Understanding Earnings Quality: Cash Profits vs Accounting Profits

Understanding Earnings Quality: Cash Profits vs Accounting Profits

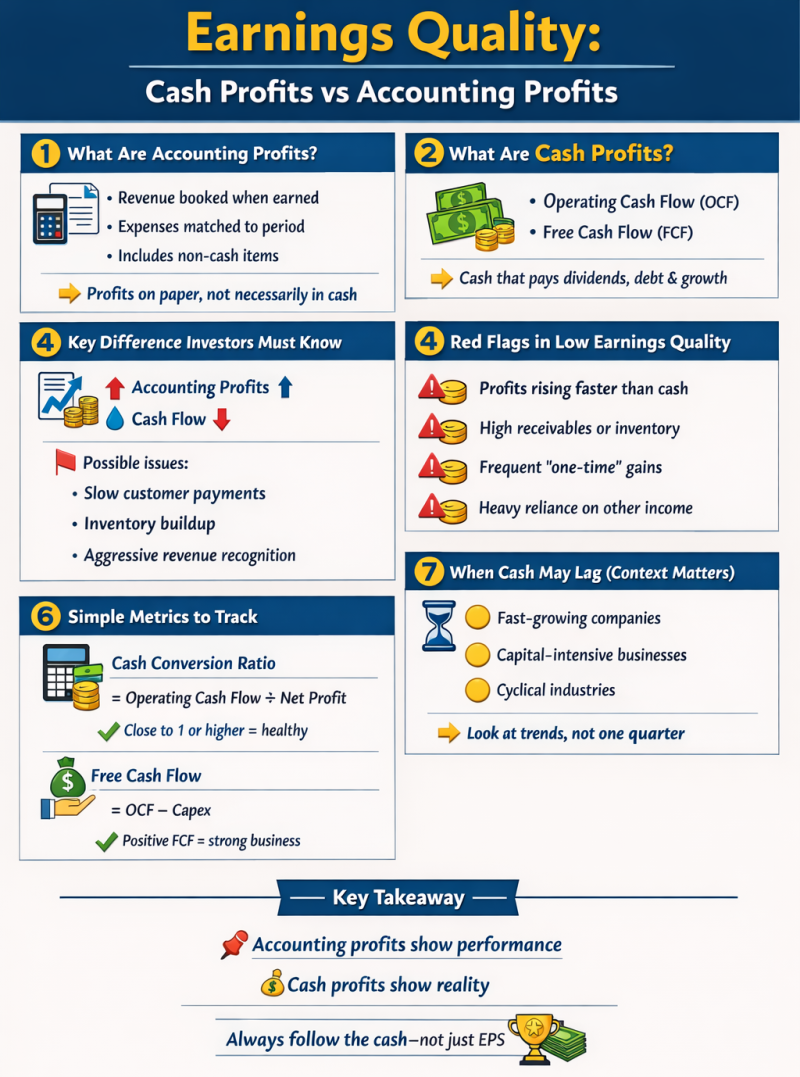

When companies announce quarterly results, investors often focus on headline profit numbers—net profit, EPS growth, and margins. But seasoned investors know that not all profits are created equal. A company can report strong accounting profits while struggling to generate actual cash, and over time, this mismatch can erode shareholder value.

Thank you for reading this post, don't forget to subscribe!For retail and emerging investors, understanding earnings quality—especially the difference between cash profits and accounting profits—is essential for evaluating the true financial health of a business.

What Are Accounting Profits?

Accounting profits are the profits reported on the profit and loss (P&L) statement under accounting standards.

They include:

-

Revenue recognised when earned, not when cash is received

-

Expenses matched to the period, even if cash is paid earlier or later

-

Non-cash items such as depreciation, amortisation, and provisions

Accounting profits are designed to reflect performance over a period, but they rely on assumptions and estimates.

What Are Cash Profits?

Cash profits refer to the actual cash generated by the business, typically reflected in:

-

Operating Cash Flow (OCF)

-

Free Cash Flow (FCF)

Cash profits show how much real money the business generates after meeting operating needs.

Unlike accounting profits, cash profits are harder to manipulate and better reflect a company’s financial strength.

Why Earnings Quality Matters

High-quality earnings are:

-

Sustainable

-

Backed by cash

-

Repeatable without aggressive assumptions

Low-quality earnings may look impressive on paper but often fail to translate into long-term shareholder returns.

1. Cash Pays the Bills

Only cash can:

-

Pay dividends

-

Reduce debt

-

Fund expansion

-

Survive downturns

Profits without cash can’t support these needs.

2. Poor Earnings Quality Raises Risk

Companies with weak cash conversion often face:

-

Liquidity stress

-

Rising debt

-

Earnings volatility

-

Sudden profit collapses

Key Differences Between Cash Profits and Accounting Profits

1. Revenue Recognition vs Cash Collection

A company may book revenue when a sale is made, even if cash is collected months later.

Red flag:

-

Rising revenue and profits but weak operating cash flow

This may indicate:

-

Aggressive credit terms

-

Slow customer payments

-

Channel stuffing

2. Working Capital Movements

Changes in:

-

Inventory

-

Receivables

-

Payables

can significantly impact cash profits without affecting accounting profits.

For example:

-

Inventory buildup absorbs cash

-

Extended receivables delay cash inflow

3. Non-Cash Expenses

Depreciation and amortisation reduce accounting profits but don’t affect cash.

High depreciation businesses may:

-

Report lower profits

-

Generate strong cash flows

Understanding this difference avoids misjudging profitability.

4. One-Time and Exceptional Items

Accounting profits may include:

-

Asset sales

-

Revaluation gains

-

Write-backs

These inflate profits but don’t represent core earnings power.

Cash profits help separate recurring performance from one-off events.

How to Assess Earnings Quality

1. Compare Net Profit with Operating Cash Flow

Over time:

-

Cash flow should broadly track net profit

Consistent gaps raise concerns.

A simple check:

Is operating cash flow consistently lower than net profit?

2. Track Cash Conversion Ratio

Operating Cash Flow ÷ Net Profit

-

Ratio close to or above 1 = good quality

-

Persistently below 1 = potential red flag

3. Examine Free Cash Flow

Free cash flow accounts for capital expenditure.

Free Cash Flow = Operating Cash Flow – Capex

Positive and growing FCF supports:

-

Dividends

-

Debt reduction

-

Sustainable growth

4. Watch Working Capital Trends

Rising:

-

Inventory days

-

Receivable days

without corresponding sales growth may signal weakening demand or aggressive accounting.

5. Check Consistency Across Cycles

High-quality earnings remain resilient across economic cycles.

If profits collapse during mild downturns, earnings quality may be weak.

Common Red Flags in Earnings Quality

-

Profits rising faster than cash flows

-

Frequent changes in accounting policies

-

Heavy reliance on “other income”

-

High receivables growth

-

Repeated “one-off” adjustments

When Accounting Profits Can Be Misleading

1. High-Growth Phases

Fast-growing companies may:

-

Invest heavily in working capital

-

Temporarily show weak cash flows

Context matters. Look for improvement as growth stabilises.

2. Capital-Intensive Businesses

These firms may:

-

Generate strong operating cash

-

Spend heavily on capex

Evaluating FCF over longer periods provides better insight.

3. Cyclical Industries

Cash flows can fluctuate significantly.

Assess earnings quality over full cycles, not just one year.

Why Markets Reward High Earnings Quality

Companies with strong cash-backed profits often enjoy:

-

Higher valuation multiples

-

Lower risk premiums

-

Better resilience during market stress

Over time, cash generation drives:

-

Compounding returns

-

Balance sheet strength

-

Investor confidence

-

How Retail Investors Can Apply This Insight

1. Don’t Rely on EPS Alone

EPS growth without cash support is fragile.

2. Use Cash Flow Statements Regularly

Even a basic review can reveal hidden issues.

3. Focus on Long-Term Trends

Short-term cash mismatches are normal—but persistent ones are not.

4. Combine with Business Quality

Strong earnings quality complements:

-

Competitive advantages

-

Pricing power

-

Good governance

Final Thoughts

Understanding the difference between cash profits and accounting profits is one of the most important skills for long-term investing. While accounting profits tell part of the story, cash profits reveal the truth about a company’s financial health.

For retail and emerging investors, focusing on earnings quality helps avoid value traps, reduces downside risk, and improves confidence in long-term holdings. In the end, profits backed by cash are the ones that truly compound wealth.

Related Blogs:

Cash Flow Statement: Why It’s More Important Than Net Profit

What is Free Cash Flow & Why Investors Track It?

How to Use Annual Reports to Evaluate a Company

Understanding the Income Statement: A Beginner’s Guide

Understanding Cash Flow Statements for Investors

How to Read a Company’s Balance Sheet Before Investing

Profit & Loss Statement: What Matters for Retail Investors in India

The Role of Working Capital Efficiency in Identifying Strong Businesses

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.