Are FMCG and Pharma Stocks True Value Plays in Every Economic Cycle?

Are FMCG and Pharma Stocks True Value Plays in Every Economic Cycle?

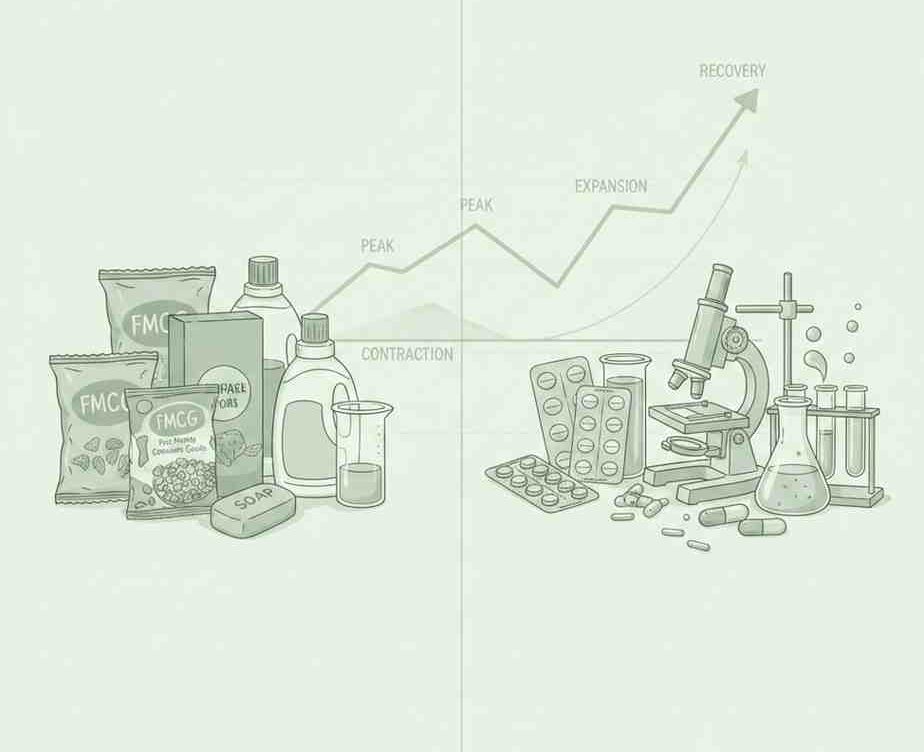

When markets turn volatile, investors often gravitate toward familiar names—companies that manufacture everyday essentials or life-saving medicines. In India, this typically means looking at the fast-moving consumer goods (FMCG) and pharmaceutical sectors.

Thank you for reading this post, don't forget to subscribe!But a fair question arises: Are FMCG stocks and pharma stocks in economic cycles genuinely dependable value plays, or is that assumption too broad?

This article explores the role of these sectors across different phases of the economy, their positioning in value investing frameworks, and how retail investors can think about defensive stocks in different economic cycles—without making sweeping generalisations.

Understanding Economic Cycles and Sector Behaviour

Economic cycles generally move through four phases: expansion, peak, contraction, and recovery. Different sectors perform differently during each phase.

- Expansion: Consumption rises, corporate earnings improve, and cyclical sectors like capital goods and automobiles often benefit.

- Contraction or slowdown: Spending becomes selective, earnings may compress, and investors prioritise stability.

- Recovery: Demand picks up gradually, and businesses begin rebuilding momentum.

This is where FMCG and pharma stocks in economic cycles often attract attention. Their demand patterns tend to be relatively less sensitive to short-term economic fluctuations compared to highly cyclical sectors.

However, “less sensitive” does not mean “immune.” Even defensive sectors face valuation risks, margin pressures, regulatory changes, and competitive intensity.

Are FMCG Stocks Good During Recession?

The question “Are FMCG stocks good during recession?” reflects a common investor search intent—seeking stability during uncertainty.

FMCG companies manufacture products such as packaged foods, personal care items, cleaning supplies, and household essentials. Since these goods are consumed regularly, demand tends to remain relatively steady even when disposable incomes tighten.

In India, rural consumption, urban middle-class demand, and pricing power influence FMCG performance. During slowdowns:

- Volumes may soften, especially in discretionary categories.

- Companies may shift focus toward smaller packs and affordability.

- Margin management becomes critical due to raw material price volatility.

From a valuation standpoint, FMCG stocks often trade at premium multiples because of perceived earnings visibility. This can reduce the margin of safety for investors pursuing value investing in the FMCG and pharmaceutical sector.

Therefore, while FMCG companies may offer relative earnings resilience, they are not automatically “value” plays in every downturn. Entry valuation, growth expectations, and competitive positioning matter significantly.

Pharma Stocks as Defensive Investments

The pharmaceutical sector is another area frequently discussed in the context of stability. The idea of pharma stocks as defensive investments stems from the essential nature of healthcare.

Demand for medicines, hospital services, and chronic therapies tends to persist irrespective of economic cycles. In India, additional drivers include:

- Growing domestic healthcare awareness

- Export opportunities, especially to regulated markets

- Government initiatives to expand healthcare access

However, pharma companies operate in a complex regulatory and pricing environment. Key risks include:

- USFDA inspections and compliance issues

- Pricing pressures in export markets

- Currency fluctuations

- Patent expirations

As a result, pharma stocks can experience sharp volatility based on regulatory outcomes or litigation developments, even when the broader market remains stable.

For retail investors, the defensive label should be understood as “relatively less cyclical” rather than “low risk.”

Value Investing in FMCG and Pharmaceutical Sector

Value investing traditionally involves identifying businesses trading below their intrinsic worth, based on earnings, cash flows, and long-term fundamentals.

In the Indian context, value investing in FMCG and pharmaceutical sector requires careful differentiation between:

- High-quality businesses with sustainable competitive advantages

- Companies facing structural growth challenges

- Firms temporarily impacted by cyclical headwinds

One challenge is that established FMCG and pharma companies often trade at elevated valuations due to consistent earnings and strong brand equity. This makes classic deep-value opportunities relatively infrequent.

Retail investors exploring long-tail search queries like:

- “How to evaluate pharma stocks in India”

- “FMCG stocks for long term investment India”

- “Defensive stocks during market downturn in India”

should consider combining qualitative and quantitative analysis. Key parameters may include:

- Return on capital employed (ROCE)

- Free cash flow consistency

- Debt levels

- R&D pipeline (for pharma)

- Brand strength and distribution reach (for FMCG)

Importantly, valuation discipline remains central. A stable business purchased at an excessive price may deliver modest returns over time.

Defensive Stocks in Different Economic Cycles: Do They Always Deliver?

The phrase defensive stocks in different economic cycles suggests reliability across market environments. While FMCG and pharma sectors have historically shown relative stability, performance varies depending on macroeconomic context.

- During High Inflation

Input costs such as crude derivatives (for FMCG packaging) or active pharmaceutical ingredients (APIs) can compress margins. Companies with pricing power may navigate this better.

- During Sharp Market Corrections

Defensive sectors may decline less than cyclical sectors, but they are not insulated from broad risk-off sentiment.

- During Economic Recovery

Cyclical sectors often outperform defensive ones as investors rotate toward higher growth opportunities.

Therefore, allocating entirely to defensive sectors may reduce volatility but could also limit participation in growth phases.

Structural Trends vs Cyclical Moves

For Indian investors, it is useful to distinguish between structural and cyclical drivers.

Structural Drivers

- Rising healthcare expenditure

- Urbanisation and premiumisation in consumption

- Government healthcare schemes

- Increasing chronic disease prevalence

Cyclical Drivers

- Rural income fluctuations

- Commodity price cycles

- Currency movements

- Regulatory changes

Understanding these drivers helps answer whether FMCG and pharma stocks in economic cycles serve as value opportunities or simply as stability anchors within diversified portfolios.

Portfolio Construction

A balanced allocation strategy might involve:

- Exposure to defensive sectors such as FMCG and pharma

- Select allocation to cyclical sectors aligned with economic recovery

- Periodic portfolio review based on evolving macroeconomic conditions

Investors should assess their:

- Risk tolerance

- Investment horizon

- Liquidity needs

- Asset allocation strategy

Equities, including defensive sectors, remain subject to market risks. Past performance does not indicate future returns.

So, Are They True Value Plays?

The answer depends on definition.

- If “value” refers to stable earnings during downturns, FMCG stocks and pharma stocks may offer relative resilience.

- If “value” implies undervaluation compared to intrinsic worth, opportunities depend on market pricing and company-specific factors.

In practice, these sectors often function as portfolio stabilisers rather than automatic value investments.

For retail investors in India, the more relevant question may not be whether these sectors outperform in every economic cycle, but whether they align with long-term financial goals and risk appetite.

Conclusion

- FMCG and pharma stocks in economic cycles tend to display relatively stable demand characteristics.

- Pharma stocks as defensive investments offer structural support but remain exposed to regulatory and operational risks.

- Value investing in FMCG and pharmaceutical sector requires careful attention to valuation, earnings quality, and competitive positioning.

- Defensive stocks in different economic cycles can support portfolio stability, but overconcentration may limit growth participation.

Related Blogs:

Emerging Markets & FMCG Stocks: A Growth Story for Your Portfolio

Top 5 Beverage Stocks in India

Best Beverage Stocks in India

Top 5 Tea and Coffee Stocks in India

Best Liquor Stocks in India

Top 5 FMCG Stocks in India

Best FMCG Stocks to Buy in India

Pharma R&D Investments: Driving Long-Term Growth for Indian Investors

Healthcare, Pharma, and Biotech Stocks: Building a Diversified Healthcare Portfolio in India

Indian Healthcare Ecosystem: Diversification Strategies Across Pharma, Biotech, and Allied Sectors

5 Best Chemical Stocks for Long-Term Investment in India

Top 5 Chemical Stocks in India

Best Chemical Stocks in India

Best Healthcare Stocks in India

How Pharma, Biotech, and Technology are Shaping Healthcare Investments in India

Diagnosis to Treatment: Investing in the Integrated Healthcare Value Chain in India

Top 5 Healthcare Stocks in India

How Biotech Research Strengthens the Future of Indian Pharma Stocks

Best Diagnostic Device Stocks in India

Top 5 Pharma Stocks in India

Top 5 Biotech Stocks in India

Best Diagnostic Device Stocks in India

The Rise of Point-of-Care Diagnostics: Impacts on Pharma, Biotech, and Investment Opportunities in India

Healthcare Investing: A Guide to Pharma, Biotech, and Related Stocks in India

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Are FMCG stocks suitable during economic slowdowns in India?

FMCG companies manufacture essential goods, which may support relatively stable demand during slowdowns. However, returns depend on factors such as valuation, earnings growth, rural demand trends, and input cost pressures. They should be evaluated within the context of overall portfolio allocation.

Why are pharma stocks considered defensive investments?

Pharmaceutical companies operate in the healthcare space, where demand for medicines and treatments tends to be less cyclical. That said, regulatory developments, pricing pressures, and export-related risks can influence stock performance.

Do defensive stocks outperform in every economic cycle?

Not necessarily. Defensive stocks in different economic cycles may decline less during market stress but may also underperform cyclical sectors during economic recovery phases. Performance varies depending on macroeconomic conditions and sector-specific factors.

Is value investing in FMCG and pharmaceutical sector always effective?

Value investing depends on buying fundamentally sound businesses at reasonable valuations. Many established FMCG and pharma companies trade at premium multiples, so valuation discipline is important.

How should retail investors approach FMCG and pharma stocks?

Retail investors may consider analysing financial ratios, earnings consistency, competitive positioning, and sector outlook. Aligning investments with individual risk tolerance and time horizon is essential.