Multi-Factor vs Single-Factor Investing: What Investors Should Know

Multi-Factor vs Single-Factor Investing: What Investors Should Know

Factor-based investing has steadily gained attention among Indian investors, especially as mutual funds and index strategies evolve beyond traditional market-cap approaches. Instead of selecting stocks based purely on intuition or short-term trends, factor investing relies on measurable characteristics—called factors—that have historically influenced returns and risk.

Thank you for reading this post, don't forget to subscribe!Within this framework, investors are often faced with a practical choice: single-factor investing or multi-factor investing. Understanding how these approaches differ, and where each may fit within a portfolio, is essential for anyone exploring factor-based investment strategies in India.

This article explains the core differences between multi-factor investing vs single-factor investing, the potential risks involved, and how factors can contribute to portfolio diversification—without offering recommendations or promises of performance.

What Is Factor-Based Investing?

Factor-based investment strategies focus on specific attributes that explain differences in stock returns. Common equity factors include:

- Value (stocks priced lower relative to fundamentals)

- Momentum (stocks showing recent price strength)

- Quality (companies with strong balance sheets and earnings stability)

- Low volatility (stocks with relatively stable price movements)

- Size (smaller companies compared to large-cap peers)

In India, these factors are increasingly reflected in factor indices, smart beta funds, and quantitative mutual fund strategies. The key distinction lies in whether an investor focuses on one factor at a time or combines multiple factors in a single strategy.

Understanding Single-Factor Investing

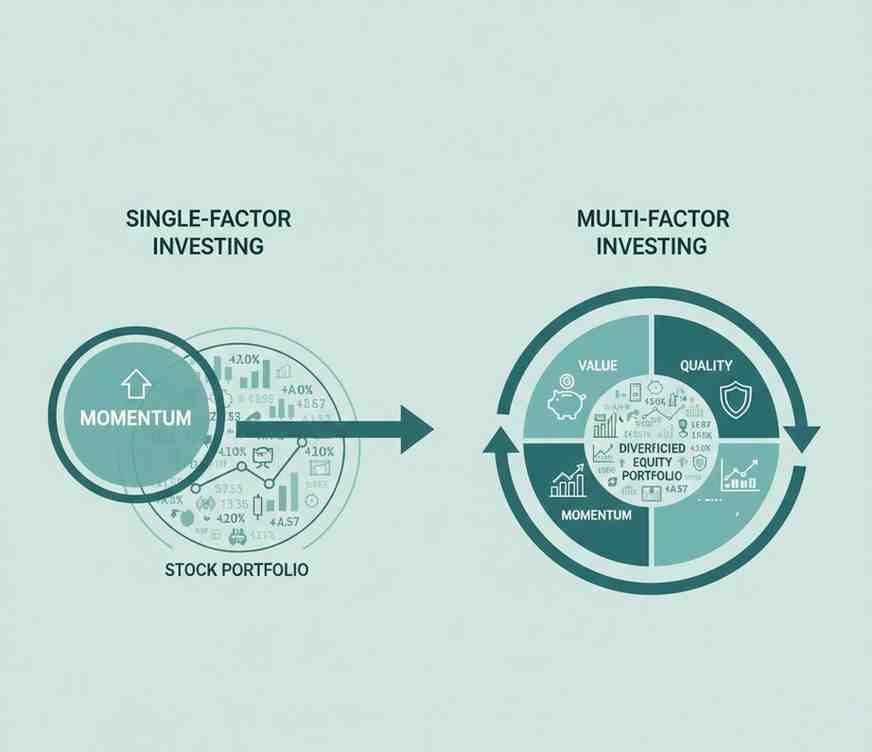

Single-factor investing involves targeting one specific factor across a portfolio. For example, a momentum-focused strategy may select stocks based solely on recent price trends, while a value-focused approach may emphasise low price-to-earnings or price-to-book ratios.

Why Investors Consider Single-Factor Strategies

Single-factor strategies are often preferred for their clarity. Investors know exactly what drives stock selection, making the approach easier to understand and track. In certain market phases, a particular factor may align well with prevailing conditions, which explains why these strategies periodically attract interest.

Single-Factor Investing Risks

However, concentrating on a single factor also brings identifiable risks:

- Cyclicality: Factors tend to go through periods of underperformance. A value strategy, for instance, may lag during growth-driven markets.

- Higher volatility: Returns can fluctuate significantly when a chosen factor falls out of favour.

- Timing sensitivity: Outcomes depend heavily on when the investor enters or exits the strategy.

For retail investors, these risks highlight the importance of understanding that factor performance is not linear or predictable.

What Is Multi-Factor Investing?

Multi-factor investing combines two or more factors within one portfolio. Instead of relying on a single characteristic, the strategy seeks to balance multiple return drivers simultaneously—such as value, quality, and momentum.

The goal is not to maximise exposure to one factor, but to create a more stable structure that adapts across different market conditions.

Benefits of Multi-Factor Investing

The growing interest in multi-factor investing among Indian investors stems from several structural advantages.

Smoother Return Profile

Because factors behave differently across market cycles, combining them may reduce sharp swings linked to any one factor. When one factor underperforms, another may contribute positively, helping moderate overall portfolio movement.

Portfolio Diversification Using Factors

Multi-factor strategies offer a form of diversification that goes beyond sectors or market capitalisation. Instead of spreading investments only across industries, investors diversify across investment styles. This approach aligns with long-term portfolio construction principles rather than short-term positioning.

Reduced Dependence on Market Timing

Unlike single-factor strategies, which can be sensitive to timing, multi-factor investing generally relies on systematic allocation rules. This can help reduce behavioural biases such as chasing recent performance.

Multi-Factor Investing vs Single-Factor Investing: A Practical Comparison

| Aspect | Single-Factor Investing | Multi-Factor Investing |

| Factor exposure | One factor | Multiple factors |

| Volatility | Can be higher | Typically moderated |

| Market cycle sensitivity | High | More balanced |

| Strategy complexity | Lower | Higher |

| Suitability | Tactical exposure | Core or long-term allocation |

This comparison does not imply superiority of one approach over the other. Instead, it reflects how each strategy behaves under different conditions and investor objectives.

Regulatory Perspective and SEBI Compliance

From a regulatory standpoint, factor-based strategies fall under rules governing mutual funds, index funds, and ETFs in India. It is important to note that:

- Factor performance is not guaranteed

- Past data does not indicate future outcomes

- Factor strategies can underperform broader markets for extended periods

SEBI regulations emphasise transparency, risk disclosure, and suitability, particularly for retail investors. Any discussion of factors should therefore focus on education rather than expectation-setting.

Choosing Between single-factor and multi-factor investing

The choice between single-factor and multi-factor investing depends on an investor’s understanding, time horizon, and risk tolerance. Some investors may explore single-factor strategies to express a specific market view, while others may prefer multi-factor exposure as part of a broader allocation framework.

What matters most is clarity—knowing why a factor is being used and how it fits into the overall portfolio.

Conclusion

Factor-based investment strategies have added a new dimension to equity investing in India. While single-factor investing offers targeted exposure, it also comes with concentration risks. Multi-factor investing, on the other hand, seeks balance by combining multiple return drivers within one framework.

Understanding these differences allows investors to make informed decisions based on structure and strategy rather than short-term narratives. As with any investment approach, aligning expectations with risk awareness remains essential.

Related Blogs:

How Multi-Factor Investing Improves Portfolio Stability

Value Investing Strategies During Recessions and Market Slowdowns

What Drives Value Investing in Different Economic Cycles

Growth Investing vs. Value Investing: Which Strategy Is Right for You?

Risk Management in Equity Investing: Protecting Your Portfolio

Value Investing as a Stock Market Investing Strategy in 2025

Long-Term Equity Investing: Beat the Market and Achieve Financial Freedom

Swing Trading: A Comprehensive Guide to Make Short-Term Gains

A Guide to Value Investing in 2025

Combining Sector Rotation with Other Investing Strategies

Beyond Buy and Hold: Elevating Returns with Sector Rotation

Common Pitfalls of Sector Rotation and How to Avoid Them

What is Sector Rotation and How Does it Work?

Sector rotation and the economic cycle: what is the connection?

How to Implement Diversification for a Profitable Portfolio

Build a Stronger Investment Portfolio Through Diversification

Diversification Strategies: Combining Commodities and Equities

Diversification Strategies: Why Spreading Your Risk Matters

How to Use Sector Rotation to Diversify Your Portfolio

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

What is the main difference between multi-factor and single-factor investing?

Single-factor investing focuses on one investment factor, such as value or momentum, while multi-factor investing combines multiple factors to balance risk and return across market cycles.

Are factor-based investment strategies suitable for retail investors in India?

Factor-based strategies can be accessed through mutual funds and ETFs in India, but their suitability depends on an investor’s risk profile, investment horizon, and understanding of factor behaviour.

What are the risks associated with single-factor investing?

Single-factor investing risks include higher volatility, cyclical underperformance, and reliance on specific market conditions for the factor to perform as expected.

How does multi-factor investing help with portfolio diversification?

Multi-factor investing supports portfolio diversification using factors by spreading exposure across different investment styles rather than relying on a single return driver.

Does multi-factor investing guarantee stable returns?

No. Multi-factor investing does not guarantee returns and may underperform at times. It aims to balance factor exposure, not eliminate market or investment risk.