Role of Gold and Silver ETFs During Market Crashes and Economic Uncertainty

Role of Gold and Silver ETFs During Market Crashes and Economic Uncertainty

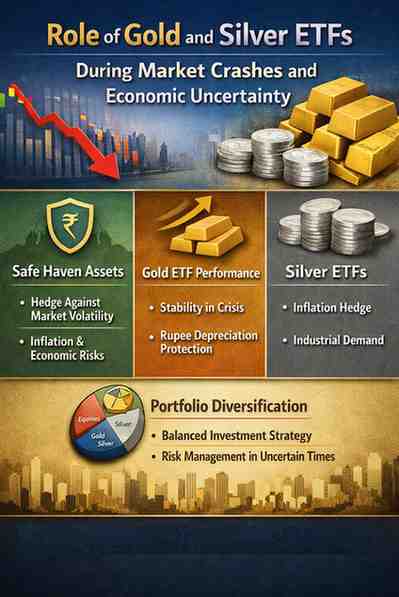

Market crashes and periods of economic uncertainty are inevitable parts of the investment cycle. For Indian investors, such phases often trigger concerns around capital protection, volatility management, and portfolio stability. Equity markets can witness sharp drawdowns, debt instruments may face interest rate risks, and even traditional fixed-income options can struggle to deliver predictable returns.

Thank you for reading this post, don't forget to subscribe!In this context, Gold and Silver ETFs during market crashes have gained relevance as instruments that help investors navigate uncertainty with a more balanced approach. Rather than attempting to time the market, many investors turn to these exchange-traded funds as part of a broader risk management and diversification strategy.

This blog explores how Gold and Silver ETFs function during turbulent market conditions, their role in portfolio construction, and why they are increasingly considered safe haven ETFs in economic uncertainty, especially within the Indian financial landscape.

Understanding Gold and Silver ETFs

Gold and Silver ETFs are exchange-traded funds that aim to track the price of physical gold or silver. Each unit of the ETF typically represents a specific quantity of the underlying metal and is backed by physical holdings stored with custodians.

In India, these ETFs are regulated by SEBI and traded on recognised stock exchanges, making them accessible to retail investors through demat accounts. Unlike physical metals, ETFs eliminate concerns around storage, purity, and insurance, while offering liquidity and transparency.

From an investment perspective, these ETFs are commonly used for:

- Hedging against macroeconomic risks

- Portfolio diversification

- Managing volatility during uncertain market phases

Why Precious Metals Matter During Market Crashes

Historically, precious metals have shown a tendency to behave differently from equities during stress periods. While stock markets are influenced by corporate earnings, interest rates, and economic growth expectations, gold and silver prices are often impacted by factors such as inflation expectations, currency movements, and global risk sentiment.

During market crashes, investor behaviour typically shifts towards capital preservation. This is where safe haven ETFs in economic uncertainty come into play. Gold, in particular, is often viewed as a store of value when confidence in financial markets weakens.

Silver, while more volatile than gold, carries both precious metal and industrial characteristics, which can make it relevant during different phases of economic cycles.

Gold ETF Performance During Market Volatility

When markets experience heightened volatility, Gold ETF performance during market volatility has often demonstrated relative stability compared to equities. This does not imply that gold prices move only upward during crises, but rather that their price movements are influenced by different drivers.

For Indian investors, gold ETFs can help offset equity drawdowns during:

- Global financial stress

- Currency depreciation

- Inflationary pressures

- Geopolitical uncertainty

Additionally, gold ETFs are denominated in Indian rupees, meaning domestic gold prices also reflect INR movements against the US dollar. During periods when the rupee weakens, gold ETFs may provide an additional layer of protection.

It is important to note that gold ETFs are not return-maximising instruments. Their role is more aligned with risk management and portfolio balance rather than aggressive wealth creation.

Role of Silver ETFs in Uncertain Economic Phases

Silver ETFs have gained attention in recent years due to increasing industrial demand and evolving macroeconomic conditions. While silver is often grouped with gold, its behaviour can differ, especially during inflationary or recovery-driven environments.

Silver ETFs as hedge against inflation and recession can play a complementary role in a diversified portfolio. During inflationary phases, silver prices may benefit from:

- Rising commodity prices

- Increased industrial usage

- Demand from renewable energy and electronics sectors

However, silver ETFs tend to exhibit higher volatility than gold ETFs. As a result, they may not always act as a traditional safe haven in the short term, but can still contribute to diversification when used judiciously.

For Indian investors, silver ETFs can be considered as a tactical allocation rather than a core defensive asset.

Portfolio Diversification with Gold and Silver ETFs

One of the most practical applications of precious metal ETFs lies in portfolio diversification with Gold and Silver ETFs. Diversification aims to reduce overall portfolio risk by combining assets that do not move in perfect correlation with each other.

In a typical Indian portfolio heavily tilted towards equities and fixed income, adding exposure to gold and silver ETFs may:

- Reduce portfolio volatility

- Improve risk-adjusted returns over market cycles

- Provide stability during equity market corrections

Financial planners often suggest a measured allocation to gold ETFs as part of long-term asset allocation. Silver ETFs, given their higher price fluctuations, may be allocated in smaller proportions depending on an investor’s risk profile.

The key is alignment with investment goals, time horizon, and tolerance for interim volatility.

Investor Behaviour and Search Intent During Market Stress

When investors search for terms related to gold and silver ETFs during uncertain times, they are typically looking for:

- Information on how these ETFs behave during crashes

- Guidance on whether they offer downside protection

- Insights into using them as hedging instruments

This indicates an informational search intent rather than an immediate transactional one. Investors want clarity, context, and realistic expectations—not guarantees or speculative outcomes.

Understanding this intent is crucial when evaluating precious metal ETFs. They are tools for managing uncertainty, not eliminating risk entirely.

Key Considerations Before Investing

Before allocating to gold or silver ETFs, Indian investors should consider:

- Expense ratios and tracking efficiency

- Liquidity and average trading volumes

- Taxation (capital gains treatment differs from physical metals)

- Alignment with long-term asset allocation strategy

It is also advisable to avoid reactive decision-making during market panic. Allocations to precious metals tend to be more effective when planned in advance rather than added impulsively after volatility has already escalated.

Conclusion

Market crashes and economic uncertainty test both financial planning and investor discipline. In such environments, Gold and Silver ETFs during market crashes offer a structured and regulated way to gain exposure to assets that historically behave differently from equities.

While gold ETFs are often associated with stability during volatile phases, silver ETFs can provide diversification benefits with higher risk exposure. Together, they contribute meaningfully to portfolio diversification with Gold and Silver ETFs, helping investors navigate uncertainty with a more balanced framework.

For Indian investors, the role of these ETFs is not about predicting market movements but about building resilience across market cycles. When used thoughtfully and aligned with long-term objectives, they can serve as valuable components in an uncertainty-aware investment strategy.

Related Blogs:

What are Closed-Ended Mutual Funds?

Best Silver Stocks in India

Lump Sum Investments – How Is It Different from an SIP?

What Are Open Ended Mutual Funds?

What is Reversal Trading?

What Is an Auction Market and How Does It Work?

Understanding Mutual Fund SIP Returns: How to Calculate and Maximize Your Earnings

SIP Calculator and Inflation: Understanding How Inflation Impacts Your Mutual Fund Returns

SIP vs. Lumpsum: What’s the Best Way to Invest in Mutual Funds for Retirement?

How to Use a SIP Calculator for Investment Planning?

Reach Your Financial Milestones Sooner with Step-Up SIPs

What is a SIP Calculator and How Can It Help?

SIP vs Lump Sum: Which Investment Strategy Is Better?

Why Smart Investors in India are Choosing Systematic Investment Plan (SIPs)

How to Start a SIP for Your Child’s Education or Future Goals

The Power of SIPs: Why Consistency Beats Timing the Market

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.