SIP in Open-Ended Funds vs Lump Sum: Which Approach Suits Your Financial Goals?

SIP in Open-Ended Funds vs Lump Sum: Which Approach Suits Your Financial Goals?

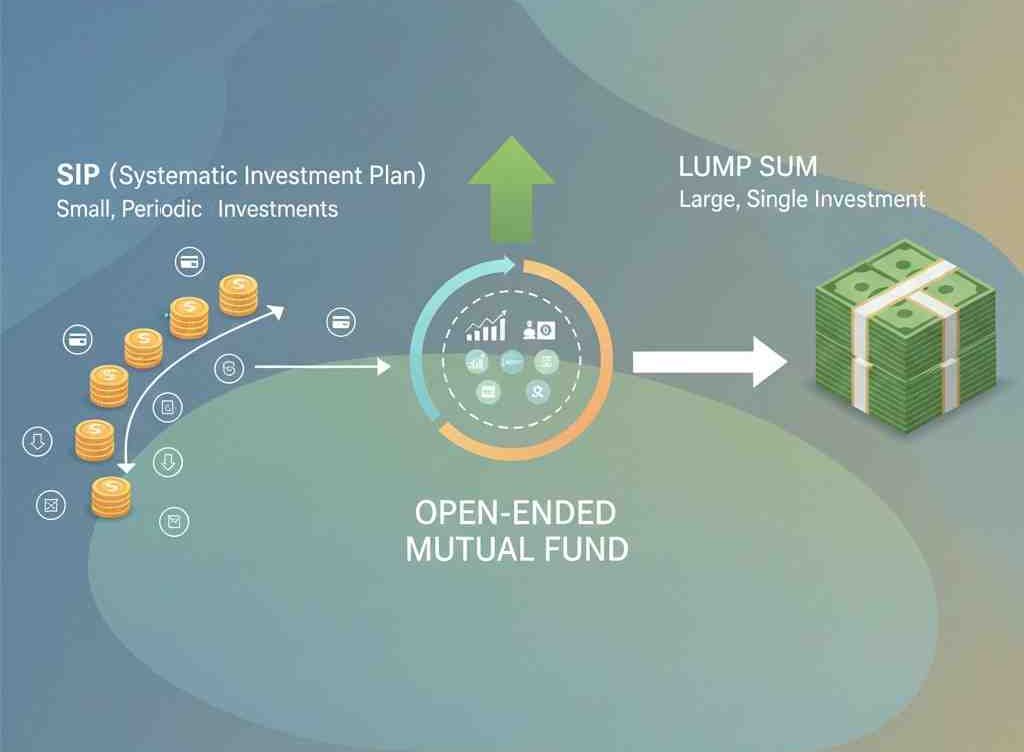

When it comes to investing in mutual funds, one of the most common questions investors ask is: Should I invest through a Systematic Investment Plan (SIP), or should I opt for a lump sum investment? This is especially relevant for those choosing SIP in open-ended mutual funds, as these schemes offer flexibility for both investment approaches. Understanding how each method works, and how they align with your financial goals, can help you make a more informed decision.

Thank you for reading this post, don't forget to subscribe!Indian investors often weigh SIP vs lump sum investment in open-ended funds when trying to plan their long-term financial journey. Both approaches have their place, and the decision usually hinges on factors such as risk tolerance, income patterns, market conditions, and financial objectives. This article discusses how both methods function, how they differ, and how you can determine which approach may suit your goals.

Understanding SIP in Open-Ended Mutual Funds

A Systematic Investment Plan (SIP) allows investors to contribute a fixed amount at regular intervals—monthly, quarterly, or even weekly—into an open-ended mutual fund scheme. This approach is essentially a disciplined investment habit, enabling investors to spread their contributions over time.

Key Characteristics of SIP in Open-Ended Schemes

- Periodic Investing

SIPs break down the investment into smaller amounts, making it more convenient for individuals who follow a regular income cycle. - Rupee-Cost Averaging

By investing consistently, regardless of market conditions, SIPs help average the purchase cost of units over time. This may reduce the impact of market volatility on the portfolio. - Flexibility

Open-ended funds allow investors to start, stop, or modify SIPs without strict restrictions. This flexibility is suitable for salaried investors or those aiming for long-term financial goals. - Goal-Based Alignment

SIPs work well for goals such as children’s education, retirement, or wealth building, where the time horizon is longer and the investor prefers a systematic approach.

Understanding Lump Sum Investment in Open-Ended Funds

A lump sum investment in open-ended funds involves investing a substantial amount at once. This method is often preferred by investors who receive periodic windfalls such as bonuses, maturity amounts, or surplus savings.

Key Characteristics of Lump Sum Investing

- Immediate Market Exposure

Unlike SIPs, lump sum investing exposes the entire amount to the market from day one. This is beneficial when market valuations are stable or favourable. - Suitable for Shorter Horizons

Investors with a medium-term financial goal and a higher risk tolerance might consider lump sum investing, especially in debt or hybrid funds. - Timing Consideration

Since the entire investment enters the market at once, timing becomes a relevant factor. Some investors mitigate this through Systematic Transfer Plans (STPs) after deploying their lump sum initially into liquid funds. - Convenient for Surplus Funds

Individuals with large idle cash reserves may prefer lump sum investing to avoid letting liquidity sit in low-yield assets.

SIP vs Lump Sum Investment in Open-Ended Funds: Key Differences

Many investors often ask, “Which is better SIP or lump sum in mutual funds?” The answer depends on individual needs and circumstances rather than a universal rule. Below are the key differences:

- Investment Pattern

- SIP: Periodic contributions over time.

- Lump Sum: One-time investment of a substantial amount.

- Market Sensitivity

- SIP: Less sensitive to market timing due to staggered investments.

- Lump Sum: Highly sensitive to market conditions at the time of investment.

- Suitability

- SIP: Works well for investors with regular income and long-term goals.

- Lump Sum: Often suitable for investors with available cash and higher risk appetite.

- Financial Planning

- SIP: Encourages disciplined financial habits.

- Lump Sum: Aligns with sudden cash inflows or strategic market entry.

SIP vs Lump Sum for Financial Goals

When comparing SIP vs lump sum for financial goals, the choice often depends on the nature of the goal itself.

- Long-Term Goals

SIPs tend to support long-term objectives such as retirement planning or long-term wealth creation. The systematic nature helps balance market fluctuations over extended periods.

- Medium-Term Goals

For goals like buying a car or planning a vacation in the next few years, both SIPs and lump sums can be suitable depending on cash flow availability and comfort with market volatility.

- Short-Term Goals

For shorter horizons, lump sum investing into debt or liquid funds might be more practical, especially if the investor aims to park a large sum temporarily.

How to Decide Between SIP and Lump Sum?

Investors often look for actionable guidance on choosing the right approach. Consider the following factors while deciding:

- Cash Flow and Income Pattern

If you earn a regular monthly income, SIPs naturally integrate into your financial routine. If you have surplus funds available at once, a lump sum may be more suitable.

- Market Conditions

Market conditions are usually relevant for lump sum investors. In volatile markets, SIPs help mitigate uncertainty through periodic allocation.

- Risk Appetite

Those comfortable with short-term fluctuations may consider lump sums in equity-oriented funds. SIPs offer a steadier experience for risk-averse investors.

- Investment Horizon

For long-term horizons, both methods can work, but SIPs often simplify the process. For shorter horizons, lump sum investing in lower-risk categories may be appropriate.

- Goal Structure

Match your method to your goals. If your objective requires disciplined saving, a SIP may suit you better. If timing aligns with available capital, a lump sum approach may be effective.

Practical Scenarios to Guide Your Choice

To simplify the decision, here are a few everyday situations for Indian investors:

Scenario 1: Salaried Professional

A professional with regular income, saving for long-term goals, may find SIPs more aligned with monthly budgeting.

Scenario 2: Entrepreneur or Freelancer

Those with irregular income may prefer flexible contributions through SIPs with the option to increase or pause investments when needed.

Scenario 3: Investor with a Financial Windfall

Individuals receiving a bonus, inheritance, or maturity amount may consider lump sum allocation based on market and risk factors.

Scenario 4: Conservative Investor

Risk-averse individuals might use SIPs in open-ended mutual funds to reduce exposure to market timing, or choose lump sum investments in low-risk debt funds for short-term needs.

What Indian Investors Typically Consider

Indian investors usually seek:

- Convenience and accessibility

- Disciplined investing options

- Market risk management

- Flexibility in contributions

- Alignment with long-term financial planning

Both SIPs and lump sums offer these in different forms, and choosing the right method depends on how these priorities fit your circumstances.

Conclusion

Choosing between SIP and lump sum investing is not about selecting a better option universally; it is about aligning the method with your financial situation and goals. Understanding the differences between SIP vs lump sum investment in open-ended funds, and evaluating your income pattern, risk tolerance, and investment horizon, can help you make informed decisions.

Whether you choose periodic investing through SIPs or opt for a one-time lump sum allocation, open-ended funds provide the flexibility to tailor your investment approach. Your choice should ultimately support your long-term financial planning and help you work progressively toward your financial objectives.

Related Blogs:

What are Closed-Ended Mutual Funds?

Lump Sum Investments – How Is It Different from an SIP?

What Are Open Ended Mutual Funds?

What is Reversal Trading?

What Is an Auction Market and How Does It Work?

Understanding Mutual Fund SIP Returns: How to Calculate and Maximize Your Earnings

SIP Calculator and Inflation: Understanding How Inflation Impacts Your Mutual Fund Returns

SIP vs. Lumpsum: What’s the Best Way to Invest in Mutual Funds for Retirement?

How to Use a SIP Calculator for Investment Planning?

Reach Your Financial Milestones Sooner with Step-Up SIPs

What is a SIP Calculator and How Can It Help?

SIP vs Lump Sum: Which Investment Strategy Is Better?

Why Smart Investors in India are Choosing Systematic Investment Plan (SIPs)

How to Start a SIP for Your Child’s Education or Future Goals

The Power of SIPs: Why Consistency Beats Timing the Market

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.