How to Use Annual Reports to Evaluate a Company

How to Use Annual Reports to Evaluate a Company

When you invest in a company, you are essentially buying a share of its future. To make smart investment decisions, you need to understand how the company has performed financially, how it plans to grow, the sustainability of its business model, and the risks ahead. One of the best tools for this evaluation is the Annual Report.

Thank you for reading this post, don't forget to subscribe!An Annual Report is a yearly publication released by a company to provide details about its financial performance, operations, management decisions, and future outlook. While it may seem lengthy and full of financial jargon, learning how to read it effectively can significantly improve your investment judgment.

This guide will walk you through the key sections of an annual report and how to interpret them as a retail investor.

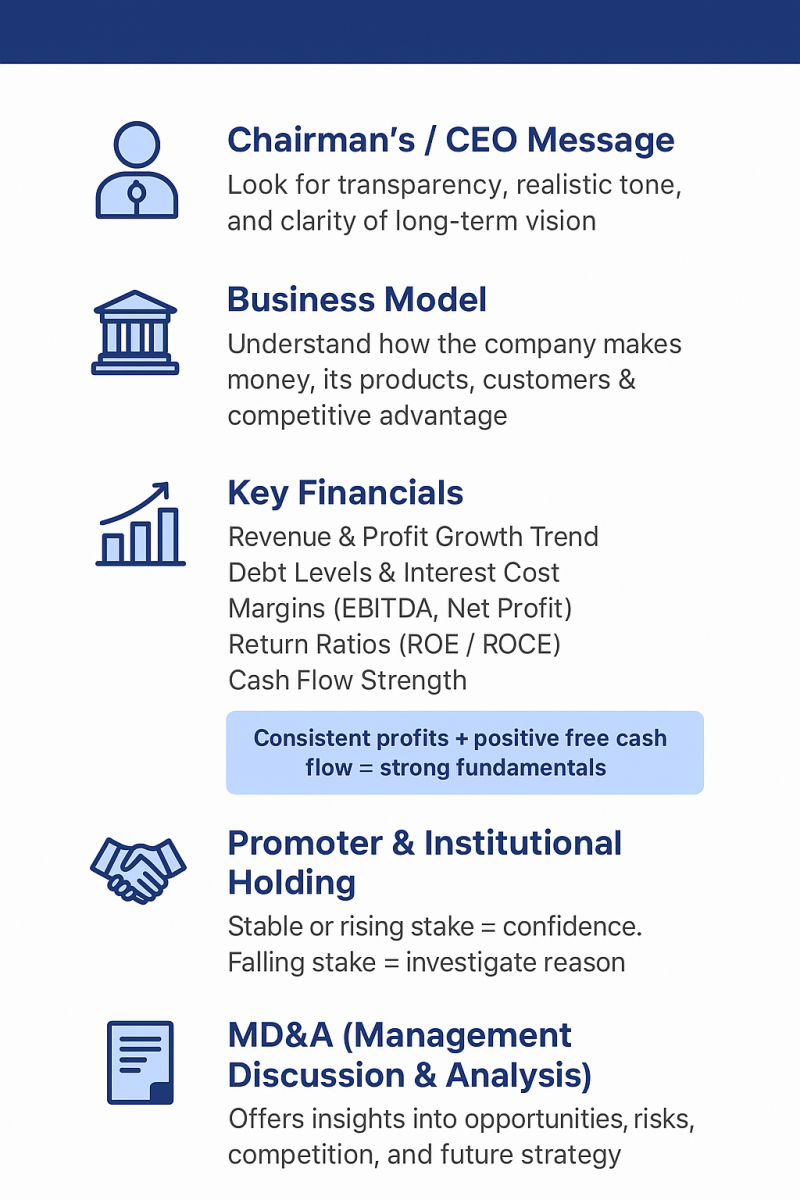

1. Start with the Director’s / Chairman’s Message

This introductory section provides insight into:

-

The company’s performance during the year.

-

Industry environment and market movement.

-

Key achievements, challenges, and future strategic goals.

What to look for:

-

Does management communicate honestly about both successes and challenges?

-

Is the tone realistic or overly optimistic?

-

Are future plans clearly articulated?

A transparent tone signals strong corporate governance; overly generic statements may indicate lack of direction.

2. Understand the Business Model

Most annual reports include a Business Overview explaining:

-

What the company does

-

Products/services offered

-

Geographic presence

-

Target markets and competitive positioning

Questions to ask yourself:

-

What problem does the company solve?

-

Is its product/service in a growing or declining market?

-

How does it differentiate itself from competitors?

Look for companies operating in growing sectors with a defensible business model.

3. Review Key Financial Statements

This is where your investment thesis becomes quantifiable. Focus on three core statements:

a) Income Statement (Profit & Loss Statement)

Shows revenue, expenses, and net profit.

Key metrics to check:

-

Revenue Growth: Is the company consistently increasing sales?

-

Operating Margin: Indicates efficiency of core business operations.

-

Net Profit Margin: Shows profitability after all expenses.

Steady and improving profit margins signal financial stability.

b) Balance Sheet

Displays assets, liabilities, and shareholder equity.

Look for:

-

Debt-to-Equity Ratio: High debt can be risky in volatile markets.

-

Cash Reserves: Companies with strong cash buffers are more resilient.

-

Asset Quality: Are assets productive or under-utilized?

A strong balance sheet reduces downside risk.

c) Cash Flow Statement

Shows how cash moves within the business—more realistic than accounting profits.

Check:

-

Operating Cash Flow: Should ideally be higher than net profit over the long term.

-

Free Cash Flow (FCF): Cash available after capital expenditures—important for dividends and growth.

Companies with positive and rising FCF have greater investment strength.

4. Analyze Promoter & Shareholding Patterns

This section tells you who controls the company and how ownership is distributed.

Promoter Holding:

-

High holding (>50%) indicates confidence and long-term commitment.

-

Falling promoter holding could be a red flag unless clearly explained.

Institutional Investors (FII/DII):

-

Increasing institutional ownership can signal market trust.

5. Examine Management Discussion & Analysis (MD&A)

This is one of the most valuable sections. It provides insights into:

-

Business performance drivers

-

Opportunities and threats

-

Operational improvements

-

Future strategy

What to look for:

-

Whether management addresses real business challenges

-

Whether growth plans are measurable and realistic (not vague promises)

Good MD&A reads like a logical roadmap, not marketing material.

6. Review Notes to Financial Statements

Many investors skip this section — but this is where crucial hidden details exist, such as:

-

Accounting policy changes

-

Contingent liabilities (potential future risks)

-

Legal disputes

-

Segment performance breakdown

Even small details here can significantly impact future performance.

7. Assess Corporate Governance

Strong governance builds investor trust. Look for:

-

Independent director representation

-

Audit committee transparency

-

ESOP (Employee Stock Ownership Plan) structure

-

Related party transactions (should be minimal and justified)

Companies with weak governance practices may inflate profits or take unethical decisions.

Putting It All Together: A Simple Evaluation Checklist

| Evaluation Area | What to Look For | Good Sign |

|---|---|---|

| Business Model | Clear value proposition, market opportunity | Growing industry, strong brand |

| Financial Performance | Revenue, profit, free cash flow trends | Consistent upward trajectory |

| Balance Sheet Strength | Low debt, healthy reserves | Low D/E ratio, strong cash |

| Management Quality | Clear communication, strategic vision | Transparent MD&A |

| Shareholding Pattern | Strong promoter + institutional confidence | Stable or rising ownership |

| Corporate Governance | Ethical and transparent processes | Strong board independence |

Conclusion

Annual Reports may seem intimidating at first, but once you understand where to focus, they become one of the most powerful tools for making informed investment decisions. By regularly reviewing these reports, you’ll learn to identify stable, growing companies and avoid those with weak fundamentals or unclear strategies.

Smart investing is not about reacting to price movements—it’s about understanding the business behind the stock.

Annual reports give you that understanding.

Related Blogs:

How to Analyze Management Quality Using Publicly Available Data

How to Read a Company’s Balance Sheet Before Investing

What Is Fundamental Analysis? A Beginner’s Guide

Understanding the Income Statement: A Beginner’s Guide

Understanding Cash Flow Statements for Investors

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.