stress, while momentum-oriented stocks may contribute during trending markets. When structured thoughtfully, the interaction between factors can create a more balanced exposure.

This does not eliminate market risk, but it may help moderate outcomes across different phases of the market cycle.

Diversification Across Investment Factors Explained

Traditional diversification focuses on spreading investments across sectors, market capitalisations, or geographies. Factor diversification adds another layer by addressing how stocks behave rather than where they belong.

Diversification across investment factors seeks to reduce concentration risk at the strategy level. Instead of relying heavily on valuation metrics or price trends alone, multi-factor portfolios distribute emphasis across several attributes.

Risk-Adjusted Perspective in Equity Portfolios

A common way to evaluate factor strategies is through the lens of risk-adjusted performance. Rather than focusing solely on returns, analysts consider how much volatility or downside risk was taken to achieve those returns.

Multi-factor strategies are often discussed in the context of improving risk-adjusted returns in equity portfolios. The rationale is that blending factors may help smooth return patterns over time, even if absolute returns vary across periods.

For Indian investors, this concept is particularly relevant given the cyclical nature of domestic markets and the influence of global economic conditions on local equities.

Implementation Through Mutual Funds and Indices

In India, retail participation in multi-factor investing typically occurs through mutual funds or index-based products that follow factor-driven methodologies. These products use predefined rules to select and rebalance stocks based on multiple factors.

From a regulatory standpoint, SEBI requires such products to disclose methodology, risks, and rebalancing frequency clearly. As a result, educational content around multi-factor investing should focus on understanding the framework rather than suggesting suitability for individual investors.

Common Misconceptions About Multi-Factor Investing

Despite its structured nature, multi-factor investing is sometimes misunderstood. One common misconception is that combining factors guarantees better outcomes. In reality, factor performance can vary, and multi-factor strategies may still experience periods of underperformance.

Another misunderstanding is assuming that more factors automatically lead to better diversification. Effective multi-factor design requires careful selection, weighting, and rebalancing. Overly complex frameworks can dilute the intended benefits.

Understanding these limitations helps set realistic expectations and aligns with a risk-aware approach to investing education.

Long-Term Relevance for Indian Retail Investors

For investors with long-term horizons, learning about factor-based approaches contributes to better portfolio literacy. Factor-based investment strategies are increasingly referenced in professional portfolio construction, making them relevant for individuals seeking to understand modern equity investing frameworks.

Multi-factor investing, in particular, offers insight into how institutional investors think about balancing risk and return across cycles. While it is not a substitute for financial planning or personalised advice, it adds depth to an investor’s analytical toolkit.

Conclusion

Multi-factor investing represents a structured attempt to address one of the enduring challenges in equity markets: inconsistency across investment styles. By combining multiple factors, investors aim to enhance portfolio stability in investing and manage variability across market conditions.

For Indian retail investors exploring educational content, the value of multi-factor investing lies in understanding how diversification across investment factors can influence portfolio behaviour over time. When evaluated through a risk-adjusted lens, these strategies highlight the importance of balance rather than prediction.

As with all market-related concepts, a clear understanding of objectives, risks, and time horizons remains essential. Multi-factor investing is best viewed as a framework for analysis—one that encourages disciplined thinking in an environment shaped by uncertainty and change.

Related Blogs:

Value Investing Strategies During Recessions and Market Slowdowns

What Drives Value Investing in Different Economic Cycles

Growth Investing vs. Value Investing: Which Strategy Is Right for You?

Risk Management in Equity Investing: Protecting Your Portfolio

Value Investing as a Stock Market Investing Strategy in 2025

Long-Term Equity Investing: Beat the Market and Achieve Financial Freedom

Swing Trading: A Comprehensive Guide to Make Short-Term Gains

A Guide to Value Investing in 2025

Combining Sector Rotation with Other Investing Strategies

Beyond Buy and Hold: Elevating Returns with Sector Rotation

Common Pitfalls of Sector Rotation and How to Avoid Them

What is Sector Rotation and How Does it Work?

Sector rotation and the economic cycle: what is the connection?

How to Implement Diversification for a Profitable Portfolio

Build a Stronger Investment Portfolio Through Diversification

Diversification Strategies: Combining Commodities and Equities

Diversification Strategies: Why Spreading Your Risk Matters

How to Use Sector Rotation to Diversify Your Portfolio

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

What is multi-factor investing?

Multi-factor investing is an approach that combines multiple investment factors—such as value, quality, momentum, or low volatility—within a single portfolio framework. The objective is to reduce dependence on any one factor and improve overall portfolio balance.

How does multi-factor investing improve portfolio stability?

By using diversification across investment factors, multi-factor investing aims to reduce the impact of market phases where a single factor may underperform. This can contribute to more consistent portfolio behaviour over time, though it does not eliminate market risk.

Is multi-factor investing suitable for Indian retail investors?

Multi-factor investing is commonly accessed through factor-based mutual funds or indices in India. While the concept is widely discussed, suitability depends on individual risk profiles and investment objectives, and understanding the framework is essential.

How is multi-factor investing different from traditional diversification?

Traditional diversification focuses on spreading investments across sectors or asset classes. Multi-factor investing adds another layer by diversifying across investment characteristics that influence stock performance.

Do multi-factor strategies guarantee better returns?

No. Multi-factor strategies aim to improve risk-adjusted returns in equity portfolios over time, but they can still experience periods of underperformance depending on market conditions.